Stock (Symbol) |

Apple (AAPL) |

Stock Price |

$333 |

Sector |

| Technology |

Data is as of |

| June 8, 2020 |

Expected to Report |

| July 28 |

Company Description |

Apple’s products and services include iPhone, iPad, Mac, iPod, Apple TV, a portfolio of consumer and professional software applications, the iOS and OS X operating systems, iCloud, and a variety of accessory, service and support offerings. The Company also sells and delivers digital content and applications through the iTunes Store, App StoreSM, iBookstoreSM, and Mac App Store. Source: Thomson Financial Apple’s products and services include iPhone, iPad, Mac, iPod, Apple TV, a portfolio of consumer and professional software applications, the iOS and OS X operating systems, iCloud, and a variety of accessory, service and support offerings. The Company also sells and delivers digital content and applications through the iTunes Store, App StoreSM, iBookstoreSM, and Mac App Store. Source: Thomson Financial |

Sharek’s Take |

Apple (AAPL) has been a hot stock lately, and helping the company’s results are wearables and services, which had sales increases of 23% and 17% respectively last qtr. These two divisions offset weakness in iPad sales (-10%) and iPhone sales (-7%). Here’s some AAPL stats from last qtr: Apple (AAPL) has been a hot stock lately, and helping the company’s results are wearables and services, which had sales increases of 23% and 17% respectively last qtr. These two divisions offset weakness in iPad sales (-10%) and iPhone sales (-7%). Here’s some AAPL stats from last qtr:

Apple isn’t the fast-growing company it used to be, the Estimated Long-Term Growth Rate is just 11%, which is below the 15% I like in a growth stock. AAPLE also yields 1%. Management also buys back billions in stock. The valuation (P/E) of 27 is high by historical standards. The median annual P/E was 12-16 the past ten years. NEW 5G phones could be coming within the next year, and they could be a catalyst for profits. So if you got a bump up in iPhone sales while Wearables and Services revenue is climbing, that would be a recipe for success for revenue and probably profits. AAPL stock is part of my Conservative Growth Portfolio. |

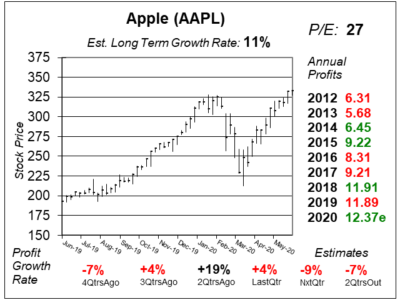

One Year Chart |

Nice rebound for this stock after the Coronavirus Bear Market. And I like that the company was still able to deliver 4% profit growth last qtr even though some of their stores were closed. Nice rebound for this stock after the Coronavirus Bear Market. And I like that the company was still able to deliver 4% profit growth last qtr even though some of their stores were closed.

The Est. LTG of 12% is down from 12% last qtr but that was up from 10% the prior qtr. Notice Annual Profits hit All-Time highs in only 3 of the last 8 years. That’s poor. The P/E of 27 is a little high for this stock, but with 5G on the way, investors are thinking profits might get a boost. |

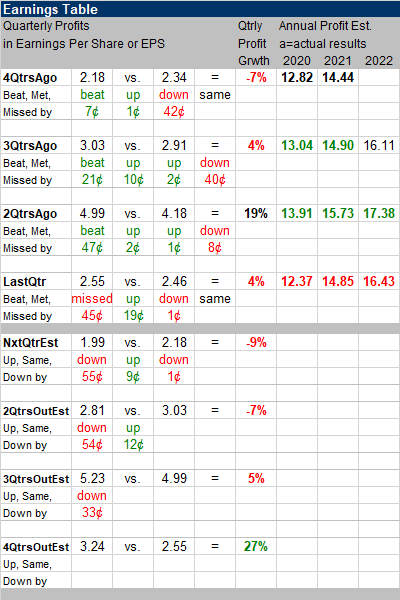

Earnings Table |

Last qtr AAPLE delivered 4% profit growth and missed estimates of 22%. Revenue increased 1%. Very good results considering much of the world was on lockdown during March (the qtr was Jan-Mar). Last qtr AAPLE delivered 4% profit growth and missed estimates of 22%. Revenue increased 1%. Very good results considering much of the world was on lockdown during March (the qtr was Jan-Mar).

Annual Profit Estimates fell slightly. I like these numbers. Qtrly profit Estimates not so much. Profit growth is expected to clock in at -9%, -7%, 5% and 27% the next 4 qtrs. I don’t have any idea what profit growth will be in the coming qtrs. I understand next qtr’s estimate declining, as many locations in the U.S. were closed in April and May and management expects revenue to be weak in iPhone and Wearables. |

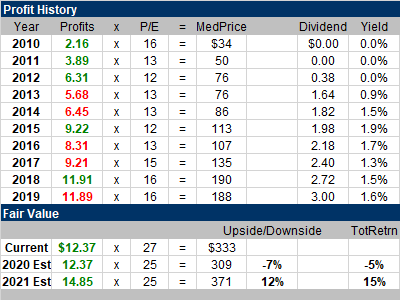

Fair Value |

I think the stock is worthy of a 25 P/E. That puts AAPL slightly above my 2020 Fair Value. The stock has some upside to 2021’s Fair Value. I think the stock is worthy of a 25 P/E. That puts AAPL slightly above my 2020 Fair Value. The stock has some upside to 2021’s Fair Value.

Note AAPL has its Fiscal Year end on September 30th. So I’ll be looking ahead to 2021’s Fair Value next qtr. |

Bottom Line |

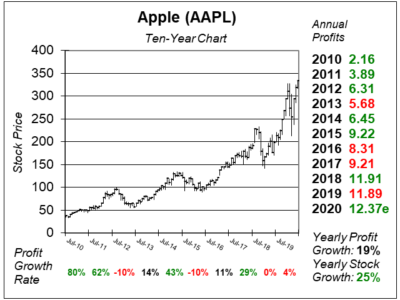

Apple (AAPL) has had its ups-and-downs the past decade, but overall it’s provided buy-and-hold investors a solid return. Apple (AAPL) has had its ups-and-downs the past decade, but overall it’s provided buy-and-hold investors a solid return.

There’s a lot of uncertainty with these profit numbers. Will AAPL miss estimates next qtr because of the riots in the streets or the Coronavirus shutting down stores? Will people use more services as they stayed at home? Will 5G boost profits higher than these estimates? AAPL ranks 8th in my Conservative Growth Portfolio Power Rankings. I’m not adjusting my ranking this qtr. I think the stock looks good as 5G is coming, but the stock might come back some in the coming months as it’s had a nice run higher. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Stock Portfolio 8 of 31 |