My Top Ten Growth Stocks for 2024 are focused on the technological revolution of Artificial Intelligene (AI).

My Top Ten Growth Stocks for 2024 are focused on the technological revolution of Artificial Intelligene (AI).

AI stocks are made up of hardware companies that build the infrastructure for handling more data. And software companies are taking advantage of new advancements to offer their customers a better product that improves productivity.

The affect is greater productivity for companies. And better productivity means higher profits.

In the info below, these charts and tables were from our 2023 Q4 collection. We follow 75 to 100 stocks at a given time, and it takes us a fuul quarter to update each stock’s charts and then prepare research reports. So the stocks have moved in price since.

The charts are one-year charts, with quarterly profit growth along the bottom. The Estimated Long-Term Growth Rate is what analysts think profit can grow at during the next 3-5 years. But these may be unrealistic goals.

All stocks are owned in client accounts, which I manage (including family accounts).

So without further adieu, here’s my Top Ten Growth Stocks for 2024:

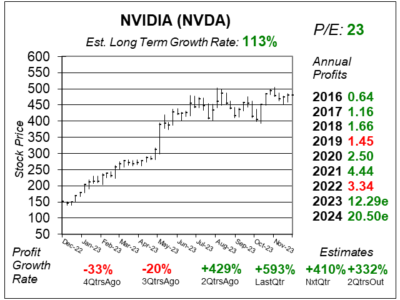

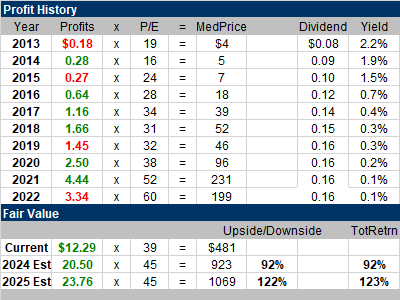

NVIDIA (NVDA) is the #1 manufacturer of AI hardware. The company makes the brains behind AI, and has a substantial lead in the hardware space.

NVDA stock has jumped from $146 to $495 in 2023. And although the stock seems high, it still could double in price in 2024.

First, I like the look of this chart. The stock is basing, and could be poised to make a move out of this tradign range.

The reason NVDA’s stock should go up is profits are zooming higher. Profits (in earnings per share or EPS) are expected to rise from $12.29 in 2023 to $20.50 in 2024.

NVDA currently has a 39 P/E, and thus sells for 39 x $12.29 = $481.

In 2024 I think it it could be 45 x $20.50 = $923.

In addition profit estimates have been rising. During the past 4 qtrs 2024 estimates have gone from $5.87 to $10.38, $16.70 and now $20.50.

NVDA coud realistically make $25 in profits in 2024. If it did so and got a 40 P/E it would be a $1000 stock.

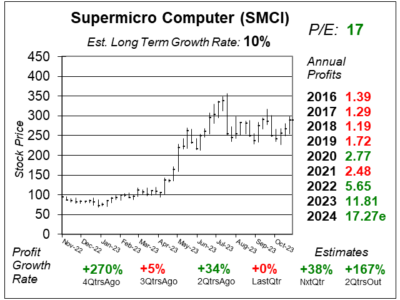

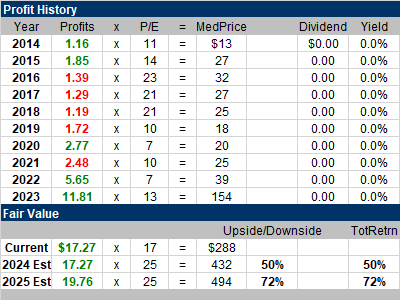

Super Micro Computer (SMCI) is NVIDIA’s right hand man in the AI hardware space.

NVIDIA makes the processors while SuperMicro handles a lot of the other stuff that goes into making AI work, including racks for NVIDIA’s processors, cooling systems, power units, and security.

SMCI isn’t as high-tech as NVDA is, so it’s not deserving of a high P/E.

I like this chart as well. The stock is digesting some gains and could be ready to make another move.

But profits have been zooming higher, and if SMCI makes what analysts expect, and the stock gets a 25 P/E, it could rise 50% in 2024.

