The stock market dipped on Wednesday as Federal Reserve Chair Jerome Powell warned that there could be more rate hikes this year, as the central bank still continues to combat inflation.

The stock market dipped on Wednesday as Federal Reserve Chair Jerome Powell warned that there could be more rate hikes this year, as the central bank still continues to combat inflation.

Overall, S&P 500 declined 0.5% to 4,366, while NASDAQ fell 1.2% to 13,502.

Tweet of the Day

Microsoft $MSFT announced today its roadmap for building its own quantum supercomputer

Microsoft believes it will take less than 10 years to build a quantum supercomputer that will be able to perform a reliable one million quantum operations per second – Tech Crunch

— Evan (@StockMKTNewz) June 21, 2023

Chart of the Day

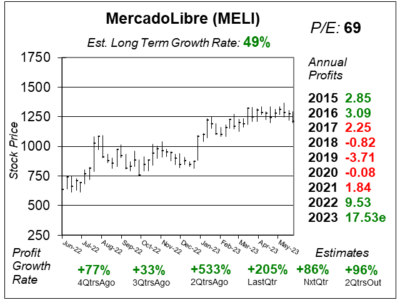

Here is the one-year chart of MercadoLibre (MELI) as of June 7, 2023, when the stock was at $1,208.

Here is the one-year chart of MercadoLibre (MELI) as of June 7, 2023, when the stock was at $1,208.

MercadoLibre is the largest online commerce platform in Latin America based on visitors and page views, and gives users a portfolio of services to do commercial transactions. It is like South America’s combination of eBay, PayPal, and Shopify rolled into one.

MercadoLibre is proving it is the “next Amazon” by driving not only sales growth, but also profit margins. When Amazon.com (AMZN) was a young stock, investors didn’t appreciate the investment opportunity because the company had low profit margins.

MercadoLibre delivered 205% profit growth last quarter, while revenue grew 58% on a F/X neutral basis and 35% in US dollars. Operating margin grew to 11.2%, from 6.2% a year ago and 6.6% two years ago.

MELI’s numbers are exceptional, especially profits in the years ahead. Analysts give the company an Estimated Long-Term Growth Rate of 49%, but the P/E of 69 is rich. Profits are expected to climb from $9.53 in 2022 to $70.77 by 2027. This company looks a lot like what Amazon did when its profits began rolling in. MELI is part of the Aggressive Growth Portfolio and Growth Portfolio.