Stock (Symbol) |

Apple (AAPL) |

Stock Price |

$117 |

Sector |

| Technology |

Data is as of |

| November 29, 2020 |

Expected to Report |

| January 26 |

Company Description |

Apple’s products and services include iPhone, iPad, Mac, iPod, Apple TV, a portfolio of consumer and professional software applications, the iOS and OS X operating systems, iCloud, and a variety of accessory, service and support offerings. The Company also sells and delivers digital content and applications through the iTunes Store, App StoreSM, iBookstoreSM, and Mac App Store. Source: Thomson Financial Apple’s products and services include iPhone, iPad, Mac, iPod, Apple TV, a portfolio of consumer and professional software applications, the iOS and OS X operating systems, iCloud, and a variety of accessory, service and support offerings. The Company also sells and delivers digital content and applications through the iTunes Store, App StoreSM, iBookstoreSM, and Mac App Store. Source: Thomson Financial |

Sharek’s Take |

Apple (AAPL) has launched its 5G iPhone 12 and this is expected to be a catalyst for the stock in the coming year. The new phone will sport incredible color, faster load times, increased durability and the iPhone Pro will have a new depth sensor that produces 3d-like images, which you can check out here. The big question is what will the 5G iPhone do for Apple’s profits? Overall, analysts expect Apple’s Fiscal 2021 profits to grow 20%, which is a solid number for this large company. And with a P/E of 30, the stock is reasonably priced. If profits start to come in above expectations due to the 5G iPhone, AAPL could have a good year. But if estimates stay the same, I see just 8% upside for the stock. Apple (AAPL) has launched its 5G iPhone 12 and this is expected to be a catalyst for the stock in the coming year. The new phone will sport incredible color, faster load times, increased durability and the iPhone Pro will have a new depth sensor that produces 3d-like images, which you can check out here. The big question is what will the 5G iPhone do for Apple’s profits? Overall, analysts expect Apple’s Fiscal 2021 profits to grow 20%, which is a solid number for this large company. And with a P/E of 30, the stock is reasonably priced. If profits start to come in above expectations due to the 5G iPhone, AAPL could have a good year. But if estimates stay the same, I see just 8% upside for the stock.

Overall, AAPL delivered -4% profit growth last qtr as sales rose 1%. Customers held off on upgrading their iPhones last qtr. iPhone revenue declined 21% last qtr. But the pandemic helped boost mac and iPad revenue, which increased 29% and 46% respectively. Service revenue grew a respectable 16%. Paid subscriptions have provided a boost to Services. Apple now has 585 million paid subscribers, up 135 million from last year. Here’s some AAPL stats from last qtr:

Apple stock has an Estimated Long-Term Growth Rate of 13% a year, in addition to a yield of 1%. Management also buys back billions in stock. AAPL is part of the Conservative Growth Portfolio. Right now I see just a little upside in the shares, but if the 5G iPhone becomes a catalyst and boosts profit estimates I will likely become more bullish. |

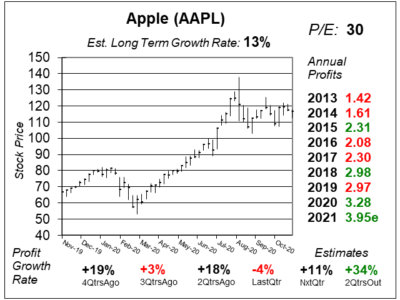

One Year Chart |

AAPL is basing right now, which is good. The stock needed to digest its prior gains. AAPL is basing right now, which is good. The stock needed to digest its prior gains.

