Stock (Symbol) |

Salesforce (CRM) |

Stock Price |

$301 |

Sector |

| Technology |

Data is as of |

| March 19, 2024 |

Expected to Report |

| May 19 |

Company Description |

Salesforce is a provider of customer relationship management (CRM) platform. Salesforce is a provider of customer relationship management (CRM) platform.

Its Customer 360 platform delivers a source, which connects customer data across systems, applications and devices to help companies sell, service, market and conduct commerce from anywhere. It focuses on cloud, mobile, social, analytics and artificial intelligence, which connect to its customers and enable companies to transform their businesses. It also enables third parties to use its platform and developer tools to create additional functionality and applications that run on its platform. Its customers use its sales offering to store data, monitor leads and progress, forecast opportunities, gain insights through analytics and relationship intelligence and deliver quotes, contracts and invoices. Its service offering helps to connect its service agents with customers across any touchpoint. It helps customers to resolve routine issues with predictions and recommendations. Source: Refinitiv |

Sharek’s Take |

Salesforce (CRM) capped off a fabulous year as a rejuvenated organization. The company is a big recipient of AI, and is utilizing its Data Cloud with its chatbot Einstien as catalysts for growth. Also, profit margins have been climbing. Last quarter non-GAAP Operating Margin was 31.4%, up from 29.2% a year ago. Profit grew 36% last quarter on just 11% revenue growth. CRM attributes its sales growth to the success of its MuleSoft and Tableau divisions in sales and service. Although revenue increased in the Americas, EMEA, and APAC regions, some parts of EMEA had limitations, but CRM saw strong new business growth in LatAm, India, and Canada. Salesforce is the world’s leader in customer relationship management (CRM) software and connects more than 150,000 clients to their customers via the internet and stores this customer information in the cloud. The company had more than 72,682 employees as of January 31, 2024. Salesforce boasts the #1 Sales Cloud, #1 Service Cloud, #1 Marketing Cloud, #1 CRM platform, and #1 integration software in Mulesoft. The company is large but continues to grow at a healthy rate due to acquisitions including Tableau, Mulesoft, and Slack. Salesforce is a perfect fit for AI and that should bring more opportunity to grow revenue in the years ahead. Salesforce has transformed into an AI and data powerhouse with its two big catalysts: Data Cloud and Einstein GPT Copilot.Data Cloud is comprised of a data warehouse for all your customer data, that’s made easy to work with, then connected it to all the Salesforce products as well as systems outside Salesforce. Einstein GPT Copilot is an AI chatbot tool that’s built by OpenAI ChatGPT. Here’s a breakdown of the company’s service offerings, with last quarter’s revenue growth in constant currency:

Salesforce is the 3rd largest enterprise software company in the world. Much of Salesforece’s growth has come from acquisitions, which is fine by me. But now that the company is an Enterprise, big acquisitions might not make as much of an impact on profits. Still, analysts have 16% Estimated Long Term Growth Rate on the stock, which I think is about right. In 2023, management bought back $7.7 billion in stock. And management just announced its intention to pay its first-ever dividend, initiating a quarterly payout of $0.40 per share. CRM is part of the Growth Portfolio and Aggressive Growth Portfolio. |

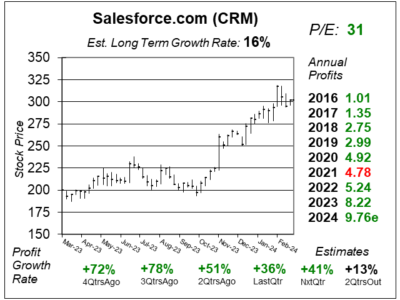

One Year Chart |

The one-year chart shows a couple breakouts. The 1st was ~$175, 2nd at ~$225 and the latest was after the company released last quarter earnings when the stock was around $300. The one-year chart shows a couple breakouts. The 1st was ~$175, 2nd at ~$225 and the latest was after the company released last quarter earnings when the stock was around $300.

