Apple’s (AAPL) Vision Pro Doesn’t Seem Like the Catalyst its Expected to Be

Apple’s ) Vision Pro needs to be a catalyst for company profits to give the stock fuel to move higher. But I don’t envision it.

Apple’s ) Vision Pro needs to be a catalyst for company profits to give the stock fuel to move higher. But I don’t envision it.

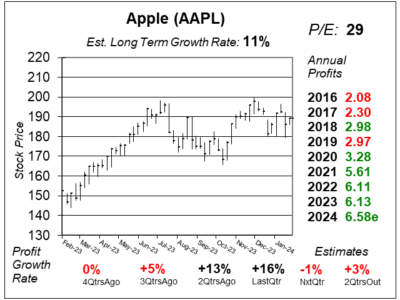

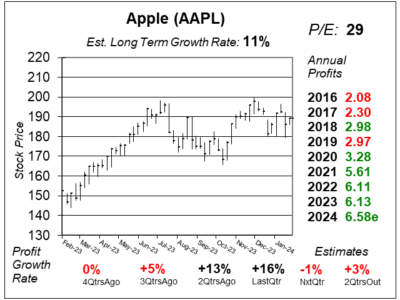

Apple (AAPL) might have a catalyst in its Apple Vision Pro. Good. It needs one with total revenue down 1% last quarter.

Apple (AAPL) has invented the next big idea in its array of computing products. This catalyst is The Apple Vision Pro headset.

Apple’s (AAPL) growth has stagnated, with year-over-year profits flat. Perhaps Apple Pay could become the company’s next catalyst?

Apple (AAPL) isn’t even growing anymore. Revenue for iPhones, Macs and Wearables: all down. Apple isn’t growing anymore.

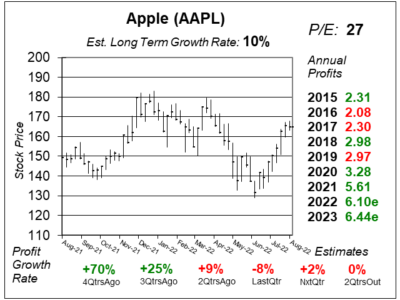

Apple (AAPL) is delivering poor profit growth. And since stock growth follows profit growth, this stock could sit here for a year.

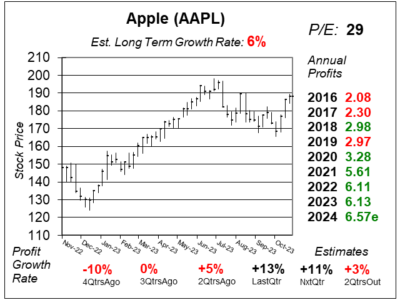

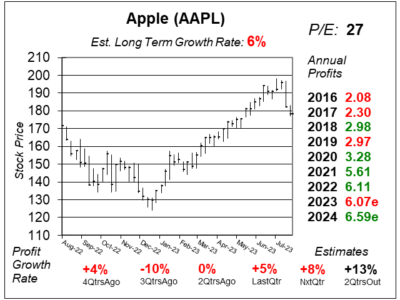

Apple (AAPL) may have finally matured, as analysts expect just 9% profit growth this year, and only 5% growth the next two years.

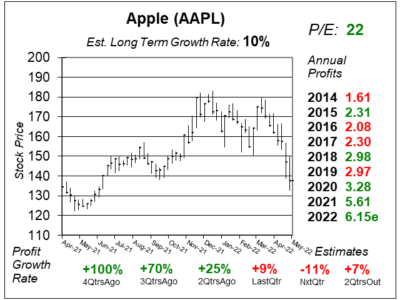

Apple (AAPL) stock is a good valuewith the P/E down from 29 to 22 since last qtr. But investors have to deal with slow profit growth.

