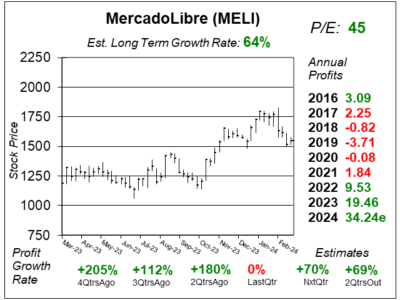

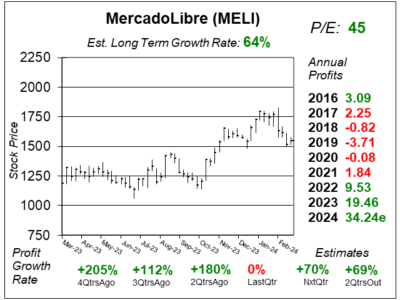

MercadoLibre (MELI) Dips After Earnings as Revenue Was Strong, Profits Weak

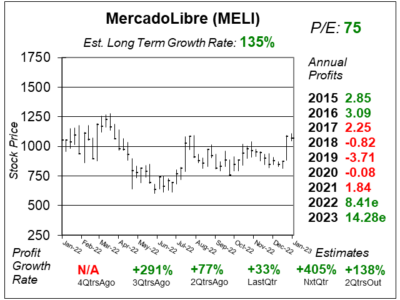

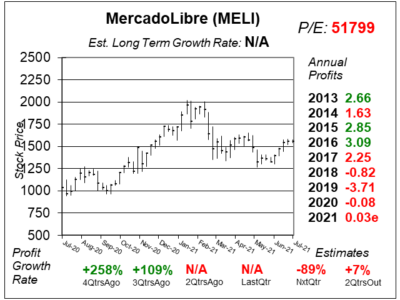

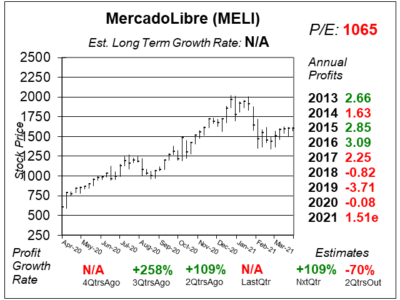

MercadoLibre (MELI) stock fell after a tax situation zapped profits last qtr. But the long-term outlook is still as good as ever.

MercadoLibre (MELI) stock fell after a tax situation zapped profits last qtr. But the long-term outlook is still as good as ever.

MercadoLibre (MELI) had 66% revenue growth in Mexico last quarter — with 40% growth in Brazil — as MELI’s rapid growth continues.

Mexico is now MercadoLibre’s (MELI) second largest ecommerce market. Now MELI is expanding its banking and credit services there.

MercadoLibe (MELI) is looking great as it grows its ecommerce, FinTech and Credit businesses while boosting profit margins.

MercadoLibre (MELI) seems to have hitthe tipping point in terms of profitability. This stock looks like Amazon did years ago.

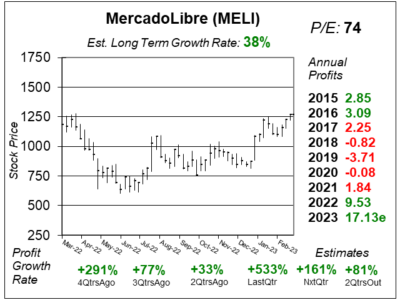

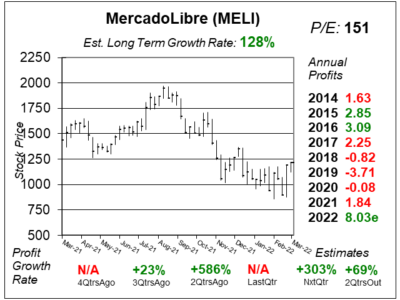

MercadoLibre (MELI) is a hot stock this month. And with profits looking to zoom higher, this could be a leader in the new Bull Market.

MercadoLibre (MELI) is getting great revenue growth in its Big Three countries: Brazil (+53%), Argentina (+62%) and Mexico (+65%).

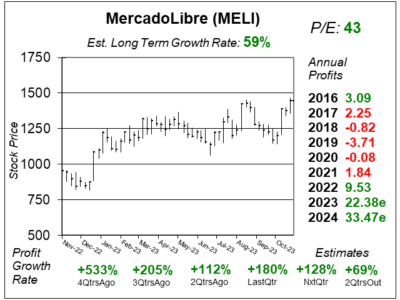

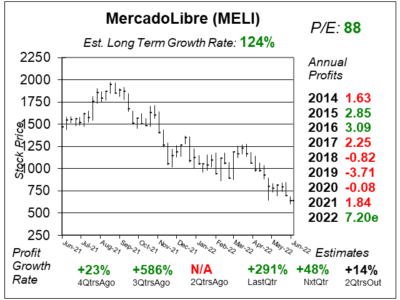

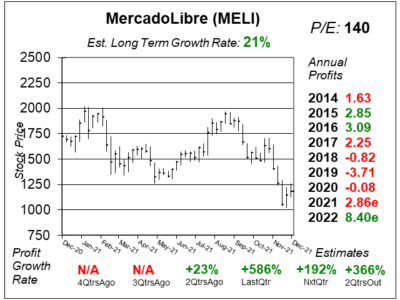

MercadoLibre (MELI) stock continues to slide as the company delivers excellent results. But MELI’s credit card debt is a concern.