The Est. LTG of 13% is same as last qtr. Note, analysts don’t expect this to be a fast growing company in the future. Thirteen percent isn’t much. The P/E of 30 is reasonable for this stock. The P/E was just 15 5QtrsAgo. In retrospect, the stock was a steal back then. |

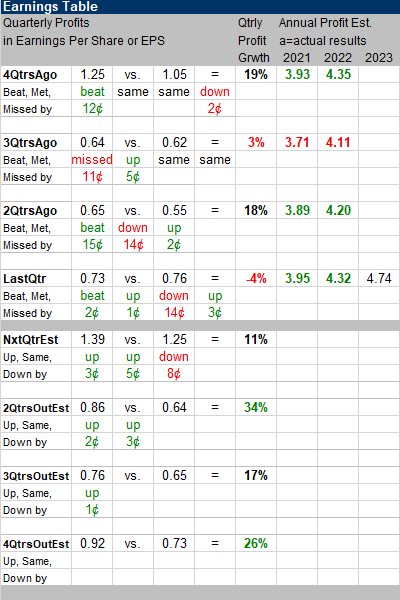

Earnings Table |

Last qtr AAPL delivered -4% profit growth and beat estimates of -6%. Revenue increased 1%. Last qtr AAPL delivered -4% profit growth and beat estimates of -6%. Revenue increased 1%.

Annual Profit Estimates had slight increases this qtr. Qtrly profit Estimates are for 11%, 34%, 17% and 26% growth the next 4 qtrs. Note the “good” qtrs have easy comparisons to the year-ago periods. |

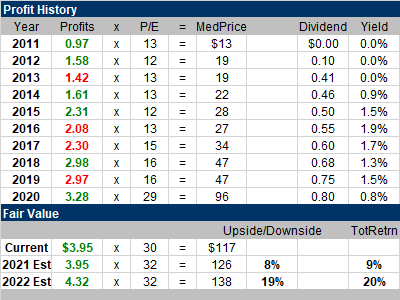

Fair Value |

The median P/E was 12 to 13 during fiscal years 2011-2016 and then was 16-17 during 2017-2019. Then last year the P/E median jumped to 29. The higher valuation (P/E) was the main reason why AAPL was such a hot stock during the past year. The median P/E was 12 to 13 during fiscal years 2011-2016 and then was 16-17 during 2017-2019. Then last year the P/E median jumped to 29. The higher valuation (P/E) was the main reason why AAPL was such a hot stock during the past year.

Now the question is: will the P/E continue to climb? I think the stock is worthy of a 32 P/E, which equates to $126 a share this year and $138 next year. If the 5G iPhone pushes profit estimates up, then my Fair Values will likely rise as well. |

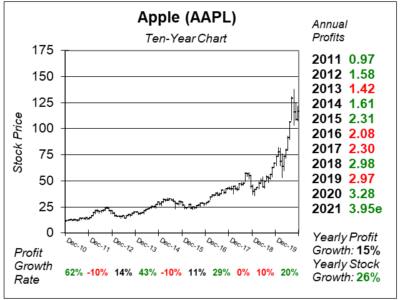

Bottom Line |

Apple (AAPL) has had its ups-and-downs the past decade, but overall it’s provided buy-and-hold investors a solid return. But do note profits only grew 15% during the decade while the stock went up 26% a year. The boost for the stock was from the P/E increasing from 13 to 30. I think its unlikely the P/E increases at all in the coming decade. Apple (AAPL) has had its ups-and-downs the past decade, but overall it’s provided buy-and-hold investors a solid return. But do note profits only grew 15% during the decade while the stock went up 26% a year. The boost for the stock was from the P/E increasing from 13 to 30. I think its unlikely the P/E increases at all in the coming decade.

5G could be a catalyst for profits, but right now I’m only seeing 20% profit growth expected for this fiscal year. AAPL stays at 8th in my Conservative Growth Portfolio Power Rankings. Although the upside doesn’t seem like much, I think it will be easy for the company to beat profit estimates. iPhone was the only division that didn’t deliver at least 16% revenue growth last qtr. AAPL isn’t part of my Growth Portfolio because its Estimated Long-Term Growth Rate is just 13%. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Stock Portfolio 8 of 34 |