Salesforce (CRM) is Growing Great as it Becomes a Leader in AI Software

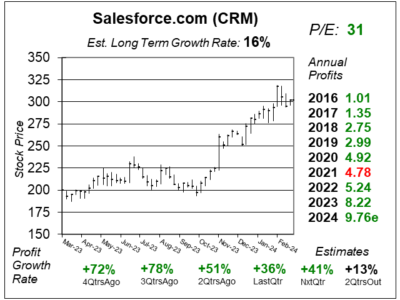

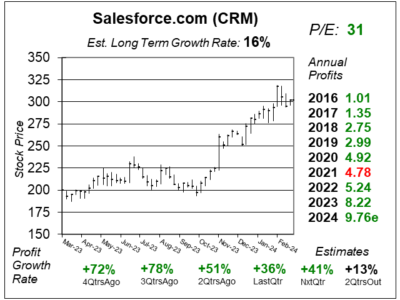

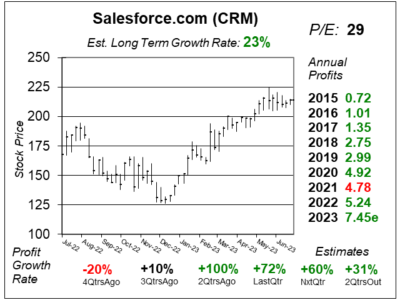

Salesforce (CRM) has evolved into a faster growing company with its two catalysts: Data Cloud and Einstein its AI chatbot.

Salesforce (CRM) has evolved into a faster growing company with its two catalysts: Data Cloud and Einstein its AI chatbot.

Salesforce (CRM) grew its $1 million deals 80% year-over-year as its customers are loving its Data Cloud and Einstein GPT Copilot.

Salesforce (CRM) enjoyed its second consecutive qtr in which its operating margin grew more than 10 percentage points.

Salesforce (CRM) is scrutinizing expenses, and last qtr sending profit margins soared to 27.6%, up from just 17.6% a year-ago.

Salesforce (CRM) delivered an amazing quarter that sent the shares higher. But we are still in a weak environment for software.

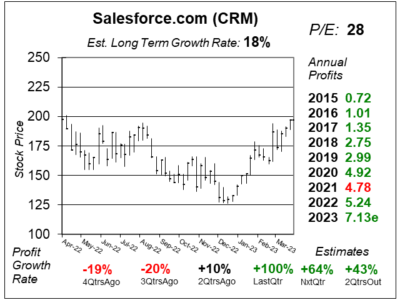

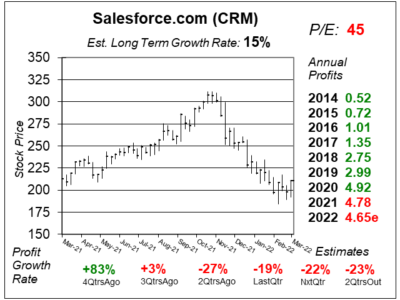

Like most big tech stocks, Salesforce (CRM) is dealing with a challenging purchasing environment that’s hampering its stock.

Salesforce (CRM) started to see more “measured buying behavior” in the last month of last qtr. That means demand might worsen.

Salesforce (CRM) is dealing with a strong USD, which is cutting into revenue estimates. And a recession hampers software deals.

Salesforce (CRM) had been making a lot of money on tech stock investments, Now the NASDAQ is down, and so are those profits.

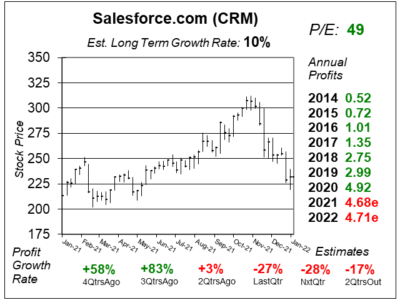

Salesforce (CRM)’s recently acquired messaging app Slack exceeded expectations during its first full quarter with the company.

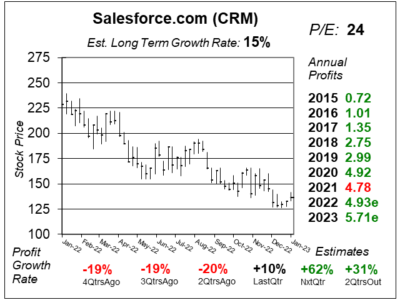

Salesforce (CRM) software is a perfect fit for large companies looking to store customer data and acquire new customers as well,

