Daily Market Wrap

Stocks Tumble After Weak GDP Data

Stocks slid on Thursday after disappointing economic data. Accenture (ACN) is growing slowly as organizations are slow to invest.

Stocks Little Changed Ahead of Key Economic Data

Stocks were flat on Wednesday ahead of GDP and inflation data. Dollar General (DG) delivered -38% profit growth due to shoplifting.

Strong Corporate Earnings Drive Stocks

Strong earnings sent stocks higher on Tuesday. DoubleVerify (DV) stock declined on high volume as guidance lowered.

Stocks Rebound Ahead of Major Earnings

On Monday, S&P 500 and NASDAQ snapped 6-day losing streak. GitLab (GTLB) stock declines due to lower 2024 profit estimates.

Tech Sell-Off Drags S&P 500, NASDAQ to 6th Straight Losing Day

A dramatic tech sell-off sent S&P 500 and NASDAQ to another losing week. International stores lead strong sales growth at Costco (COST).

Growth Stock Newsletter

These GREAT Stocks Are 4 the Birds

Stocks have been red hot lately, and some are already at their 2024 Fair Vales. These 5 stocks might have hit their near-term limits.

David Sharek’s Top Ten Conservative Stocks for 2024

Growth stocks have been hot during the first month of 2024. Maybe too hot. Perhaps its time for Conservative stocks to shine.

David Sharek’s Top Ten Growth Stocks for 2024

2024 is looking like another strong year for Artificial Intelligence (AI) stocks. Here’s the ten stocks I like the best entering the New Year.

Research Reports -- Subscription Required

Hi! I’m David Sharek, Founder of The School of Hard Stocks. Our specialty is stock research on stocks that (hopefully) compound over time. Here’s a free sample of Research Reports:

Hi! I’m David Sharek, Founder of The School of Hard Stocks. Our specialty is stock research on stocks that (hopefully) compound over time. Here’s a free sample of Research Reports:

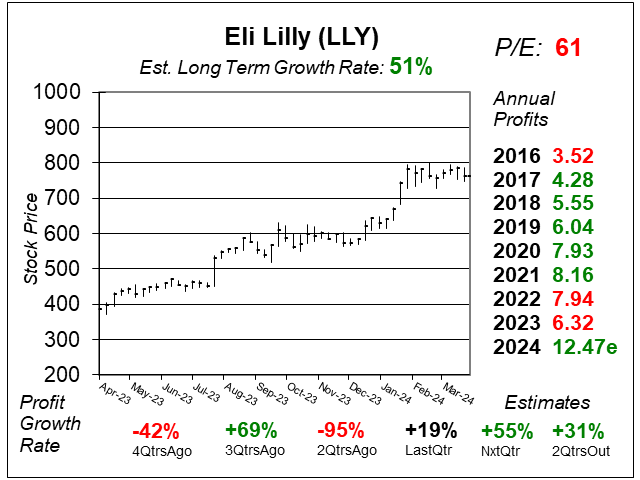

Demand Increases for Eli Lilly’s (LLY) Mounjaro With Delays in Filling Orders

Eli Lilly (LLY) can’t keep up with demand for Mounjaro, and now it has to make Zepbound too. That’s good news for shareholders.

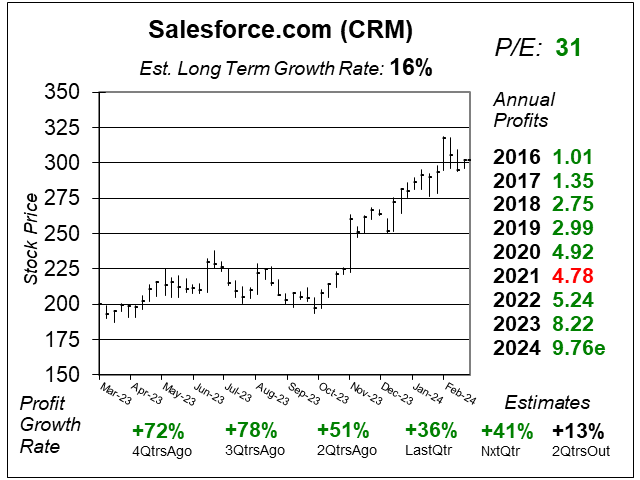

Salesforce (CRM) is Growing Great as it Becomes a Leader in AI Software

Salesforce (CRM) has evolved into a faster growing company with its two catalysts: Data Cloud and Einstein its AI chatbot.

Stock of the Week

Stock of the Week

Each week we highlight a stock that stands out from the crowd, and give FREE access to the Research Report.

About Us

Located in the heart of Midtown Manhattan, The School of Hard Stocks is searching for tomorrow's stock market winners today.

Stock Education

Looking to sharpen your stock picking skills? That's our specialty. Check out our Definitive Guide to Growth Stocks.

Stock Research

Our stock research has been a staple for stockbrokers and financial advisers for more than a decade.

Money Management

We've delivered double-digit returns to investors for almost 20 years, and can manage your stock portfolio for you.

Ready to Learn More?

Looking to Learn Stocks?

-

Whether you're new to the stock market or have been trading for years, let us show you the characteristics top stocks possess.

Searching for Top Stocks?

-

If you're the type who likes to manage their own stock portfolio, our research reports can do your stock research for you.

Want a Portfolio Manager?

-

We can manage your stock portfolio for you on a fee basis, getting you in and out while you view your stocks online anytime.