Stock (Symbol) |

DoubleVerify (DV) |

Stock Price |

$37 |

Sector |

| Technology |

Data is as of |

| June 14, 2023 |

Expected to Report |

| August 1 |

Company Description |

DoubleVerify Holdings offers a software platform for digital media measurement and analytics. Its solutions include DV Authentic Ad, DV Authentic Attention, Custom Contextual, and Supply-Side Solutions. DoubleVerify Holdings offers a software platform for digital media measurement and analytics. Its solutions include DV Authentic Ad, DV Authentic Attention, Custom Contextual, and Supply-Side Solutions.

The DV Authentic Ad is its definitive metric of digital media quality, which evaluates the existence of fraud, brand safety, viewability, and geography for each digital ad. DV Authentic Attention is a predictive measure of digital ad performance, which provides real-time prediction data that helps drive media campaign performance in a privacy-friendly manner, as an alternative to individual reach and frequency performance tools. Contextual solution allows advertisers to match their ads to relevant content in order to maximize user engagement and drive campaign performance. Supply-side advertising platforms utilize its data analytics to validate the quality of their ad inventory and provide metrics to their customers to facilitate the targeting and purchasing of digital ads. Source: Refinitiv |

Sharek’s Take |

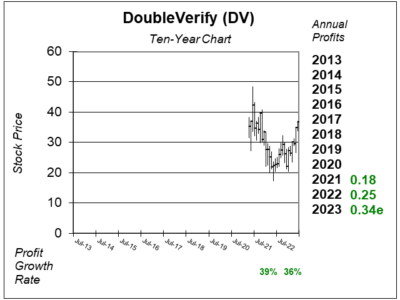

DoubleVerify (DV) stands poised for a promising future as the advertising industry rebounds from challenging times. The company reported 27% year-over-year increase in revenue last quarter, same as two quarters ago. That’s good growth in a tough ad market. DV’s revenue growth in the first quarter can be attributed to its strategic focus on global expansion and capturing market share. Existing customers played a pivotal role, as they significantly expanded their utilization of DV’s programmatic, Social, and Connected TV products. Social measurement delivered 33% volume growth last quarter as brands used DV’s tools for Meta, YouTube and TikTok. The company grew CTV measurement volumes by 39% last quarter, growing much faster than the 14% CTV industry growth that’s expected in 2023. DV also secured significant wins, solidifying its position as a trusted provider of measurement and verification solutions. Among the notable clients that adopted DoubleVerify’s solutions were Merck, Airbnb, and Amazon Prime Video. A highlight of the quarter was DoubleVerify’s Authentic Brand Suitability (ABS), which allows advertisers to create a set of controls for where its ads are placed. ABS revenue jumped 56% last quarter. DoubleVerify is a software platform for digital media measurement and analytics, helping companies increase their return on digital advertising investments. The company checks to see if ads are placed at appropriate places, making sure there isn’t any bot fraud. DoubleVerify pioneered digital ad verification over a decade ago and today it is the only verification company to cover both programmatic and direct buys. DV works with advertisers, marketers, and agencies and generates revenue based on the volume of ads that the software measures. In 2022, the company measured 5.5 trillion media transactions, up 22% from 2021. DoubleVerify works with greater than 1000 of the world’s top brands in 93 countries. Its top 100 customers spend an average of $2.6 million per year with the company. Customers include more than 50 of the top 100 global advertisers. Gross revenue retention rates are over 95%, including 100% of its top 75 customers from 2019 through 2021. DoubleVerify sees three catalysts for growth opportunity: expansion on social media, Connected TV (CTV), and fraud measurement. Last qtr revenue stats:

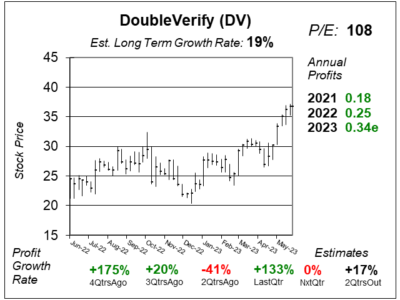

DoubleVerify is growing rapidly with a compounded annual growth rate of 47% from 2018 to 2021. I consider this a 30%-plus grower. Analysts give DV has a Estimated Long Term Growth Rate of 19%, but this was 30% in my last report. The P/E is high, at 108, but this stock sells for a reasonable 11x 2023 revenue estimates. This is a tough ad environment for the stock. Companies are cutting marketing staff and crypto ads were a BIG deal a year or two ago. Still, DV is in an uptrend. The stock’s broken out and has been hitting 52-week highs. That’s bullish. I think DV is a leader of this new Bull Market. The stock is part of the Growth Portfolio and Aggressive Growth Portfolio. |

One Year Chart |

I bought this stock for clients on 10/15/2022 when it broke out at $31. But recession fears and a Bear Market pulled the stock back down into the low-$20s. I recently added to my DV position as growth stocks perked up and this stock started breaking out. The breakout has held, and that’s a good sign. I bought this stock for clients on 10/15/2022 when it broke out at $31. But recession fears and a Bear Market pulled the stock back down into the low-$20s. I recently added to my DV position as growth stocks perked up and this stock started breaking out. The breakout has held, and that’s a good sign.