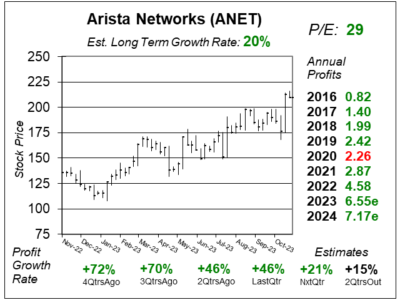

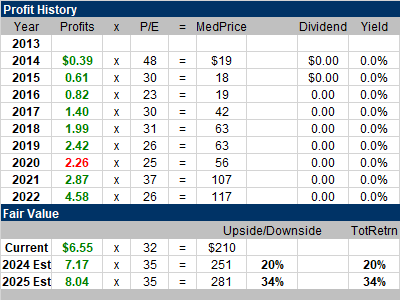

Arista Networks (ANET) is also a growing player in the AI hardware sector. Arista makes network routers and switches that help computer servers communicate in data centers.

Arista Networks (ANET) is also a growing player in the AI hardware sector. Arista makes network routers and switches that help computer servers communicate in data centers.

Arista equipment is not only used to the back-end for AI, but also for the front-end to improve overall infrastructure. In 2023, customers were buying a lot of equipment for AI. 2024 might see a return to infrastructure spending (the basic equipment needed to improve a network.

ANET is seeing strong demand for its cloud hardware from enterprise customers, including cloud titans such as Microsoft and Meta. One plus about ANET is Meta just increased its 2024 capital expendature budget.

My 2024 Fair Value is a 35 P/E, which gives the stock upside of around 20% for 2024.

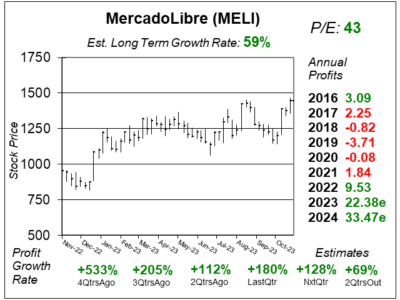

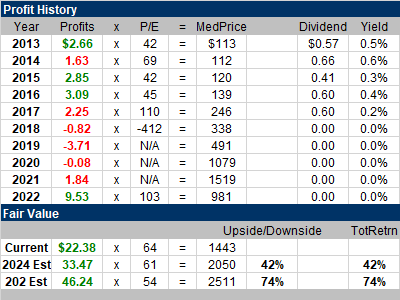

MercadoLibre (MELI) is the largest online commerce platform in Latin America and gives users a portfolio of services to do commercial transactions.

MercadoLibre (MELI) is the largest online commerce platform in Latin America and gives users a portfolio of services to do commercial transactions.

The company is like South America’s combination of eBay, PayPal, and Shopify rolled into one.

MELI’s numbers are exceptional, especially profit estimates for the years ahead. The company is a big ecommerce presence in Brazil, Argentina, and Mexico.

Last quarter the stock sold for 64x 2023 profit estimates of $22.38, or $1443 a share.

If it sells for 61x 2024 profit estimates of $33.47 this stock would be $2050, or around 40% higher.

I also loke the look of this chart. The stock’s been building a base and I’m optimistic it can break out to new highs in 2024.

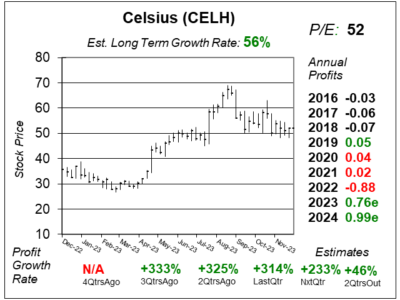

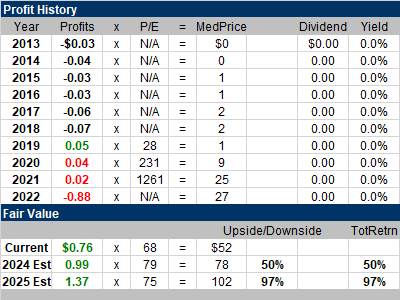

Celsius (CELH) is the #3 energy drink brand in the United States, with 10.5% market share, more than double the 4.4% a year ago.

Celsius (CELH) is the #3 energy drink brand in the United States, with 10.5% market share, more than double the 4.4% a year ago.

The company has a proprietary calorie-burning formulation called MetaPlus, while being as natural as possible, without the artificial preservatives found in many energy drinks and sodas.

