Money Management

Let Us Manage Your Stock Portfolio

Conservative Stock Portfolio

-

A portfolio with safer stocks which are often Blue Chips and/or pay dividends. Stocks with Est. LTG plus dividend yield of 10% or more per year

-

30 to 50 stocks

-

$100,000 Minimum Account Size

-

Individual and Joint brokerage accounts, IRA's, Rollover IRAs, and SEPs

-

1% to 2% per year Management Fee

Growth Stock

Portfolio

-

Our flagship portfolio is comprised with large and small companies with Estimated Long-Term Growth Rates (Est. LTG) of 15% or more per year

-

30 to 50 stocks

-

$100,000 Minimum Account Size

-

Individual and Joint brokerage accounts, IRA's, Rollover IRAs, and SEPs

-

2% to 3% per year Management Fee

Aggressive Growth Portfolio

-

A focused portfolio comprised of top stocks from the Growth Portfolio which have rapid profit growth are timely in the stock market today

-

25 to 50 stocks

-

$100,000 Minimum Account Size

-

Individual and Joint brokerage accounts, IRA's, Rollover IRAs, and SEPs

-

3% per year Management Fee

Conservative Growth Portfolio

Growth of $100,000 Investment Since Inception

Objective & Strategy

Sharek’s Conservative Growth Portfolio invests in companies with Estimated Long Term Growth Rates of 10% or greater.

- Portfolio Style: Separately Managed Accounts

- Number of Positions: 30 to 50

- Equity Style: Large, Medium and Small Cap Value

- Minimum Account Size: $100,000

- Annual Management Fee: 1% to 2%

- Incentive Fee: None

Power Rankings as of December 31, 2021

| Rank | Stock | LTG |

| 1 | Booking (BKNG) | 21% |

| 2 | Alphabet (GOOG) | 21% |

| 3 | Amazon (AMZN) | 36% |

| 4 | Target (TGT) | 15% |

| 5 | Microsoft (MSFT) | 17% |

| 6 | Apple (AAPL) | 15% |

| 7 | Fortinet (FTNT) | 17% |

| 8 | DR Horton (DHI) | 11% |

| 9 | Dollar General (DG) | 15% |

| 10 | Pool Corp (POOL) | 17% |

Sector Allocation as of December 31, 2021

| Technology | 32% |

| Retail & Travel | 25% |

| Healthcare | 7% |

| Food & Necessities | 15% |

| Financial | 8% |

| Energy & Commodities | 10% |

| Cash | 4% |

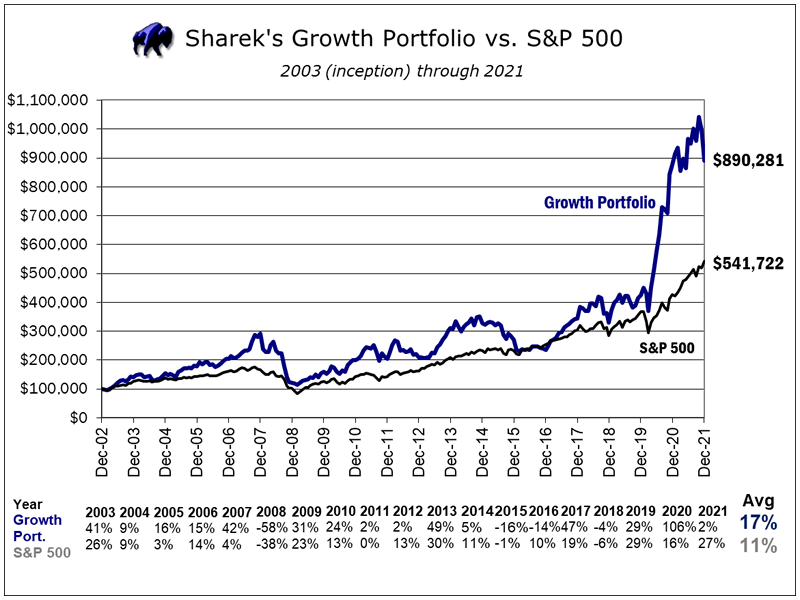

Growth Stock Portfolio

Growth of $100,000 Investment Since Inception

Objective & Strategy

Sharek’s Growth Stock Portfolio invests in companies with Estimated Long Term Growth Rates of 15% or greater.

