Stock (Symbol) |

Apple (AAPL) |

Stock Price |

$171 |

Sector |

| Technology |

Data is as of |

| December 7, 2020 |

Expected to Report |

| January 25 |

Company Description |

Apple’s products and services include iPhone, iPad, Mac, iPod, Apple TV, a portfolio of consumer and professional software applications, the iOS and OS X operating systems, iCloud, and a variety of accessory, service and support offerings. The Company also sells and delivers digital content and applications through the iTunes Store, App StoreSM, iBookstoreSM, and Mac App Store. Source: Thomson Financial Apple’s products and services include iPhone, iPad, Mac, iPod, Apple TV, a portfolio of consumer and professional software applications, the iOS and OS X operating systems, iCloud, and a variety of accessory, service and support offerings. The Company also sells and delivers digital content and applications through the iTunes Store, App StoreSM, iBookstoreSM, and Mac App Store. Source: Thomson Financial |

Sharek’s Take |

Apple (AAPL) has gained power in battles with other big tech companies, which has lead to the stock being able to hold a higher multiple (P/E ratio). Apple first flexed its muscles in a video game fee-sharing arrangement with Epic Games. Then made it harder for advertisers to track people online, which hampered Facebook and really hurt Snap. Apple (AAPL) has gained power in battles with other big tech companies, which has lead to the stock being able to hold a higher multiple (P/E ratio). Apple first flexed its muscles in a video game fee-sharing arrangement with Epic Games. Then made it harder for advertisers to track people online, which hampered Facebook and really hurt Snap.

In its grab, Epic Games wasn’t giving Apple 30% of its share of Fortnite’s revenue, now the game isn’t playable on Apple devices. Video game developer Epic Games has a HUGELY popular game shooter called Fortnite, which used to be available for free in Apple’s app store, with added perks available for the game to buy better guns, armor, etc at a cost (of which Apple got a 30% cut of). Well, Epic changed the coding in the game to offer perks at 20% off if the gamer bought using a like to another webpage, which basically left Apple out of a cut of revenue. Apple then took Epic off its app store, and Epic sued Apple. Apple won 9 of 10 counts, then Apple kept Fortnite off of Apple products in a spiteful (yet legal) move. So Apple gained power. Next, Apple has made changes to its iOS 14.5 asking people if they want to opt-out of apple tracking them across the Internet. Many users did, and this hurt social media companies. Say you go to the Polo website to check out a sweater. If you were logged into Facebook, Meta would know you were there. Then when you went back on Facebook, either Ralph Lauren or another sweater company would show you a sweater ad as it placed targeted ads to people who visited the big apparel maker’s “Sweaters” page. Meanwhile, Apple continues to deliver solid results as last qtr profits jumped 70% from the year-ago period and revenue soared 29%. iPhone revenue was up 47%, with Services up 26%, iPad up 21%, wearables up 12%, and Mac up 2%. Here’s some AAPL stats from last qtr:

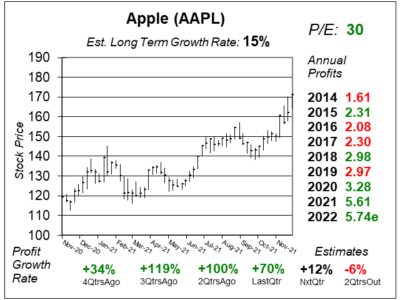

Apple stock has been moving higher as most tech stocks have been falling. I think its because the company is a stronger player in the tech world. Companies have to pay 30% for game add-ons, maybe Facebook and Snap need to chip in a slice of their ad revenue growth? Or maybe Apple takes that data and sells it to advertisers itself. This qtr AAPL has a P/E of 30, which is high for this stock. But it seems investors think the stock is more valuable after this power-play. The stock has an Estimated Long-Term Growth Rate of 15% a year, in addition to a yield of less than 1%. Management also buys back billions in stock. Management has reduced the share count 37% since 2013 (source: Squawk on the Street 11/17/21). Last qtr, management declared $0.22 cash dividend per share payable on November and repurchased $20 billion in stock. AAPL is part of the Conservative Growth Portfolio. The stock has great momentum right now. |

One Year Chart |

This stock just broke out in a “bear market” for growth stocks. This is one of the only tech stocks that is moving higher right now. Incredible momentum. Note qtrly profit Estimates suggest growth will slow in a big way. I think that will be the case. This stock just broke out in a “bear market” for growth stocks. This is one of the only tech stocks that is moving higher right now. Incredible momentum. Note qtrly profit Estimates suggest growth will slow in a big way. I think that will be the case.

