Stock (Symbol) |

Apple (AAPL) |

Stock Price |

$452 |

Sector |

| Technology |

Data is as of |

| August 7, 2020 |

Expected to Report |

| October 28 |

Company Description |

Apple’s products and services include iPhone, iPad, Mac, iPod, Apple TV, a portfolio of consumer and professional software applications, the iOS and OS X operating systems, iCloud, and a variety of accessory, service and support offerings. The Company also sells and delivers digital content and applications through the iTunes Store, App StoreSM, iBookstoreSM, and Mac App Store. Source: Thomson Financial Apple’s products and services include iPhone, iPad, Mac, iPod, Apple TV, a portfolio of consumer and professional software applications, the iOS and OS X operating systems, iCloud, and a variety of accessory, service and support offerings. The Company also sells and delivers digital content and applications through the iTunes Store, App StoreSM, iBookstoreSM, and Mac App Store. Source: Thomson Financial |

Sharek’s Take |

Apple (AAPL) has been a hot stock lately, and much of that is because investors value the Services revenue the company has been delivering. Just last qtr, Services accounted for 22% of total company revenue, that’s up from 21% a year ago, 18%, two years ago, 16% three years ago and 14% four years ago. Apple Services include: Apple Pay, Apple Music, iTunes and the App Store. And within App Store are the video game sales, which I assume are soaring with so many people staying at home. Epic Games, the developer for one of the worlds most popular games, Fortnite, is sick of paying a 30% cut to Apple when gamers buy in-game currency to purchase things like better guns and armour. Epic recently allowed users to buy in-game currency without using (and paying) Apple. Apple retaliated and shut down Fortnite on the iPhone. Now, Epic is suing Apple, trying to get the “take” reduced. Epic currently takes 12% from app makers in its app store. Game revenue is a big deal. China’s Tencent currently gets 35% of its revenue from video games. This suit is very important because the rise in Apple stock is mainly due to its higher P/E ratio, and part of that is because investors cherish service revenue. Apple (AAPL) has been a hot stock lately, and much of that is because investors value the Services revenue the company has been delivering. Just last qtr, Services accounted for 22% of total company revenue, that’s up from 21% a year ago, 18%, two years ago, 16% three years ago and 14% four years ago. Apple Services include: Apple Pay, Apple Music, iTunes and the App Store. And within App Store are the video game sales, which I assume are soaring with so many people staying at home. Epic Games, the developer for one of the worlds most popular games, Fortnite, is sick of paying a 30% cut to Apple when gamers buy in-game currency to purchase things like better guns and armour. Epic recently allowed users to buy in-game currency without using (and paying) Apple. Apple retaliated and shut down Fortnite on the iPhone. Now, Epic is suing Apple, trying to get the “take” reduced. Epic currently takes 12% from app makers in its app store. Game revenue is a big deal. China’s Tencent currently gets 35% of its revenue from video games. This suit is very important because the rise in Apple stock is mainly due to its higher P/E ratio, and part of that is because investors cherish service revenue.

Last qtr, Apple had 10% growth in Product sales, and 15% in Services. Products were 78% of revenue last qtr, down from 79% a year ago. Product revenue includes iPhone, Wearables, Macs and iPad. Services were 22% of sales, up from 21% last year. Here’s some AAPL stats from last qtr:

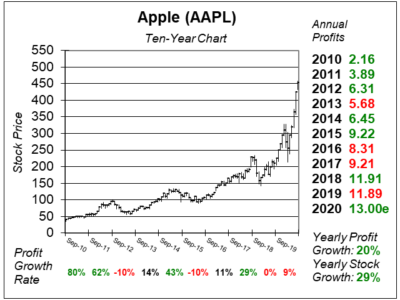

Apple stock has an Estimated Long-Term Growth Rate of 13% a year, and yields less than 1%. Management also buys back billions in stock. The stock’s valuation is higher than its been in a decade, as investors appreciate consistent Services revenue. The P/E has shot up from 15 to 29 in just the past year. The median annual P/E was 12-16 the past ten years. NEW 5G phones could be coming within the next year, and that could be a catalyst for profits. AAPL stock is part of my Conservative Growth Portfolio. If the company has to lower its cut on Services revenue, that could pressure the P/E ratio to come down. Management approved a 4-for-1 stock split, but that doesn’t impact the stock’s Fair Value. |

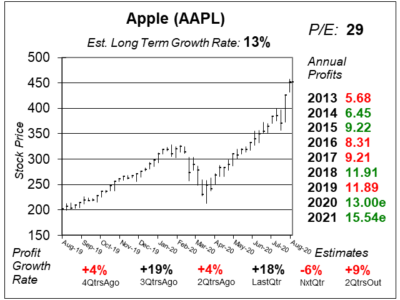

One Year Chart |

This stock has been fabulous during the past year while profit growth has been below average. This “move” was all-about valuation. This stock has been fabulous during the past year while profit growth has been below average. This “move” was all-about valuation.