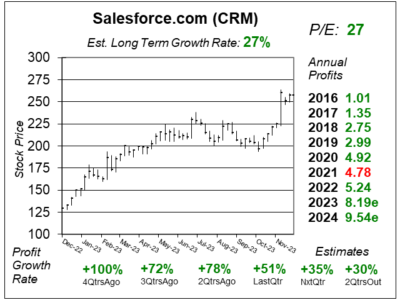

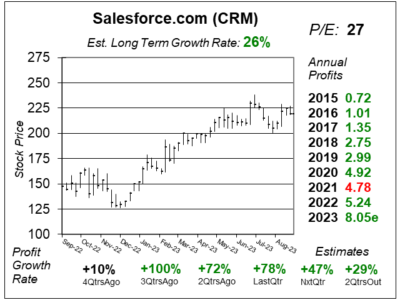

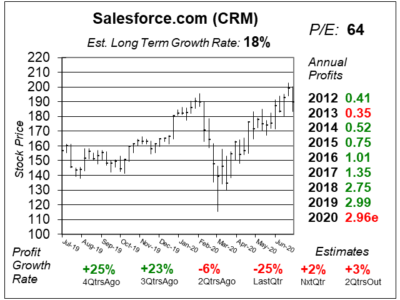

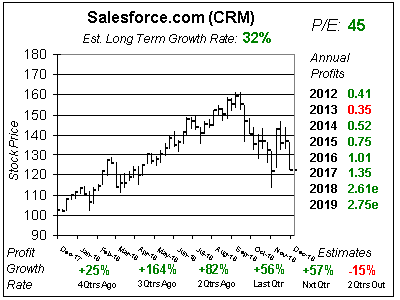

Salesforce (CRM) is growing sales at a brisk pace, but profits are expected to decline this year, which is keeping CRM in check.

Salesforce (CRM) aims at taking annual revenue from $21 billion to $50 billion in five years, which might double the stock price.

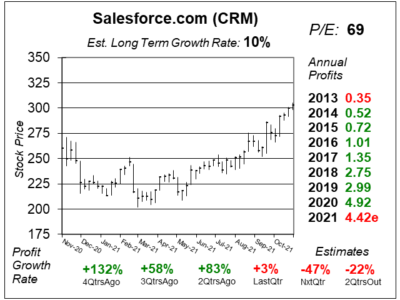

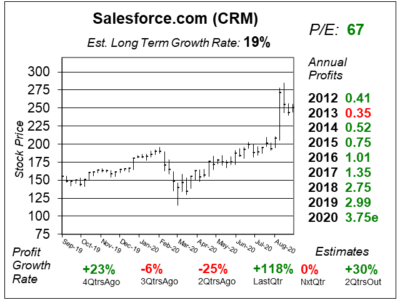

Salesforce (CRM) is buying Slack, which is great. But most of CRM’s profits last qtr came from gains from the Snowflake IPO.

Salesforce (CRM) delivered a knockout quarter as organizations upgraded their software due to COVID-19.

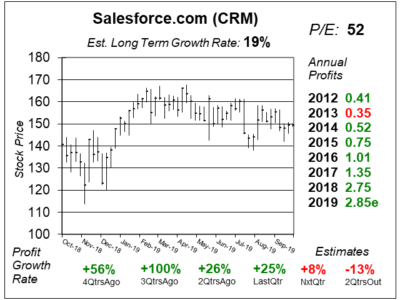

Salesforce (CRM) is a machine that evolves by acquires leaders in growing software fields, like Tableau for web analytics.

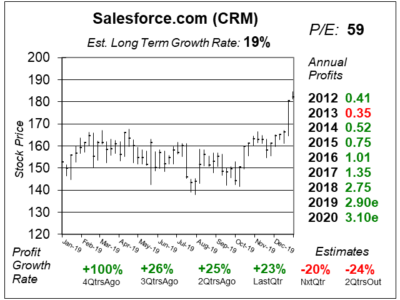

Salesforce’s (CRM) acquisition of Tableau software last year and this has slashed CRM’s qtrly profit growth rate.

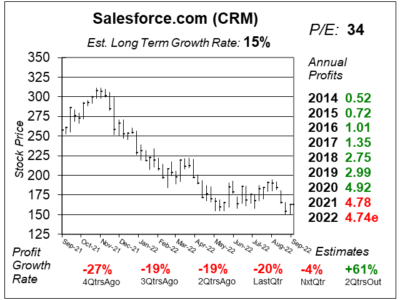

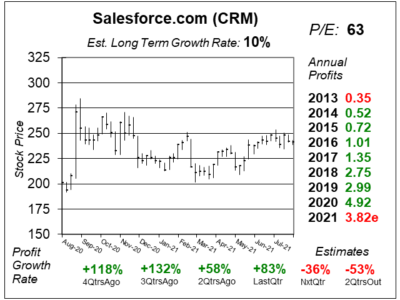

Salesforce (CRM) stock jumped this month after a brokerage firm upgrade. To Sharek this seems to be all-hype.

