Stock (Symbol) |

MercadoLibre (MELI) |

Stock Price |

$1197 |

Sector |

| Retail & Travel |

Data is as of |

| August 17, 2023 |

Expected to Report |

| November 1 |

Company Description |

Mercado Libre Inc is a Uruguay-based e-commerce business facilitator of Argentinian origins. Mercado Libre Inc is a Uruguay-based e-commerce business facilitator of Argentinian origins.

The e-commerce products enable retail and wholesale via Internet platforms designed to provide users with a portfolio of services to facilitate commercial transactions. The Company’s geographic coverage includes 18 countries of Latin America. The primary offer is an ecosystem of six integrated e-commerce services: the Mercado Libre Marketplace, the Mercado Libre Classifieds service, the Mercado Pago payments solution, the Mercado Credito financial solutions, the Mercado Envios logistic solutions including shipping, the Mercado Ads advertising platform and the Mercado Shops digital storefront solution. Source: Refinitiv |

Sharek’s Take |

MercadoLibre (MELI) continues to deliver great results as Mexico is now a key driver of growth. Last quarter, Mexico surpassed Argentina as the company’s 2nd largest market in ecommerce business in terms of gross merchandise value, surpassing Argentina. Brazil remains the company’s number one market. Mexico is also delivering the highest growth rates in terms of items sold within the company’s six largest markets. The company is also expanding its logistics network in the country with two new fulfillment centers. For the fintech segment, the company sees a huge opportunity in Mexico which management sees as “underbanked” as it has low adoption for general financial servcies compared to other Latin American countries. Mercado Pago users in Mexico can open their digital account in minutes, and the money on the account can be used anytime digitally or with a free debit card. The company launched its credit card in Mexico during the first half of the year to complement its buy-now-pay-later and consumer loan services. MercadoLibre (MELI) continues to deliver great results as Mexico is now a key driver of growth. Last quarter, Mexico surpassed Argentina as the company’s 2nd largest market in ecommerce business in terms of gross merchandise value, surpassing Argentina. Brazil remains the company’s number one market. Mexico is also delivering the highest growth rates in terms of items sold within the company’s six largest markets. The company is also expanding its logistics network in the country with two new fulfillment centers. For the fintech segment, the company sees a huge opportunity in Mexico which management sees as “underbanked” as it has low adoption for general financial servcies compared to other Latin American countries. Mercado Pago users in Mexico can open their digital account in minutes, and the money on the account can be used anytime digitally or with a free debit card. The company launched its credit card in Mexico during the first half of the year to complement its buy-now-pay-later and consumer loan services.

MercadoLibre is the largest online commerce platform in Latin America based on visitors and page views, and gives users a portfolio of services to do commercial transactions. MELI is like South America’s combination of eBay, PayPal, and Shopify rolled into one. The company, which was founded in Delaware in 1999 and has its executive offices in Buenos Aires, had a strategic alliance with eBay from 2001 to 2006, during which MELI’s management gained know-how experience that accelerated the company’s development. In 2016, eBay sold all its shares of MELI. Here are the business highlights from last qtr:

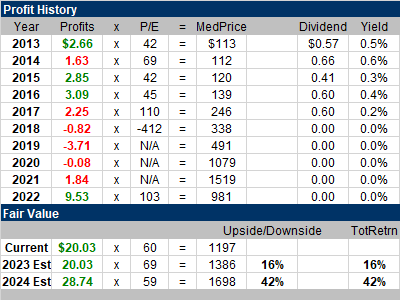

MELI’s numbers are exceptional, especially profits in the years ahead. Profits are estimated to grow from $10 a share last year to $20 this year, $29 next year and $43 in 2025. Further out, analysts estimate the company making $55 in 2025 and $74 in 2027. A 40 P/E on $74 in profits would get this stock from $1200 to around $3000 four years from now. Analysts give the company an Estimated Long-Term Growth Rate of 49%, but the P/E of 60 is rich. This company looks a lot like Amazon did when its profits began rolling in. MELI is part of the Aggressive Growth Portfolio and Growth Portfolio. |

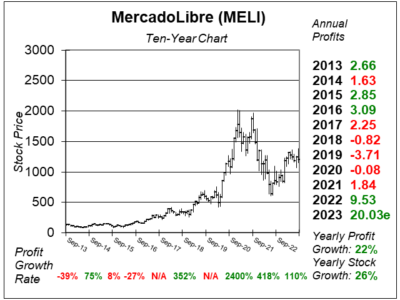

One Year Chart |

During 2020, MELI went from $572 to $1,675. So in 2021 the stock digested those gains. In 2022 the stock was sold off hard with the rest of the high-P/E fast growth companies. 2023 is looking like a good year for growth stocks. MELI is basing here. The stock tried to break out to a 52-week high this month, but the move wasn’t successful as the stock market was weak. During 2020, MELI went from $572 to $1,675. So in 2021 the stock digested those gains. In 2022 the stock was sold off hard with the rest of the high-P/E fast growth companies. 2023 is looking like a good year for growth stocks. MELI is basing here. The stock tried to break out to a 52-week high this month, but the move wasn’t successful as the stock market was weak.