The Est. LTG of 15% is very good for a conservative growth stock, but its not the 20% growth I like for a traditional growth stock. Thus, I consider this a conservative growth stock. The P/E of 30 is high compared to recent history, but the P/E was also 30 4QtrsAgo. The P/E was just 25 last qtr. |

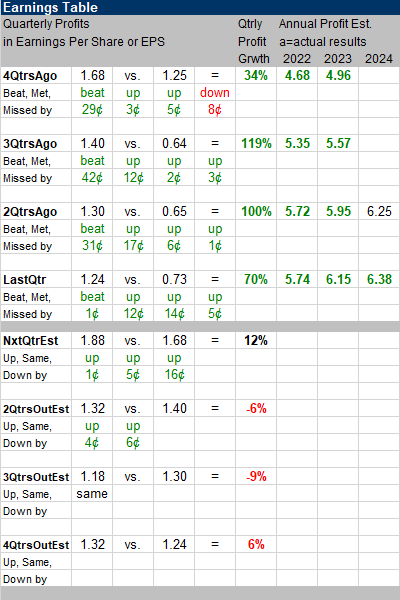

Earnings Table |

Last qtr, AAPL delivered 70% profit growth beat estimates of 68%. Note AAPL only beat profit estimates by a penny. So I’m not going to assume it will beat these qtrly estimates by much. Revenues increased 29%, year-over-year. iPhone business remained the largest in sales contribution and had the highest growth, during the qtr. Last qtr, AAPL delivered 70% profit growth beat estimates of 68%. Note AAPL only beat profit estimates by a penny. So I’m not going to assume it will beat these qtrly estimates by much. Revenues increased 29%, year-over-year. iPhone business remained the largest in sales contribution and had the highest growth, during the qtr.

Record sales performance was driven by very strong customer demand in MacBook Aid and iPad Pro as well as sustained demand for iPhone 12 lineup. Annual Profit Estimates increased this qtr. But this year’s estimates only increased by two cents. Qtrly Profit Estimates are for 12%, -6%, -9%, and 6% growth the next 4 qtrs. I doubt growth will go negative 2QtrsOut and 3QtrsOut. Momentum is strong. For the next qtrs, management estimates around $6 billion sales impact due to silicon shortages and COVID-19-related production disruptions. All product categories are expected to grow in the future, except for iPad (due to supply constraints). |

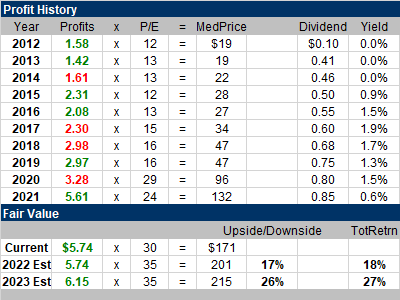

Fair Value |

AAPL was incredibly undervalued a decade ago. The stock’s median P/E was 12 to 13 during fiscal years 2011-2016 and then it was 16-17 during 2017-2019. In 2020 the median P/E jumped to 29. The increase in valuation (P/E) during 2029-2020 was the main reason why AAPL was such a hot stock during that time (note the median stock price jumped from $47 to $96). AAPL was incredibly undervalued a decade ago. The stock’s median P/E was 12 to 13 during fiscal years 2011-2016 and then it was 16-17 during 2017-2019. In 2020 the median P/E jumped to 29. The increase in valuation (P/E) during 2029-2020 was the main reason why AAPL was such a hot stock during that time (note the median stock price jumped from $47 to $96).

Looking ahead, I feel this stock is worthy of a 35 P/E, which equates to $201 a share for 2022 and $215 for 2023. |

Bottom Line |

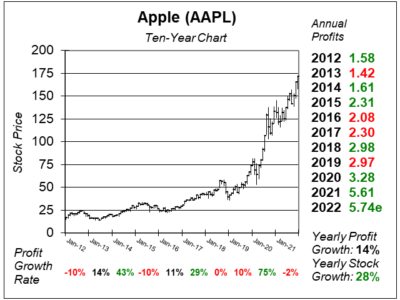

Apple (AAPL) has benefited from COVID-19 and he work-from-home trend. But notice yearly profit growth was only 14% per year while the stock grew 28% (that includes 2022 profit estimates). So the stock benefited in a big way from the rising P/E. I’m thinking the future profit growth rate and stock growth rate might be closer to 12-15% a year. Apple (AAPL) has benefited from COVID-19 and he work-from-home trend. But notice yearly profit growth was only 14% per year while the stock grew 28% (that includes 2022 profit estimates). So the stock benefited in a big way from the rising P/E. I’m thinking the future profit growth rate and stock growth rate might be closer to 12-15% a year.

AAPL is a hot stock right now as the company is more powerful than even a few months ago. Momentum is high in the short-term, but the P/E of 30 is higher than usual so the stock has mediocre upside over the long-term. AAPL remains at 5th in the Conservative Growth Portfolio Power Rankings. I increased my position two qtrs ago. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Stock Portfolio 5 of 37 |