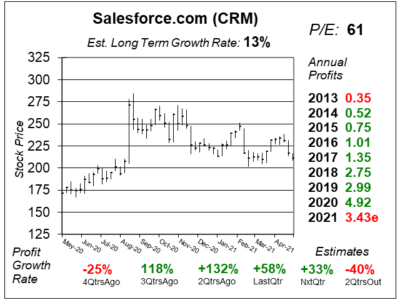

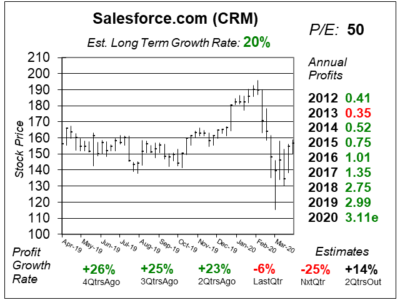

Salesforce (CRM) just has 2020 and 2021 profit estimates slashed. Here’s why CRM might be rangebound for a while.

Salesforce (CRM) is one of the only undervalued software stocks that I follow. Unless I’m missing something here.

Analysts expect 0% profit growth from Salesforce.com (CRM) this year. Wow! That would be down from 104% last year.

Shares of Salesforce (CRM) are looking great as this could be a once-in-a-decade opportunity to get one of the market’s top stocks.

Salesforce (CRM) management just upped 2018 profit estimates. But analysts didn’t increase qtrly estimates. CRM could beat the street.

Salesforce (CRM) is expecting profit growth of 70% this year as a change in the tax law is pushing profits into the period the contract was signed.

Lower taxes and an accounting change has boosted Salesforce.com’s (CRM) 2018 outlook, which ups our Fair Value on the stock.

Salesforce (CRM) is teaming up with Google to make it even easier (and more effective) to get new customers with Salesforce’s software and Google ads.

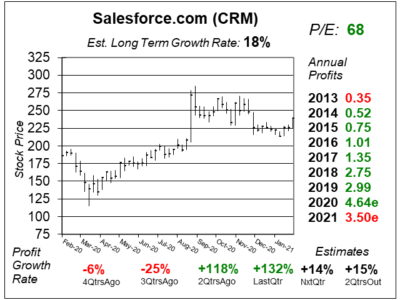

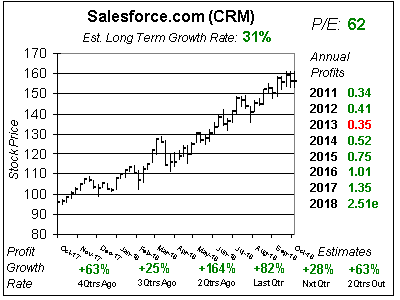

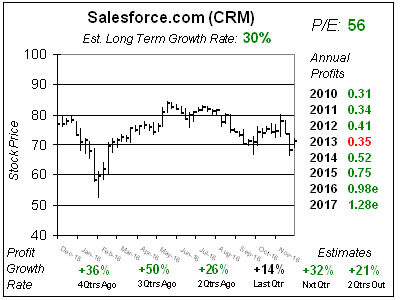

Salesforce.com (CRM) shot to a new All-Time high after it reported earnings — growth of just 17%. Seventeen percent growth with a P/E of 68? Why so high?

Salesforce.com’s (CRM) stock is hot. And the company continues to deliver impressive results. 2017 looks to be a banner year –once we get past this qtr.

Salesforce.com (CRM) usually has an enourmous P/E ratio — and rightly so. But after a year of flatlining the multiple is at one of the lowest points in years.

Salesforce.com’s (CRM) stock has been doing well, but after updating its spreadsheet today I thought the numbers would look better than this.

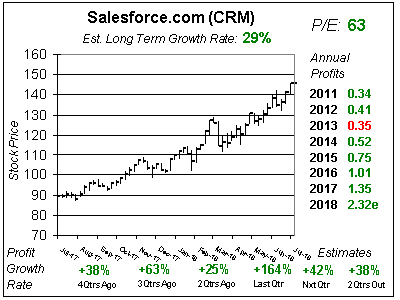

Salesforce.com (CRM) is one of the best stocks I don’t own, but the P/E of 69 is sky high.

Salesforce.com (CRM) always has a valuation in the clouds, and I will look to buy this dynamic company on a dip.

Salesforce.com (CRM) has a sky-high valuation — as it always does. The thing to do is buy CRM on a dip, regardless of the P/E.

High P/E stocks have been getting attacked in the stock market, here’s where I think Salesforce.com (CRM) would be a good buy.

I usually don’t suggest investors short a stock, but Salesforce.com (CRM) is an exception. I just don’t think CRM can go higher.

Ok, this makes no sense. Salesforce.com (CRM) just bolted from $100 to $150. Now the stock has a P/E of 111. Yes, one hundred and eleven.

Oracle (ORCL) reported poor quarterly results last week. But the real news was it’s likely other software companies will have trouble too — namely Salesforce.com (CRM).

2011 looks like a bad year for Salesforce.com (CRM). Let me rephrase that: the company should be fine. The stock should not.

Here’s three of the Best Stocks we missed as they ran higher in 2010: Netflix (NFLX), Salesforce.com (CRM) and Opentable (OPEN).

Salesforce.com (CRM) is expected to report qtrly profits (EPS) and revenues:

Profits Estimates: $2.38 vs. $1.69 = +41%

Revenue Est: +11%