On August 1, 2022 PepsiCo made a $550 million investment that makes PepsiCo Celsius’ primary distributor in the US and the preferred partner internationally.

Now sales are zooming (+104% last qtr) due to expansion in colleges, hospitals, hotels, casinos, and even Jersey Mike’s locations.

That deal with Pepsi was done around 9x CELH’s 2022 sales estimates. If the stock sells for 10x 2024 sales estimates, it could rise around 50% in 2024.

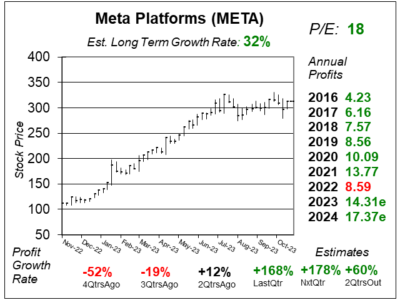

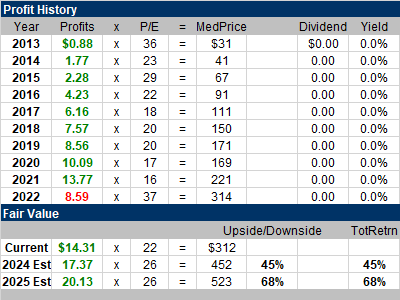

Meta Platforms (META) is cranking out the profits once again as the combination of expense cuts and AI improvements has boosted productivity big time.

Meta Platforms (META) is cranking out the profits once again as the combination of expense cuts and AI improvements has boosted productivity big time.

Last quarter the Facebook, Instagram and WhatsApp conglomerate grew profits a whopping with 168% on just 23% revenue growth.

Revenue has been accelerating the past four quarters from -4% to +3%, +11%, and now +23%.

Expense cuts in last quarter”s income statement include Marketing & Sales to $2.9 billion from $3.8 billion a year ago as well as General & Administrative expenses to $2.1 billion from $3.4 billion during the same quarter last year.

My Fair Value is a P/E of 26. That equates to $452 for 2024, giving the stock 45% upside according to my calculations.

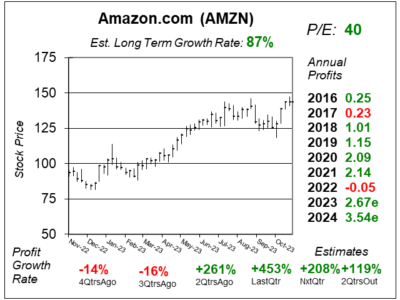

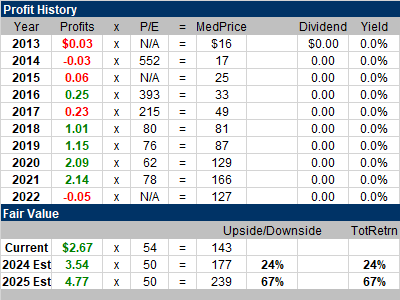

Like MercadoLibre, Amazon (AMZN) looks like a good ecommerce selection for 2024.

Like MercadoLibre, Amazon (AMZN) looks like a good ecommerce selection for 2024.

But the reason is different. Amazon isn’t growing its ecommerce recenue rapidly like MercadoLibre. Instead AMZN is improving profits through greater efficiency.

AMZN is saving on shipping costs as its transitioned the fulfillment network from 1 national network in the US to 8 separate regions. This is helping profits and profit margins climb.

Shorter distances and fewer touches helped profits come in at $0.94 per share and beat estimates of $0.58 last quarter.

Amazon is also implementing Artificial Intelligence (AI) across its Amazon Web Services (AWS) network.

Companies that are already using AWS AI with the Amazon Bedrock Platform include Booking.com, GoDaddy and United Airlines.

Management sees AI adding tens of billions of dollars in revenue per year to AWS in the long-run.

