Stock (Symbol) |

Salesforce (CRM) |

Stock Price |

$257 |

Sector |

| Technology |

Data is as of |

| December 13, 2023 |

Expected to Report |

| February 28 |

Company Description |

Salesforce is a provider of customer relationship management (CRM) platform. Salesforce is a provider of customer relationship management (CRM) platform.

Its Customer 360 platform delivers a source, which connects customer data across systems, applications and devices to help companies sell, service, market and conduct commerce from anywhere. It focuses on cloud, mobile, social, analytics and artificial intelligence, which connect to its customers and enable companies to transform their businesses. It also enables third parties to use its platform and developer tools to create additional functionality and applications that run on its platform. Its customers use its sales offering to store data, monitor leads and progress, forecast opportunities, gain insights through analytics and relationship intelligence and deliver quotes, contracts and invoices. Its service offering helps to connect its service agents with customers across any touchpoint. It helps customers to resolve routine issues with predictions and recommendations. Source: Refinitiv |

Sharek’s Take |

Salesforce (CRM) has transformed into an AI and data powerhouse with its two big catalysts: Data Cloud and Einstein GPT Copilot. Salesforce (CRM) has transformed into an AI and data powerhouse with its two big catalysts: Data Cloud and Einstein GPT Copilot.

Together, these two catalysts helped the company land 80% more $1 million deals last quarter than a year ago. And with unemployment low, companies are looking to Salesforce to get more productivity from their employees. Salesforce is the world’s leader in customer relationship management (CRM) software and connects more than 150,000 clients to their customers via the internet and stores this customer information in the cloud. The company had more than 73,000 employees as of January 31, 2022. Salesforce boasts the #1 Sales Cloud, #1 Service Cloud, #1 Marketing Cloud, #1 CRM platform, and #1 integration software in Mulesoft. The company is large but continues to grow at a healthy rate due to acquisitions including Tableau, Mulesoft, and Slack. Salesforce is a perfect fit for AI and that should bring more opportunity to grow revenue in the years ahead. Here’s a breakdown of the company’s service offerings:

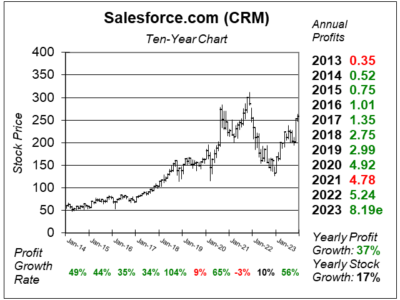

Salesforce used to be a rapid grower, and has now had its revenue growth simmer down as the company’s gotten exponentially larger. Much of Salesforece’s growh has come from acquisitions, which is fine by me. But now that the company is an Enterprise, big aquisitions might not make as much of an impact on profits. Still, analysts have 26% Estimated Long Term Growth Rate on the stock, which I think is overly optimistic. CRM doesn’t pay a dividend, but management has a stock buyback program in place. In 2022, management bought back $4 billion in stock, but since this is a software company that offers a lot of stock options for employees, shares outstanding didn’t drop much. I’m very excited about Salesforce becoming a force in AI. CRM will be added to the Growth Portfolio today. |

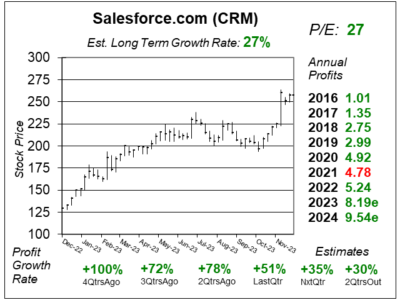

One Year Chart |

The one-year chart shows a couple breakouts. The 1st was ~$175 and the latest was ~$225. Both were on high volume. This reportwas very special. It impressed me a lot. The one-year chart shows a couple breakouts. The 1st was ~$175 and the latest was ~$225. Both were on high volume. This reportwas very special. It impressed me a lot.

The Est. LTG is 27% this qtr. That’s up from 26% last quarter. The P/E of 27 is the same as last qtr. But this time I’m calculating it using 2024 profit estimates ($9.54). Last quarter i used 2023’s (which were $8.05 at the time). My Fair Value is a P/E of 32. Qtrly profit growth looks good! Estimates as well! |

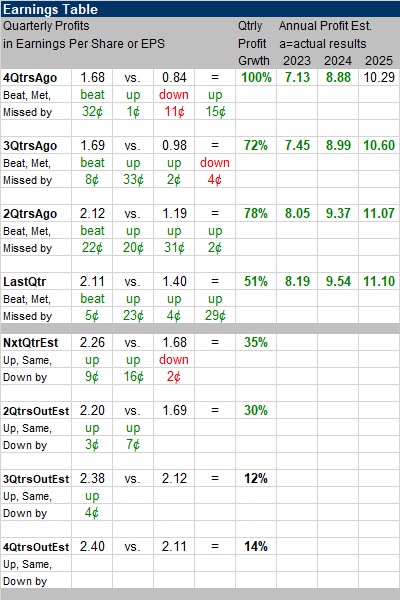

Earnings Table |

Last qtr, Salesforce delivered 51% profit growth and beat expectations of 47% growth. Revenue increased 11%, same with 2QtrsAgo and in line with analyst expectations. The current remaining performance obligation grew by 14%. Revenue, geographically speaking: Last qtr, Salesforce delivered 51% profit growth and beat expectations of 47% growth. Revenue increased 11%, same with 2QtrsAgo and in line with analyst expectations. The current remaining performance obligation grew by 14%. Revenue, geographically speaking:

Big Deals over $1 million jumped 80% year over year. Growth was driven by momentum in multi-cloud deals, where 9 of the top 10 deals involve six or more clouds. Data Cloud got 1000 new customers last quarter. Annual Profit Estimates are up again this qtr. But not as much as last quarter. Qtrly Profit Estimates are for 35%, 30%, 12%, and 14% profit growth in the next 4 qtrs. For next quarter, analysts expect revenue to grow 10%. |

Fair Value |

| My Fair Value P/E is 32 this quarter, up from 28 last quarter.

The stock has around 20% upside for the next year. But I feel this isn’t enough. I can imagine profit estimates continuing to climb and/or the stock getting a P/E of 35. CRM has a January 31 fiscal year-end. |

Bottom Line |

Salesforce (CRM) had been a solid stock this last decade. The shares corrected in 2022, and that decline was too harsh, so the stock has rallied higher this year. I blew a grand opportunity to buy the stock in January this year when the stock was $136.Tech stocks sold off in December 2022 due to tax loss selling and investors capitulating from a Bear Market. Salesforce (CRM) had been a solid stock this last decade. The shares corrected in 2022, and that decline was too harsh, so the stock has rallied higher this year. I blew a grand opportunity to buy the stock in January this year when the stock was $136.Tech stocks sold off in December 2022 due to tax loss selling and investors capitulating from a Bear Market.

Salesforce has really transformed itself into a leader in AI. I’m thinking the company is getting good profit margins on its new software offerings. CRM will be added to the Growth Stock Portfolio today and the stok will rank 19th in the Power Rankings. The stock will also be put into the Aggressive Growth Portfolio where it will rank 12th in the Power Rankings. |

Power Rankings |

Growth Stock Portfolio

19 of 33Aggressive Growth Portfolio 12 of 17Conservative Stock Portfolio N/A |