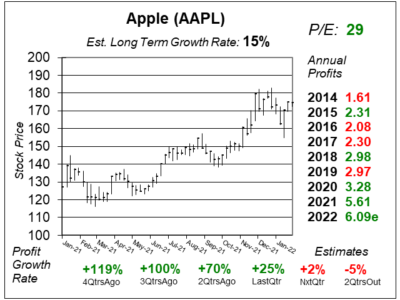

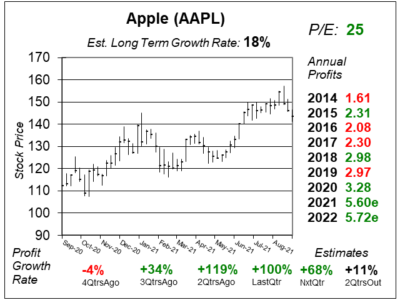

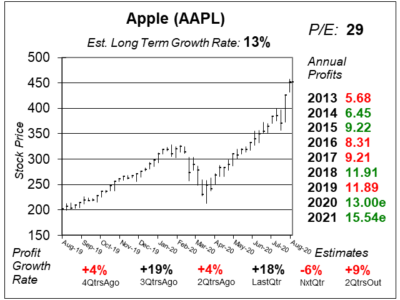

Apple’s (AAPL) been a special stock the past two years. But post-COVID, profit growth & stock growth could slow to 12-15% a year.

Apple (AAPL) is a stronger company than it used to be, as its successfully bullying Facebook and Snap — as well as Epic Games.

Apple (AAPL) has a new iPhone 13, and a new watch as well. These and other prouct advances should keep AAPL stock timely.

Apple (AAPL) delivered stupendous results last qtr with iPhone revenue up 66%, with Mac up 70%, and iPad up 79%.

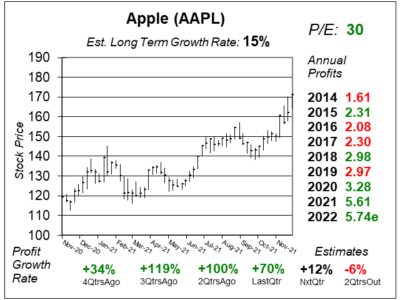

Apple (AAPL) reported a quarter that beat expectations while delivering 34% profit growth on 21% revenue growth.

Apple’s (AAPL) new camera creates 3D like images, and this could be a catalyst for the stock. If not, I see little upside here,

Apple (AAPL) takes 30% of add-on game revenue from video game developers, then blocks the game if they don’t pay up.

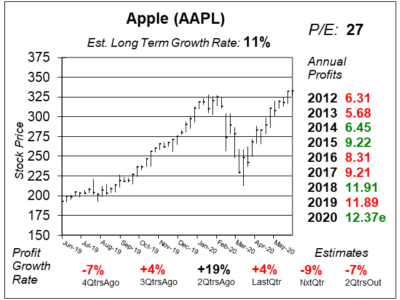

Apple’s (AAPL) iPhone sales were down last qtr as the Coronavirus closed stores. But Wearables and Services picked up the slack.

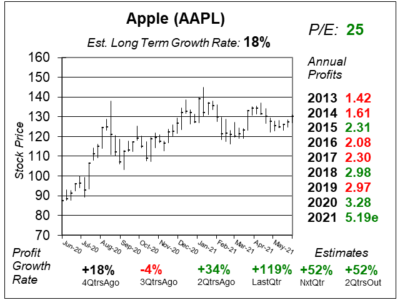

Apple (AAPL) stock is up 91% in just a year. So now the question is will this rally continue or is the run done?

Apple (AAPL) wearable sales and services revenue have been catalysts for the stock as AAPL’s P/E hits a decade high.

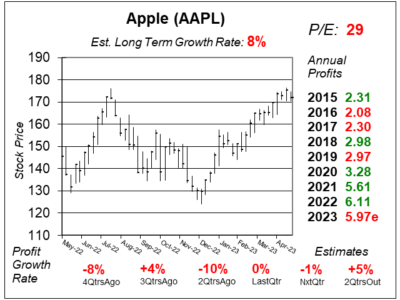

Apple’s (AAPL) profits are coming in so crappy, that next year’s profits are expected to grow 12% due to easy comparisons.

During the past week, Apple (AAPL) stock has sold off with the stock market. My analysis points to more downside risk.