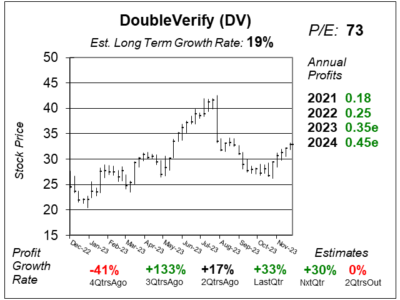

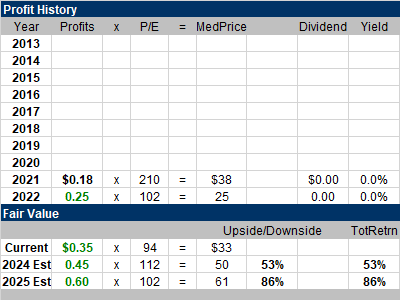

DoubleVerify (DV) is a software platform for digital media measurement and analytics, helping companies increase their return on digital advertising investments.

The company checks to see if ads are placed at appropriate places, making sure there isn’t any bot fraud.

DV looks like the next big thing in the advertising space.

The company’s ad tracking software continues to grow steady through a slowdown in global advertising.

And last quarter, revenue growth accelerated, which could mean the advertising space is now turning up.

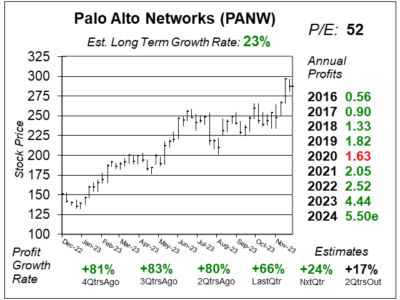

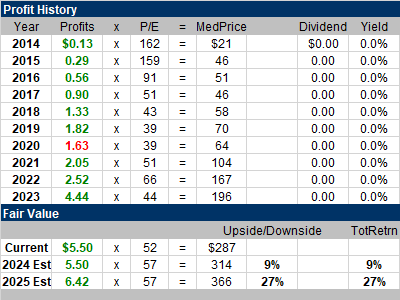

Palo Alto Networks (PANW) has the industry’s most comprehensive platform for large organizations, and delivers both hardware and software to prevent and/or stop breaches.

Palo Alto Networks (PANW) has the industry’s most comprehensive platform for large organizations, and delivers both hardware and software to prevent and/or stop breaches.

PANW has been a stock market leader recently as hackers have executed some high profile data breaches.

MGM, Ceasars, Clorox, VF Corp, and Comcast have all had data breaches in 2023.

In addition to positive PR, Palo Alto has been delivering some good profits this year. During the past four quarters, profit growth has averaged 83% per quarter.

And what I really like is I ddn’t hear excuses about how deals aren’t getting signed due to te slow economy, which was common a year ago.

Unfortunately, this stock has just gone on a big run higher, and that’s zapped a lot of the stock’s upside.

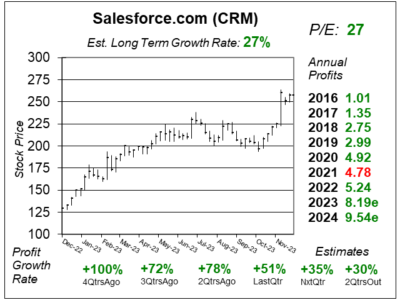

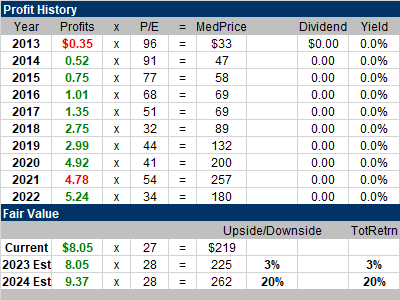

Salesforce (CRM) is the world’s leader in customer relationship management (CRM) software and connects more than 150,000 clients to their customers via the internet and stores this customer information in the cloud.

Salesforce (CRM) is the world’s leader in customer relationship management (CRM) software and connects more than 150,000 clients to their customers via the internet and stores this customer information in the cloud.

Salesforce boasts the #1 Sales Cloud, #1 Service Cloud, #1 Marketing Cloud, #1 CRM platform, and #1 integration software in Mulesoft.

CRM has transformed into an AI and data powerhouse with its two big catalysts: Data Cloud and Einstein GPT Copilot.

Data Cloud is comprised of a data warehouse for all your customer data, that’s made easy to work with, then connected it to all the Salesforce products as well as systems outside Salesforce.

Einstein GPT Copilot is an AI chatbot tool that’s built by OpenAI ChatGPT. Einstein GPT can summarize articles, write emails, schedule meetings, and compile information from various sources.

The future of AI is having a digital assistant, and Salesforce is already leading the way.