Stock (Symbol) |

Apple (AAPL) |

Stock Price |

$325 |

Sector |

| Technology |

Data is as of |

| February 14, 2020 |

Expected to Report |

| April 28 |

Company Description |

Apple’s products and services include iPhone, iPad, Mac, iPod, Apple TV, a portfolio of consumer and professional software applications, the iOS and OS X operating systems, iCloud, and a variety of accessory, service and support offerings. The Company also sells and delivers digital content and applications through the iTunes Store, App StoreSM, iBookstoreSM, and Mac App Store. Source: Thomson Financial Apple’s products and services include iPhone, iPad, Mac, iPod, Apple TV, a portfolio of consumer and professional software applications, the iOS and OS X operating systems, iCloud, and a variety of accessory, service and support offerings. The Company also sells and delivers digital content and applications through the iTunes Store, App StoreSM, iBookstoreSM, and Mac App Store. Source: Thomson Financial |

Sharek’s Take |

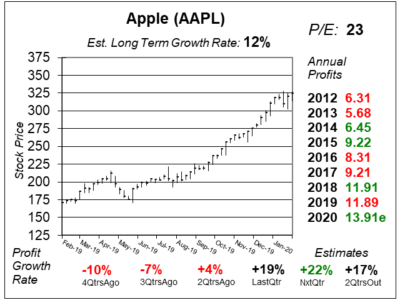

Apple (AAPL) stock has been on a tear the past year — it’s up 91% from $170 to $325 — and now the question is: Will Apple Stock Keep Rising? I say yes, because profits are growing again. Last qtr, Apple profit growth accelerated from 4% to 19% and analysts estimate profits will grow 22% and 17% the next 2 qtrs. That’s maybe twenty percent growth vs. 0% growth in 2019. And although the stock has gone on a tear, the valuation is still reasonable as the P/E is just 23. If Apple makes what analysts expect next year ($15.73), and the stock earns a P/E of 25, it will be $393 a share — a 21% gain from here. Here’s some AAPL stats from last qtr: Apple (AAPL) stock has been on a tear the past year — it’s up 91% from $170 to $325 — and now the question is: Will Apple Stock Keep Rising? I say yes, because profits are growing again. Last qtr, Apple profit growth accelerated from 4% to 19% and analysts estimate profits will grow 22% and 17% the next 2 qtrs. That’s maybe twenty percent growth vs. 0% growth in 2019. And although the stock has gone on a tear, the valuation is still reasonable as the P/E is just 23. If Apple makes what analysts expect next year ($15.73), and the stock earns a P/E of 25, it will be $393 a share — a 21% gain from here. Here’s some AAPL stats from last qtr:

Apple isn’t the fast-growing company it used to be, so investors should tempter their expectations. The Estimated Long-Term Growth Rate is just 12%, which is below the 15% I like in a growth stock. But one plus is the stock does have a 1% dividend yield. Last qtr the company had net income of $22 billion, cash flow of $31 billion, and bought back $20 billion in stock in addition to paying $3.5 billion in dividends. Apple is looking good here, but the valuation (P/E) is at decade highs. The median annual P/E was 12-16 the past ten years. NEW 5G phones could be coming in late 2020. 5G iPhones would be a catalyst for iPhone revenue, and probably profit growth as well. AAPL stock is part of my Conservative Growth Portfolio. With profits growing around 20%, I don’t think thus run is done. |

One Year Chart |

So this stock broke out and went on this tear last October (2019). Profit growth was poor at the time, so somebody knew something good was coming (I sure didn’t). So this stock broke out and went on this tear last October (2019). Profit growth was poor at the time, so somebody knew something good was coming (I sure didn’t).

