The stock market was slightly up on Monday, as investors are focused on earnings this week.

The stock market was slightly up on Monday, as investors are focused on earnings this week.

Overall, S&P 500 and NASDAQ were both up 0.3% to 4,151 and 12,158, respectively.

Tweet of the Day

2023 Revenue Growth Comp Sheet: pic.twitter.com/V0ijleP6Z9

— Brad Freeman (@StockMarketNerd) April 16, 2023

Chart of the Day

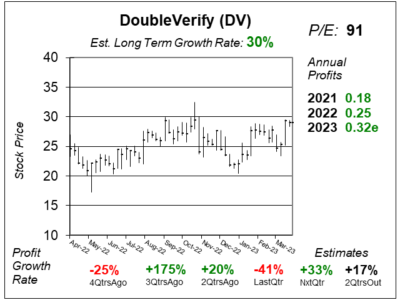

Our chart of the day is the one-year chart of DoubleVerify (DV) as of March 29, 2023, when the stock was at $29.

Our chart of the day is the one-year chart of DoubleVerify (DV) as of March 29, 2023, when the stock was at $29.

DoubleVerify is a software platform for digital media measurement and analytics, helping companies increase their return on digital advertising investments. The company checks to see if ads are placed at appropriate places, making sure there isn’t any bot fraud.

DoubleVerify is doing well considering the challenging environment for advertisers. It is a software that tracks ad placements, so lower demand for ads isn’t good.

Overall, the company grew revenue a respectable 27% last qtr, which was “multiples above” the digital ad industry’s single-digit growth rate. Despite headlines focused on macro headwinds and recession fears, the digital advertising industry continues to grow, with global digital ad spend expected to expand by 8% in 2023.

Revenue growth slowed from 35% two quarters ago to 27% last quarter. And estimates are for 22% this quarter. So this is a tough environment for the stock. Still, DV is in an uptrend and is around its 52-week high.

David Sharek thinks that DV will be a stock market leader when ad spend turns higher. DV is part of the Growth Portfolio and Aggressive Growth Portfolio.