Stock (Symbol) |

Apple (AAPL) |

Stock Price |

$194 |

Sector |

| Technology |

Data is as of |

| November 17, 2018 |

Expected to Report |

| Jan 30 |

Company Description |

Apple’s products and services include iPhone, iPad, Mac, iPod, Apple TV, a portfolio of consumer and professional software applications, the iOS and OS X operating systems, iCloud, and a variety of accessory, service and support offerings. The Company also sells and delivers digital content and applications through the iTunes Store, App StoreSM, iBookstoreSM, and Mac App Store. Source: Thomson Financial Apple’s products and services include iPhone, iPad, Mac, iPod, Apple TV, a portfolio of consumer and professional software applications, the iOS and OS X operating systems, iCloud, and a variety of accessory, service and support offerings. The Company also sells and delivers digital content and applications through the iTunes Store, App StoreSM, iBookstoreSM, and Mac App Store. Source: Thomson Financial |

Sharek’s Take |

Apple (AAPL) stock’s run could be done as 59% of sales come from the iPhone, but iPhone unit sales were just 0% last qtr, with the “growth” coming from higher prices. That’s not good. Apple sales rose 20% last qtr, but if iPhone revenue would have been flat, it would have reduced sales growth down to 4%. Apple (AAPL) stock’s run could be done as 59% of sales come from the iPhone, but iPhone unit sales were just 0% last qtr, with the “growth” coming from higher prices. That’s not good. Apple sales rose 20% last qtr, but if iPhone revenue would have been flat, it would have reduced sales growth down to 4%.

And now this: Starting next qtr, Apple management will no longer be providing unit sales data for iPhone, iPad and Mac. Okay, fine. I didn’t track unit sales anyway. But in term of managing my position, I have to know what parts are growing and what parts are slowing. So here’s a rundown:

If Apple has a downturn in iPhone sales — ahem, I mean revenue — that would certainly hurt the stock. The growing areas are Wearables at 7% of sales and Services at 16% of sales, which aren’t big enough to make a big difference. Thankfully, Apple does an amazing job buying back stock, so profit growth could could still be in the double-digits with single-digit sales growth. Apple has $237 billion in cash, and $115 billion in debt, for a net cash position of $123 billion. Last qtr it repurchased $19 billion in stock and repaid $3.5 billion in dividends. Apple has an Est. LTG of 13% per year, a yield of 1.5%, and a P/E of just 14. Luckily, with the P/E so low, the stock might find support here. My Fair Value is a P/E of 16, which works out to $216 a share. AAPL is a value, but I’m very concerned about iPhone sales growth going forward. The company needs a new catalyst. I have to reduce my position in this stock, but will continue to hold some shares long-term. |

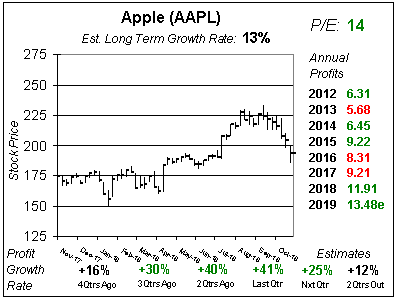

One Year Chart |

Last qtr Apple delivered 41% profit growth and beat estimates of 31%, as sales increased 20%, the 8th consecutive qtr of accelerating sales growth. Last qtr Apple delivered 41% profit growth and beat estimates of 31%, as sales increased 20%, the 8th consecutive qtr of accelerating sales growth.

But management guided estimates lower, thus analysts took their 2019 estimates from $13.56 to $13.48 and 2020 estimates from $14.97 to $14.82. Not bad. Qtrly profit Estimates are for 25%, 12%, 8% and 7% profit growth the next 4 qtrs. My guess is these further out estimates are too low, and Apple will deliver 10-20% growth next year. But that’s just a guess. The Est. LTG of 13% per year is ok, and investors get a 1.5% yield too. This stock has a low valuation, a P/E of 14 is good! |

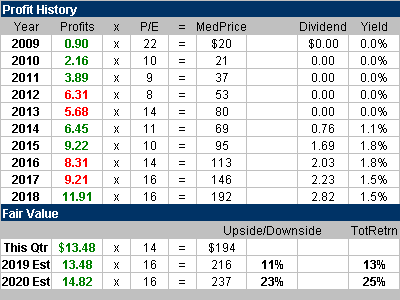

Fair Value |

Apple is moving more towards a service business model, where the apps and subscriptions it sells become a more meaningful part of its business model. This should result in a higher valuation, or P/E ratio. Apple is moving more towards a service business model, where the apps and subscriptions it sells become a more meaningful part of its business model. This should result in a higher valuation, or P/E ratio.

My Fair Value is a P/E of 16, which gives the stock modest upside. Note the P/E on the stock was just 16 the prior two years. |

Bottom Line |

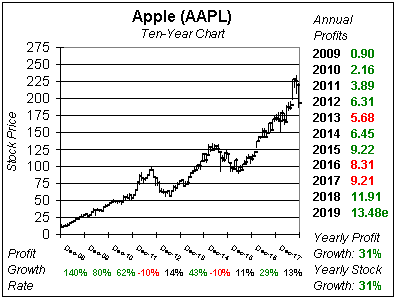

Apple has had its ups-and-downs the past decade. Just last qtr it was at an All-Time high. Now this qtr people are freaking out, I mean wondering about iPhone sales. And that’s a big concern, as the other divisions aren’t large enough to pick up the slack. Apple has had its ups-and-downs the past decade. Just last qtr it was at an All-Time high. Now this qtr people are freaking out, I mean wondering about iPhone sales. And that’s a big concern, as the other divisions aren’t large enough to pick up the slack.

AAPL takes a dive in my Power Rankings, as it was the top ranked stock in all my portfolios after I wrote last qtr’s report. AAPL now ranks 15th in the Conservative Growth Portfolio Power Rankings, and I will sell some shares from this portfolio. In the Growth Portfolio it ranks 33rd, and I will reduce my position somewhat here too. I will sell the stock entirely from the Aggressive Growth Portfolio. |

Power Rankings |

Growth Stock Portfolio

33 of 42Aggressive Growth Portfolio N/AConservative Stock Portfolio 15 of 35 |