The Est. LTG of 13% is up from 12% last qtr. Notice Annual Profits hit All-Time highs in only 3 of the last 8 years. The P/E of 29 is up from 27 last qtr, 23 2QtrsAgo, 21 3QtrsAgo, and 15 4QtrsAgo. |

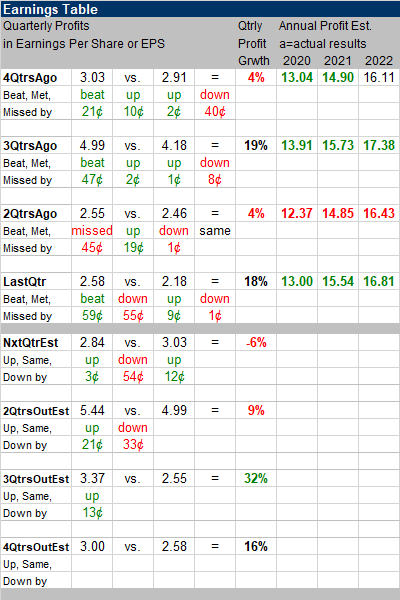

Earnings Table |

Last qtr AAPL delivered 18% profit growth and beat estimates of -9%. Revenue increased 11%. With people stuck at home, they ended up buying phone and computer equipment. Also, revenue growth was only 1% the prior qtr, so there was some pent-up demand. Last qtr AAPL delivered 18% profit growth and beat estimates of -9%. Revenue increased 11%. With people stuck at home, they ended up buying phone and computer equipment. Also, revenue growth was only 1% the prior qtr, so there was some pent-up demand.

Annual Profit Estimates had solid increases across the board. Qtrly profit Estimates are for -6%, 9%, 32% and 16% growth the next 4 qtrs. I doubt profit growth will be negative next qtr. The company just made it through a recession and profits kept climbing. Notice LastQtr that estimates declined by 55 cents, then Apple beat by 59 cents. Well NxtQtrEst declined by 54 cents last qtr and this qtr only increased by 3 cents. I think Apple will beat the street in a big way next qtr. |

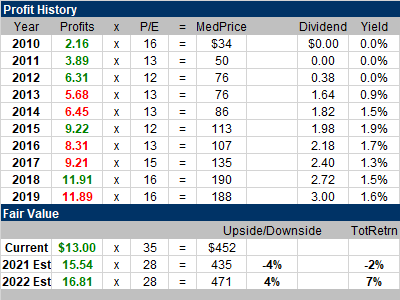

Fair Value |

I’ve been underestimating AAPL’s P/E ratio. This qtr I take my Fair Value P/E up from 25 to 28. But I really don’t have a clue what the P/E should really be. 25? 30? 35? That’s up to investors. Years ago I invested a lot into AAPL thinking the P/E would grow. It didn’t, and that call ended up hurting my overall results. I’ve been underestimating AAPL’s P/E ratio. This qtr I take my Fair Value P/E up from 25 to 28. But I really don’t have a clue what the P/E should really be. 25? 30? 35? That’s up to investors. Years ago I invested a lot into AAPL thinking the P/E would grow. It didn’t, and that call ended up hurting my overall results.

Note AAPL has its Fiscal Year end on September 30th. The stock currently has a 35 P/E on 2020 estimates. Above, in my one-year chart, I used a 29 P/E because I’m looking ahead to the next fiscal year (which is two weeks away). My analysis points to the stock being around its Fair Value right now. But 2021 estimates could increase in the coming qtrs, and the stock could follow suit. Also, AAPL might get continue to receive a 35 P/E, and that would help the stock too. |

Bottom Line |

Apple (AAPL) has had its ups-and-downs the past decade, but overall it’s provided buy-and-hold investors a solid return. These recent run is parabolic, and I am afraid that could lead to a big correction. Apple (AAPL) has had its ups-and-downs the past decade, but overall it’s provided buy-and-hold investors a solid return. These recent run is parabolic, and I am afraid that could lead to a big correction.

Apple the company is doing very well right now, and 5G could be a catalyst for profits. But the dark cloud overhead is the 30% take on developer revenue. If that comes down, it could cause the P/E to be reduced as well. I think a 10% to 12% take is fair, and I think the court will rule against Apple. AAPL moves down from 3rd to 5th in my Conservative Growth Portfolio Power Rankings. I’m going to sell a few share from client accounts because the stock is on a parabolic move and is dangerous up here. AAPL isn’t part of my Growth Portfolio because its Estimated Long-Term Growth Rate is just 13%. With a dividend yield of just 1%, that’s an estimated total return of 14% a year, less than the 15% I like for the Growth Portfolio (which has a lot of 35%-plus growers). |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Stock Portfolio 5 of 31 |