Stock (Symbol) |

Apple (AAPL) |

Stock Price |

$123 |

Sector |

| Technology |

Data is as of |

| March 3, 2020 |

Expected to Report |

| April 28 |

Company Description |

Apple’s products and services include iPhone, iPad, Mac, iPod, Apple TV, a portfolio of consumer and professional software applications, the iOS and OS X operating systems, iCloud, and a variety of accessory, service and support offerings. The Company also sells and delivers digital content and applications through the iTunes Store, App StoreSM, iBookstoreSM, and Mac App Store. Source: Thomson Financial Apple’s products and services include iPhone, iPad, Mac, iPod, Apple TV, a portfolio of consumer and professional software applications, the iOS and OS X operating systems, iCloud, and a variety of accessory, service and support offerings. The Company also sells and delivers digital content and applications through the iTunes Store, App StoreSM, iBookstoreSM, and Mac App Store. Source: Thomson Financial |

Sharek’s Take |

Apple (AAPL) just reported a quarter that beat expectations while delivering 34% profit growth on 21% revenue growth. Those are very good numbers. Every division beat analyst estimates in terms of sales growth, with the exeption of Mac. It was really a great qtr. But was that because people ordered more hardware because they were building home offices while stuck at home during COVID-19? Here’s some AAPL stats from last qtr: Apple (AAPL) just reported a quarter that beat expectations while delivering 34% profit growth on 21% revenue growth. Those are very good numbers. Every division beat analyst estimates in terms of sales growth, with the exeption of Mac. It was really a great qtr. But was that because people ordered more hardware because they were building home offices while stuck at home during COVID-19? Here’s some AAPL stats from last qtr:

The 5G iPhone 12 has launched, and this is expected to be a catalyst for the stock in the coming year. The new phone sports incredible color, faster load times, increased durability and the iPhone Pro has a new depth sensor that produces 3d-like images, which you can check out here. The company couldn’t keep up with demand for the new Pro models, which should lead to better results later this year. Apple stock has an Estimated Long-Term Growth Rate of 15% a year, in addition to a yield of less than 1%. Management also buys back billions in stock. During the past two years (2018-2020) shares outstanding have decreased from 20 billion to 17.5 billion. AAPL is part of the Conservative Growth Portfolio. The stock has 15% upside to my 2021 Fair Value of $142. |

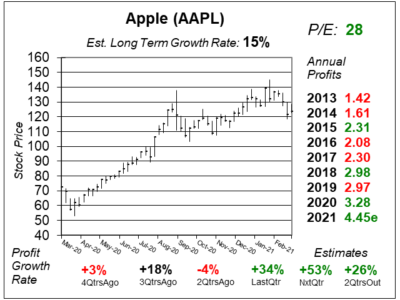

One Year Chart |

AAPL might be in the midst of a nice string of qtrly profit growth, as profits grew 34% last qtr and are expected to climb 53% and 26% the next two qtrs. And the P/E of 28 is reasonable. I htink the stock looks good. AAPL might be in the midst of a nice string of qtrly profit growth, as profits grew 34% last qtr and are expected to climb 53% and 26% the next two qtrs. And the P/E of 28 is reasonable. I htink the stock looks good.

The Est. LTG of 15% is up from 13% last qtr. Analysts are getting more positive on the stock’s profit prospects. |

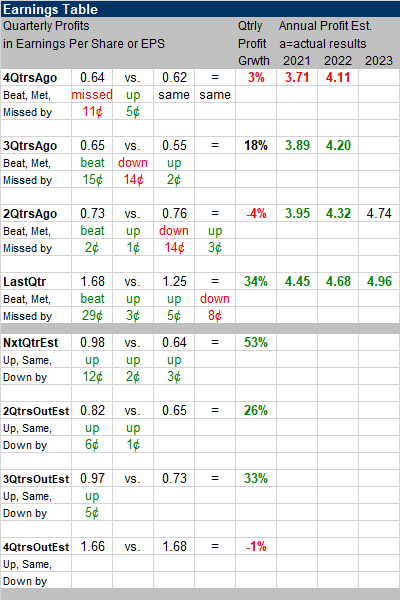

Earnings Table |

Last qtr AAPL delivered 34% profit growth and beat estimates of 11%. Revenue increased 21%. That was the October, November, December qtr. The iPhone 12 was released on October 23 of last year. Last qtr AAPL delivered 34% profit growth and beat estimates of 11%. Revenue increased 21%. That was the October, November, December qtr. The iPhone 12 was released on October 23 of last year.

Annual Profit Estimates jumped higher this qtr. Especially this year’s estimates (which count the most). Qtrly profit Estimates are for 53%, 26%, 33% and -1% growth the next 4 qtrs. Note the 4QtrsOut estimate needs time to adjust as the company just beat the street and “last year’s comparison” will be the qtr it just reported. |

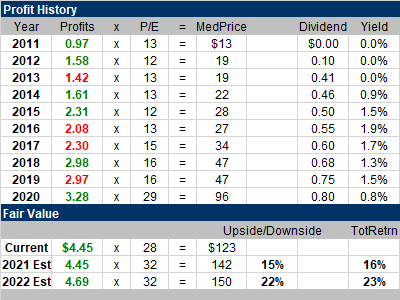

Fair Value |

The median P/E was 12 to 13 during fiscal years 2011-2016 and then was 16-17 during 2017-2019. Then last year the P/E median jumped to 29. The higher valuation (P/E) was the main reason why AAPL was such a hot stock during the past year. The median P/E was 12 to 13 during fiscal years 2011-2016 and then was 16-17 during 2017-2019. Then last year the P/E median jumped to 29. The higher valuation (P/E) was the main reason why AAPL was such a hot stock during the past year.

I feel this stock is worthy of a 32 P/E, which equates to $142 a share this year (+15%) and $150 next year (+22%). I think of this company as a 12-15% grower, so that’s good upside for me. I have tempered expectations. |

Bottom Line |

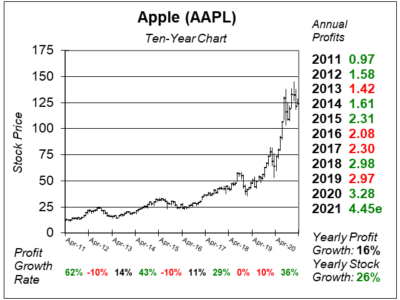

Apple (AAPL) has had a good decade. Notice profits only grew 16% during the decade while the stock went up 26% a year. The boost for the stock was from the P/E increasing from 13 to 28. Apple (AAPL) has had a good decade. Notice profits only grew 16% during the decade while the stock went up 26% a year. The boost for the stock was from the P/E increasing from 13 to 28.

5G iPhones are out and they should help boost revenue growth percentages for the next three qtrs. And since profit estimates just increased, I believe that might become a trend in the short-term. In the long-run I think this is around a 15% grower. AAPL moves slightly from 9th to 10th in my Conservative Growth Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Stock Portfolio 10 of 34 |