Apple’s (AAPL) profit estimates just got gashed, as iPhone revenue (62% of sales) declined 15% last qtr. Sharek feels AAPL is done as a growth stock.

iPhones make up 59% of Apple (AAPL) sales, and with the company having 0% unit growth last qtr, this stock’s run could be done.

Apple (AAPL) is my favorite stock right now, and holds the top spot in all my Power Rankings. Here’s what I think the stock is worth.

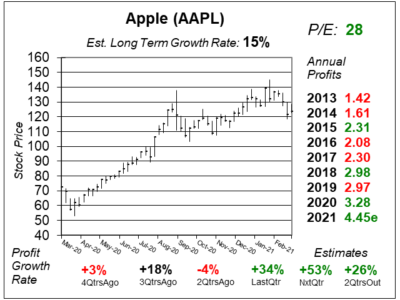

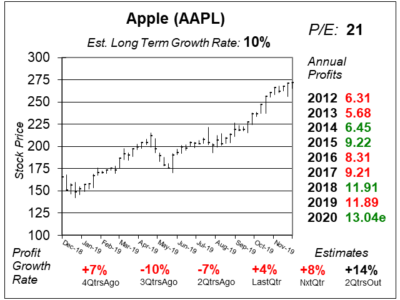

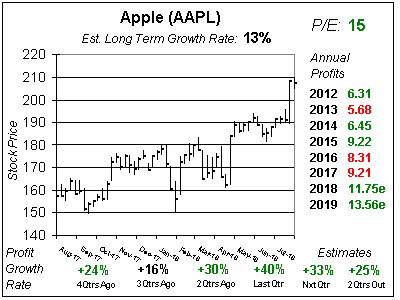

Apple (AAPL) broke out this month after delivering 30% profit growth. And with estimates of 31% growth next qtr, this stock has the ability to make a move.

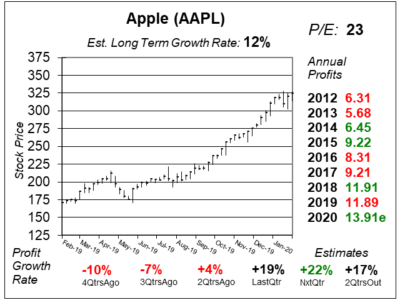

Apple (AAPL) stock was getting slammed a couple weeks ago — both in the markets and in the news. Maybe that was just “fake news” as profits look to grow briskly the next 4 qtrs.

Apple (AAPL) just kicked it up a notch as its profits swelled 24% last qtr. What’s more is qtrly Estimates are for 12%, 39%, 32% and 20% profit growth the next 4 qtrs.

Apple (AAPL) is expected to debut its new iPhone 8 on September 12th. That should be good for profits. Also, service revenue is becoming a bigger piece of the AAPL.

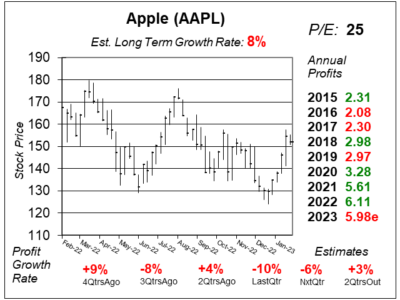

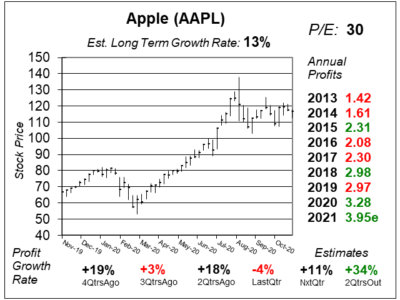

Apple (AAPL) is sliding lower — breaking below its 50-day moving average today — so is it time to sell AAPL stock? Let’s take a closer look and see.

I was wrong not owning Apple (AAPL) stock, but with just 3% revenue growth and 2% profit growth last qtr I still think you should sell it.

Apple’s (AAPL) hasn’t grown profits in almost a year now, yet investors are still enamored with the stock. I’m not. Here’s my take on AAPL.

The iPhone 7 has arrived! And Apple (AAPL) stock is rallying on the news. Let’s take a look at the numbers, and see if profit estimates jumped.

With shares of Apple (AAPL) down from $110 to $94, many investors feel the stock is a deal. Not me, the numbers are worse than you think.

