The stock market rallied on Tuesday as a strong batch of earnings alleviates the rising concerns over interest rates.

The stock market rallied on Tuesday as a strong batch of earnings alleviates the rising concerns over interest rates.

Overall, S&P 500 grew 1.2% to 5,071, while NASDAQ rose 1.6% to 15,697.

Tweet of the Day

$ADBE News from Adobe today:

– Introducing the Acrobat AI assistant starting from $4.99 per month

– Adobe is in talks with OpenAI for potential integration of AI video tools into Premiere Pro.

– They unveiled new generative AI innovations for Premiere Pro, including tools for… pic.twitter.com/eIKR7nNHgt— The Future Investors (@ftr_investors) April 15, 2024

Chart of the Day

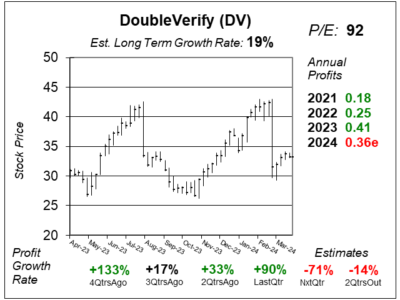

Here is the one-year chart of DoubleVerify (DV) as of March 26, 2024, when the stock was at $33.

Here is the one-year chart of DoubleVerify (DV) as of March 26, 2024, when the stock was at $33.

DoubleVerify stock got slammed lower after the company lowered 2024 guidance. Profit estimates dove from $0.45 to $0.36. The company made $0.41 in 2023, so it is now expected to have negative profit growth this year. Management said that they are seeing a slow ramp of new customers and a slow start from certain advertisers, including one large enterprise client. This is really gonna hurt next quarter’s results with profit growth now expected to be -71% year-over-year. Overall, DV dropped from $42 to $31 from the day earnings were to be announced after the market close to the day after when the public knew about the lower guidance.

The P/E is high at 92, but this is a young stock and needs time to grow profits.

DV is part of the Growth Portfolio and Aggressive Growth Portfolio.