- Portfolio Style: Separately Managed Accounts

- Number of Positions: 35 to 50

- Equity Style: Large, Medium and Small Cap Growth

- Minimum Account Size: $100,000

- Annual Management Fee: 2% to 3%

- Incentive Fee: None

Top Holdings as of December 31, 2021

| Rank | Stock | LTG |

| 1 | NVIDIA (NVDA) | 39% |

| 2 | Sea (SE) | N/A |

| 3 | The Trade Desk (TTD) | 32% |

| 4 | Tesla (TSLA) | 73% |

| 5 | Amazon (AMZN) | 21% |

| 6 | Alphabet (GOOGL) | 21% |

| 7 | Floor & Decor (FND) | 33% |

| 8 | Palo Alto Networks (PANW) | 26% |

| 9 | Cloudflare (NET) | N/A |

| 10 | Shopify (SHOP) | 29% |

Sector Allocation as of December 31, 2021

| Technology | 53% |

| Retail & Travel | 20% |

| Industrails & Energy | 5% |

| Financial | 12% |

| Healthcare | 0% |

| Food & Necessities | 3% |

| Cash | 7% |

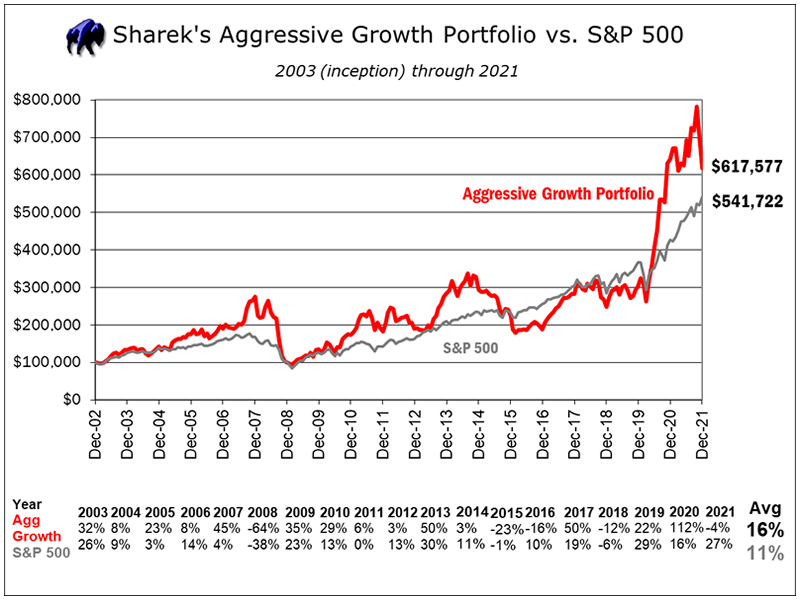

Aggressive Growth Portfolio

Growth of $100,000 Investment Since Inception

Objective & Strategy

Sharek’s Aggressive Growth Stock Portfolio invests in companies with Estimated Long Term Growth Rates of 20% or greater.

- Portfolio Style: Separately Managed Accounts

- Number of Positions: 25 to 50

- Equity Style: Large, Medium and Small Cap Growth

- Minimum Account Size: $100,000

- Annual Management Fee: 2% to 3%

- Incentive Fee: None

Power Rankings as of December 31, 2021

| Rank | Stock | Est. Rev. Growth 2020-2023 |

| 1 | Nvidia (NVDA) | 32% |

| 2 | Sea (SE) | 68% |

| 3 | Upstart (UPST) | 108% |

| 4 | Applovin (APP) | 68% |

| 5 | Celsius (CELH) | 79% |

| 6 | Atlassian (TEAM) | 26% |

| 7 | Zscaler (ZS) | 47% |

| 8 | Square (SQ) | 38% |

| 9 | MercadoLibre (MELI) | 48% |

| 10 | Hubspot (HUBS) | 33% |

Sector Allocation as of December 31, 2021

| Technology | 64% |

| Retail & Travel | 7% |

| Industrials & Energy | 3% |

| Cash | 8% |

| Financial | 14% |

| Healthcare | 0% |

| Food & Necessities | 4% |

Become a Collectors of Great Franchises

These great companies you see above are fantastic franchises. And thier stocks are good as well (or at least they had been).

I believe the best way to manage an equity portfolio is to buy-and-hold good-to-great stocks. There have been plenty of stocks that have provided investors grown in the double-digit (+10% ore more) a year on average over ten years.

The goal is to become a collector of stocks that compound in value over a number of years.

Find one winner, then hold it, and try to find another. We can help you make it happen. We research the stock market, perform stock research, and manage stock portfolios for people like you.

You own the stocks, we do the trades.

David Sharek

Stock Portfolio Manager

School of Hard Stocks

Own Stock in Companies You Know and Trust

Above: Ten Year Charts as of 2019 Q4

About David Sharek

David Sharek is stock portfolio manager for Shareks Stock Portfolios and founder of The School of Hard Stocks.

David’s flagship Growth Stock Portfolio has returned 13% per year since inception vs. 9% in the S&P 500 (2003-2019). He‘s had four years of +40% returns in his 17 years as a portfolio manager.

Sharek is author of the book The School of Hard Stocks — How to Get Your Portfolio Back to Even, which can be found on Amazon.