The Est. LTG of 12% is up from 10% last qtr. This stock looks to be back to growing in the double-digits again, but overall expectations still remain low as analysts expect profits to grow just 12% a year the next 3-5 years. Notice Annual Profits hit All-Time highs in only 3 of the last 8 years. That’s poor. The P/E of 23 is reasonable for a high-teens grower (which AAPL is now). |

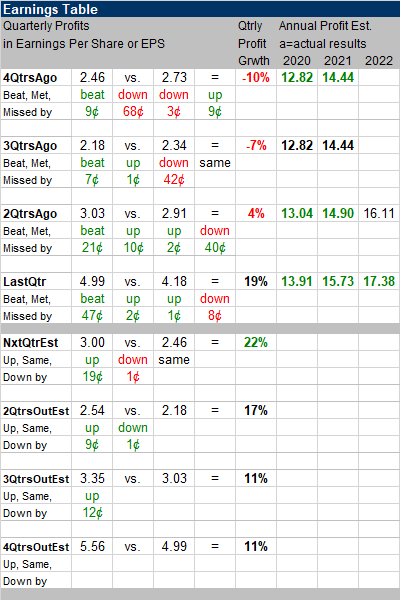

Earnings Table |

Last qtr’s 19% growth was a surprise to me as analysts had expected 8% growth. This stock was flying higher when profit growth estimates were 8%. Seems like somebody knew something good was coming. Last qtr’s beat was the biggest of the year. Sales growth accelerated from 2% 2QtrsAgo to 9% last qtr. Last qtr’s 19% growth was a surprise to me as analysts had expected 8% growth. This stock was flying higher when profit growth estimates were 8%. Seems like somebody knew something good was coming. Last qtr’s beat was the biggest of the year. Sales growth accelerated from 2% 2QtrsAgo to 9% last qtr.

Annual Profit Estimates surged higher this qtr. Annual estimates got gashed six qtrs ago, and declined five qtrs ago. Since then estimates have bottomed and turned higher. Qtrly profit Estimates are for 22%, 17%, 11% and 11% profit growth the next 4 qtrs. Notice that AAPL had -10% and -7% profit growth 4QtrsAgo and 3QtrsAgo. So these 22% and 17% qtrs coming up have easy comparisons to the year-ago periods. |

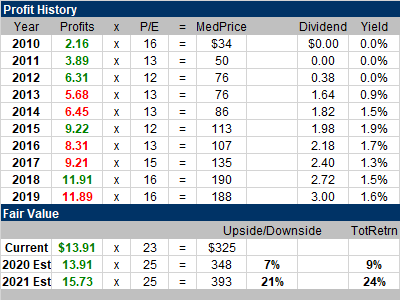

Fair Value |

Notice the stock’s median annual P/E was between 12 and 16 the past ten years. Now the P/E’s jumped to 23. But with profits growing 20% now, I think the stock is worthy of a 25 P/E. That gives the stock modest upside now, with more than 20% upside for 2021. Notice the stock’s median annual P/E was between 12 and 16 the past ten years. Now the P/E’s jumped to 23. But with profits growing 20% now, I think the stock is worthy of a 25 P/E. That gives the stock modest upside now, with more than 20% upside for 2021.

Note AAPL has its Fiscal Year end on September 30th. So I’ll be looking ahead to 2021’s Fair Value during the Summer. Also, annual estimates have been rising lately. If that continues, my Fair Value will probably rise too. |

Bottom Line |

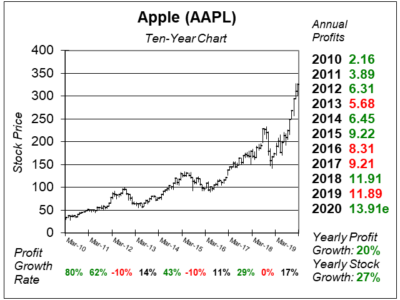

Apple (AAPL) has had its ups-and-downs the past decade, but overall it’s provided buy-and-hold investors a return of 27% the past ten years. Apple (AAPL) has had its ups-and-downs the past decade, but overall it’s provided buy-and-hold investors a return of 27% the past ten years.

Looking ahead, the stock is still racing higher. Most of that is from the P/E increasing. So I wouldn’t bet on the stock continuing to surge. But 5G could provide a new catalyst for profits. AAPL moves up from 8th to 4th in my Conservative Growth Portfolio Power Rankings. I will look to add it back into the Growth Portfolio if the stock simmers down some. Last February. I sold AAPL from the Growth Portfolio at $174 (like a big dummy). |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Stock Portfolio 4 of 34 |