The P/E of 108 is high, but I didn’t shade it in red as the company sells for 11x revenue, which I think is fair. The Est. LTG is 19%. That’s a solid figure. But this was 30% last qtr, and I think it’s more accurate. |

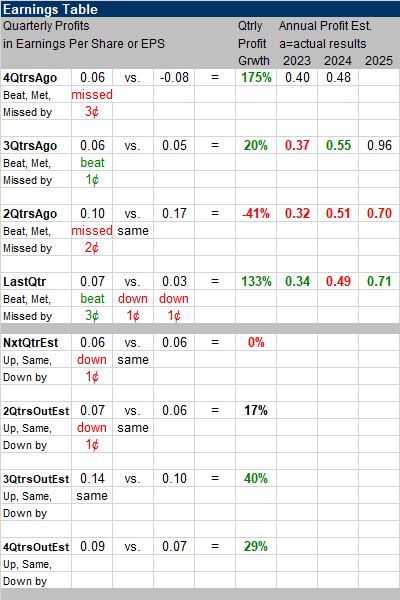

Earnings Table |

Last qtr, DV achieved 133% profit growth and beat expectations of 33% growth. But the EPS figure from a year ago is small ($0.03) so that 133% has to be taken with a grain of salt. Revenue increased 27%, year-on-year, and beat estimates of 22%. Total volume grew 22% while pricing was up 3%. The company witnessed a 26% increase in International measurement revenue, with solid growth in the EMEA region at 23%, and the APAC region at 31%. Last qtr, DV achieved 133% profit growth and beat expectations of 33% growth. But the EPS figure from a year ago is small ($0.03) so that 133% has to be taken with a grain of salt. Revenue increased 27%, year-on-year, and beat estimates of 22%. Total volume grew 22% while pricing was up 3%. The company witnessed a 26% increase in International measurement revenue, with solid growth in the EMEA region at 23%, and the APAC region at 31%.

Revenue growth was driven by volume growth in activation and supply side businesses which was led by usage expansion and new enterprise wins such as Merck, Airbnb, and Amazon Prime Video. Management said advertising demand was healthy, in general. Annual Profit Estimates are mixed this qtr. For 2023, management expects revenue to grow 23%. Look at profit estimates for the upcoming years: 2023 $0.34 Qtrly profit estimates are for 0%, 17%, 40%, and 29% profit growth in the next 4 qtrs. For next qtr, analysts expect sales to grow 22%. I’m not concerned with the flat profit growth expected next quarter as quarterly profits have been all over the place the past two years (notice the qtrly EPS in the Earnings Table). |

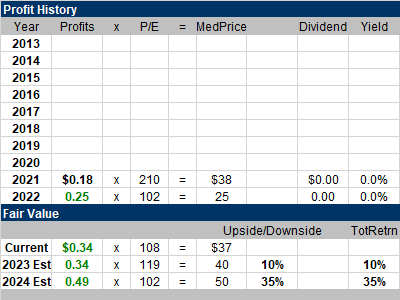

Fair Value |

This quarter my Fair Value on this stock moves up from 9x annual revenue estimates to 12x. That’s a reasonable multiple now that tech stocks are climbing: This quarter my Fair Value on this stock moves up from 9x annual revenue estimates to 12x. That’s a reasonable multiple now that tech stocks are climbing:

Current Qtr: 2023 Fair Value: 2024 Fair Value: |

Bottom Line |

DoubleVerify (DV) is a new stock that has the ability to be a bigger presence in in the ad space. I think this stock is already a leader in this new Bull Market. It’s a company that is used heavily by large Enterprise sized organizations. DoubleVerify (DV) is a new stock that has the ability to be a bigger presence in in the ad space. I think this stock is already a leader in this new Bull Market. It’s a company that is used heavily by large Enterprise sized organizations.

And I like that revenue growth has been the same the past two quarters (27%). If revenue growth accelerates, look out. Also, last quarter, Activation revenue grew faster than Measurement revenue, and that could mean companies are ramping up to do more business with DoubleVerify. DV ranks 23rd in the Growth Portfolio Power Rankings. The stock stays at 18th in the Aggressive Growth Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

23 of 29Aggressive Growth Portfolio 18 of 19Conservative Stock Portfolio N/A |