The Est. LTG is 16% this quarter, down big from 27% in my last report. The P/E is 31 and that’s up from 27 last quarter. So the valuation has increased. My Fair Value is a P/E of 33. Qtrly profit growth looks good. |

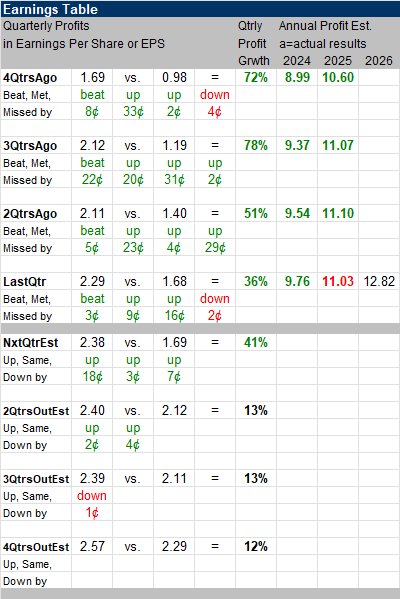

Earnings Table |

Last qtr, Salesforce delivered 36% profit growth, slightly above expectations of 35% growth. Revenue increased 11% for the 3rd consecutive quarter and in beat analyst expectations of 10%. Operating Margin was 31.4%, up from 29.2% a year ago. Revenue growth, geographically speaking, was: Last qtr, Salesforce delivered 36% profit growth, slightly above expectations of 35% growth. Revenue increased 11% for the 3rd consecutive quarter and in beat analyst expectations of 10%. Operating Margin was 31.4%, up from 29.2% a year ago. Revenue growth, geographically speaking, was:

Growth was driven by success of its MuleSoft and Tableau divisions. MuleSoft was part of 8 out of our top 10 deals this quarter, handling a record $319 billion in workflows, doubling from last year. Tableau was involved in 20 out of our top 25 deals, fully integrated into Data Cloud. Some notable wins this quarter were IHG, Heathrow Airport, and Brazilian FinTech, StoneCo. Annual Profit Estimates are mixed this qtr. Qtrly Profit Estimates are for 41%, 13%, 13%, and 12% profit growth in the next 4 qtrs. For next quarter, analysts expect revenue to grow 10%. |

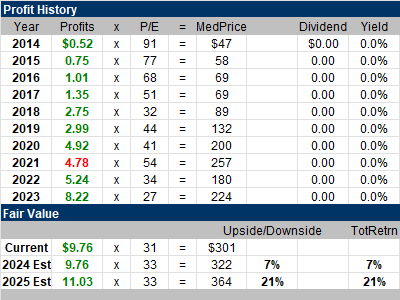

Fair Value |

My Fair Value P/E is 33 this quarter, up from 32 last quarter. My Fair Value P/E is 33 this quarter, up from 32 last quarter.

The stock seems slightly undervalued at this point. CRM has a January 31 fiscal year-end. |

Bottom Line |

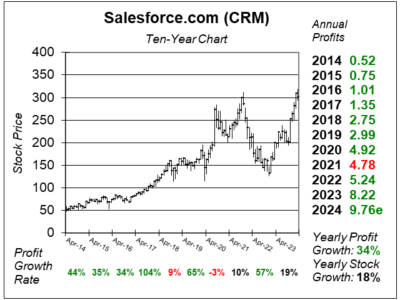

Salesforce (CRM) had been a solid stock this last decade. The shares corrected in 2022, and that decline was too harsh, so the stock has rallied higher this year. I blew a grand opportunity to buy the stock in January this year when the stock was $136.Tech stocks sold off in December 2022 due to tax loss selling and investors capitulating from a Bear Market. Salesforce (CRM) had been a solid stock this last decade. The shares corrected in 2022, and that decline was too harsh, so the stock has rallied higher this year. I blew a grand opportunity to buy the stock in January this year when the stock was $136.Tech stocks sold off in December 2022 due to tax loss selling and investors capitulating from a Bear Market.

Salesforce has really transformed itself into a leader in AI. Momentum is good as profits are growing faster than sales due in part from rising profit margins. 2024 upside has declined from 19% last quarter to 7% this quarter. Thus, CRM drops from 13th to 18th in the Growth Stock Portfolio Power Rankings. The stock moves from 11th to 13th in the Aggressive Growth Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

18 of 33Aggressive Growth Portfolio 13 of 15Conservative Stock Portfolio N/A |