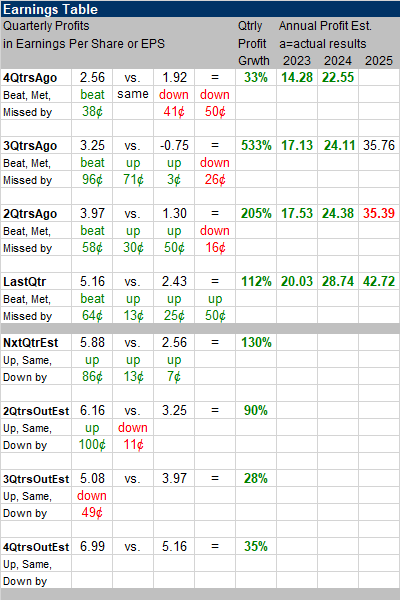

Qtrly profit growth looks great. Triple digit profit growth is a hallmark of top growth stocks. The Est. LTG is 49%. But that’s a 3-5 year profit growth estimate, not a stock growth estimate. The P/E fell from 69 to 60 this qtr. |

Earnings Table |

Last qtr, MercadoLibre reported 112% profit growth and beat expectations of 86% growth. Profits have increased from $2.56, $3.25, $3.97, and $5.16 the past four quarters. Revenue increased 31%, year-over-year in US dollars against analyst estimates of 25%. Revenue grew 57% on an FX neutral basis. Operational margin grew to 16.3% from 9.6% a year ago. Expansion in margin was due to efficiencies in collection fees, scaling of customer experience, and reduced costs for point-of-sale (POS) devices. Last qtr, MercadoLibre reported 112% profit growth and beat expectations of 86% growth. Profits have increased from $2.56, $3.25, $3.97, and $5.16 the past four quarters. Revenue increased 31%, year-over-year in US dollars against analyst estimates of 25%. Revenue grew 57% on an FX neutral basis. Operational margin grew to 16.3% from 9.6% a year ago. Expansion in margin was due to efficiencies in collection fees, scaling of customer experience, and reduced costs for point-of-sale (POS) devices.

Here are the year-on-year geographic highlights last qtr:

Revenue from the commerce business grew 24% in US dollars. Growth was driven by higher marketplace monetization, accelerating fulfillment penetration in Brazil (+46%), and its first-party business. GMV 47% year-on-year on a FX neutral basis driven by Brazil and Mexico. Revenue from the fintech segment grew 24% in US dollars. Growth was driven by off-platform payments with its total payment value growing 129% and its credit business which has a 37% interest margin after losses, compared to 30% a year ago. Revenue from advertising grew 70% on an FX neutral basis. Growth was driven by an increasing number of sellers using the Products Ads service. Annual Profit Estimates are up this qtr. Here are the future estimates: 2023 $20.03 Qtrly Profit Estimates are for 130%, 90%, 28%, and 34% profit growth the next 4 qtrs. Analysts think MELI revenue will grow 33% next quarter. |

Fair Value |

I’m pricing MELI on a price-to-sales basis as profits are low right now. Looking back to past years, MELI’s year-end price-to-sales was: I’m pricing MELI on a price-to-sales basis as profits are low right now. Looking back to past years, MELI’s year-end price-to-sales was:

2014: 10 This qtr, the stock sells for 4x 2023 revenue estimates, my Fair Value is 5x revenue. Current: 2023 Fair Value: 2024 Fair Value:

|

Bottom Line |

MercadoLibre (MELI) has been a wild stock the past four years. Overall this has been an excellent investment as MELI went public in 2007 and opened at $22 a share. MercadoLibre (MELI) has been a wild stock the past four years. Overall this has been an excellent investment as MELI went public in 2007 and opened at $22 a share.

This company is growing revenue at a brisk rate, and profits are climbing even faster as margins are expanding. Profit estimates are HUGE for the upcoming years. And Mexico gives the company vast growth potential, especially within banking. In the Growth Portfolio, the stock moves up from 9th to 7th in the Power Rankings. MELI stays at 7th in Aggressive Growth Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

7 of 29Aggressive Growth Portfolio 7 of 19Conservative Stock Portfolio N/A |