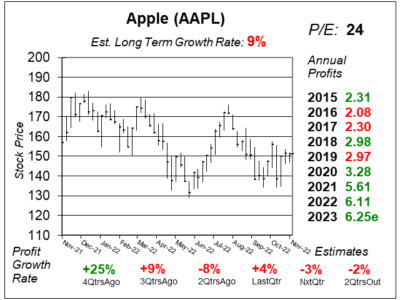

Apple’s (AAPL) profit growth shrunk to 7% last qtr, that’s why the stock fell.

Although Apple (AAPL) stock has lost its momentum, the stock is a real deal at just 12 times earnings.

Just when you think Apple’s (AAPL) ready to move again it drops after earnings and is now back in its base.

Shares of Apple (AAPL) are still a good buy right now, fueled by iPhone sales growth of 55% last qtr.

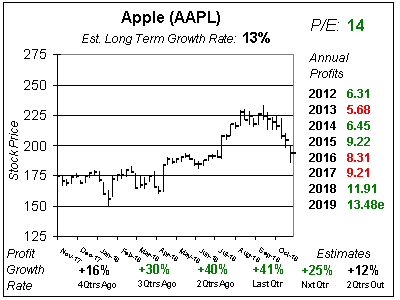

Apple (AAPL) is back with 20% profit growth — and a 14 P/E — so I will add it to the Growth Portfolio & Aggressive Growth Portfolio.

Now that Apple (AAPL) is loved once again, here’s a list of things you probably didn’t know about the stock.

Apple (AAPL) broke $600 yesterday, so let’s look at AAPL stock and see if it’s time to get back in.

I think shares of Apple (AAPL) are stuck between $500 and $600 and the stock isn’t going anywhere soon. I’ve moved on.

It’s time to say goodbye to a former top holding that has fallen and cannot get back up. Take care Apple (AAPL), come back soon.

Shares of Apple (AAPL) rose $15 to $566 yesterday as the stock got upgraded to Buy at a brokerage firm. Here’s my take on shares of

Apple’s (AAPL) stock might have turned the corner, but nothing’s better in the Earnings Table, and this move isn’t back to $700.

Apple’s (AAPL) stock isn’t declining anymore but the numbers are free falling. I don’t think AAPL’s going back to $700 soon. It shouldn’t be a top holding.

Apple (AAPL) had flat profit growth last quarter. Here’s my thesis on where AAPL is now and exactly when I see the stock rallying.

Apple (AAPL) went from $400 to $700 in less than a year. After a move like that a correction to $550 was inevitable. Now the stock can go to $1000.

Apple’s (AAPL) iPhone 5 an iPad Mini are coming this fall. That news trumps the fact AAPL’s numbers took a hit after last quarter’s poor results.

Think Apple’s (AAPL) move is done? Think again. The run has just begun. On the horizon I see the stock blowing past $1000. Even $2500 is possible.

Just before Apple (AAPL) reported last quarter’s earnings, the stock was $420. Now it’s pushed through $500 and could make a parabolic move.

This was the first earnings release after Steve Jobs passed away. The headlines said AAPL missed estimates by 34 cents. But in reality, AAPL beat the street. This stock is around $400 and should at least be $680.

Last quarter in my Apple (AAPL) article, I wrote “The pressure is building. The levee has to break”. Well the levee has broke and the stock has hit all-time highs — yet to me the stock is cheaper. Here’s why…

Apple (AAPL) almost doubled profits last quarter — crushing analyst estimates along the way. This stock should have a P/E of 35 and instead its 14. The pressure is building. The levee has to break.

Apple’s (AAPL) sweet 16. Not the stock price, the P/E. Apple’s business is actually accelerating — with estimates jumping higher. This is one of the top investments of our time.

Apple’s (AAPL) got a 16 P/E. Apple’s got a 16 P/E. Apple’s got a 16 P/E. The iPhone and iPad awesome, and I’m going to tell you about something that could be even bigger.

Apple (AAPL) has all the characteristics to go on an explosive move higher. Strong profit growth & a low P/E give this stock huge upside. Here’s why a double seems realistic in the short term.