MercadoLibre (MELI) has survived the growth stock selloff. Now the chart shows the stock might head higher, possibly to $1500.

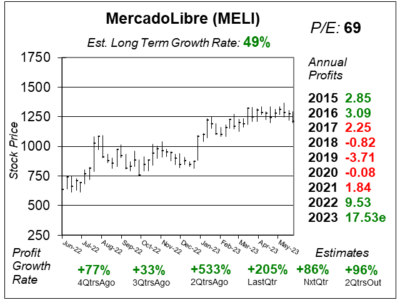

MercadoLibre (MELI) is increasing orders with free shipping and same-day shipping. The outlook for 2022 looks great.

MercadoLibre (MELI) continues to grow at brisk rates, but the company is issuing a lot of credit to customers (5x a year-ago).

MercadoLibre (MELI) is growing very rapidly, but has missed earnings estimates the past two qtrs, with losses each time.

MercadoLibre (MELI) has stiff competition coming from Sea’s Shopee ecommerce platform, which is already #1 in Brazil.

MercadoLibre (MELI) profits are expected to soar from around $1 in 2020 to $48 in 2024. But the stock has already run higher.

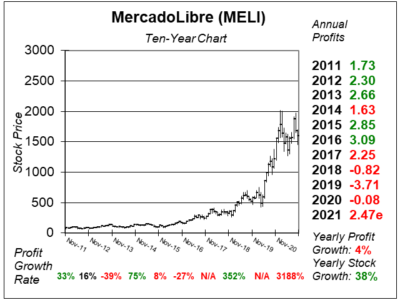

MercadoLibre (MELI) is what I like to call the Amazon of South America. But can this stock rise like Amazon’s has?

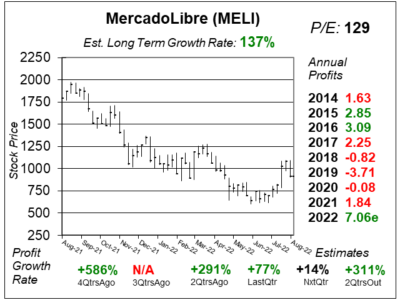

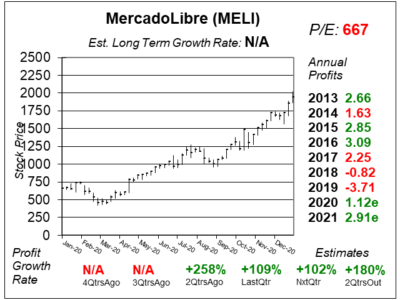

MercadoLibre (MELI) just produced a stellar qtr. The stock is about to gap-up when the stock market opens.

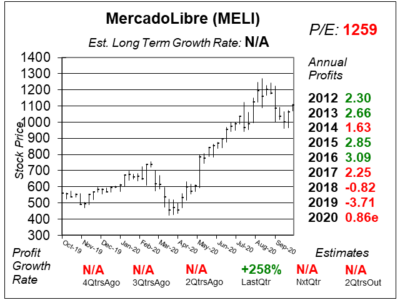

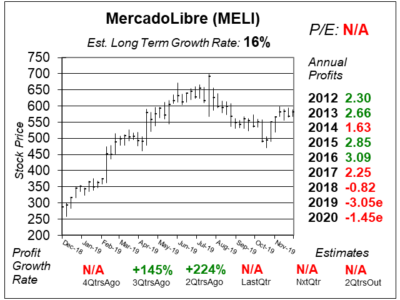

MercadoLibre (MELI) just posted a nasty loss and profit estimates got slashed. Now profits aren’t expected to return until 2021.

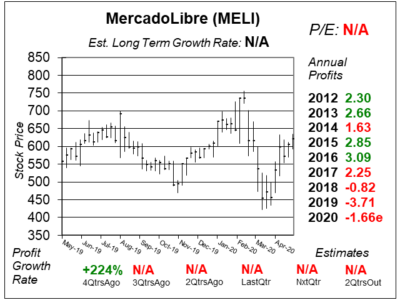

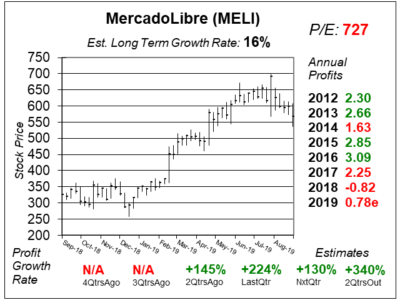

MercadoLibre (MELI) is like South America’s combination of eBay, PayPal and Shopify rolled into one. MELI’s P/E is 727.

MercadoLibre is like South America’s combination of eBay, PayPal and Shopify rolled into one company. Let’s take a look.

MercadoLibre (MELI) is expected to report qtrly profits (EPS) and revenues:

Profits Estimates: $6.73 vs. $3.97 = +70%

Revenue Est: +29%