Palo Alto (PANW) Aims to Be the Leader in Cybersecurity with Platformization

Palo Alto Networks (PANW) wants to be the one-stop shop for cybersecurity, and is giving away services to strive for this goal.

Palo Alto Networks (PANW) wants to be the one-stop shop for cybersecurity, and is giving away services to strive for this goal.

Palo Alto Networks (PANW) is seeing strong demand for cybersecurity as high profile hacks are hitting large organizations.

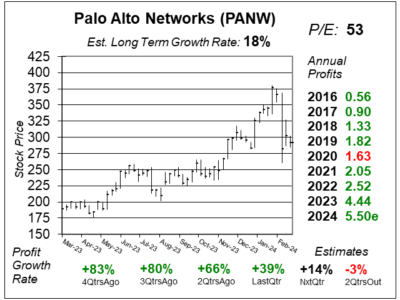

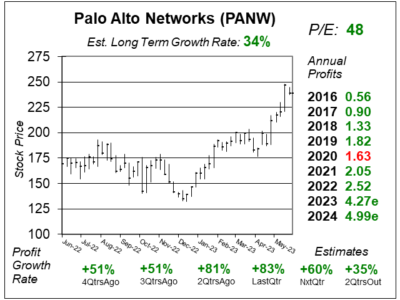

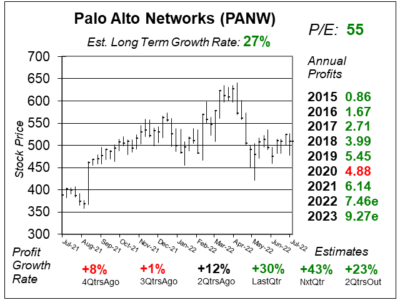

Palo Alto Networks (PANW) continues its “large deal” momentum as profit grew 80% while revenue grew 26% last quarter.

Palo Alto Networks (PANW) is proving companies prioritize cybersecurity, as big $10 million-plus deals jumped 136% last quarter.

Palo Alto Networks (PANW) delivered splendid results last quarter with “profitable growth” as cybersecurity spending grows.

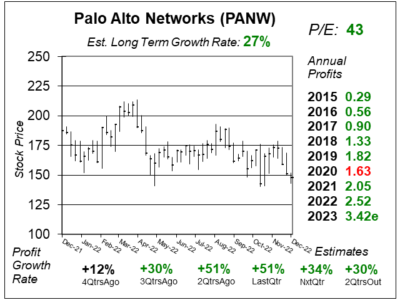

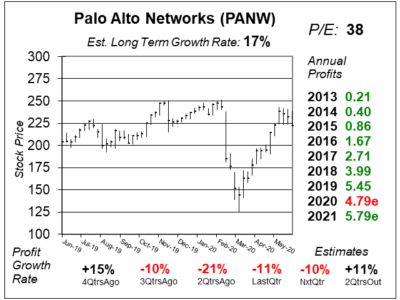

Even cybersecurity is feeling the pinch of the recession. Palo Alto (PANW) stock has been weak since it reported slower billings.

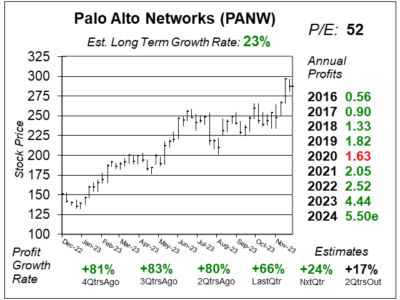

Palo Alto Networks (PANW) is rolling right now, with more than 1200 customers paying $1 million-plus per year for cybersecurity.

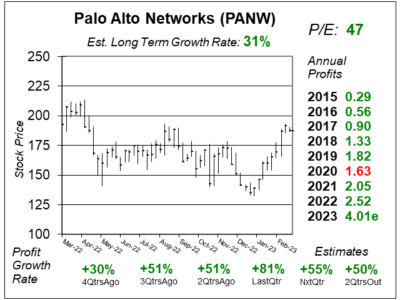

Last qtr, Palo Alto Networks (PANW) delivered 40% billings growth as the demand for cybersecurity continues to be strong.

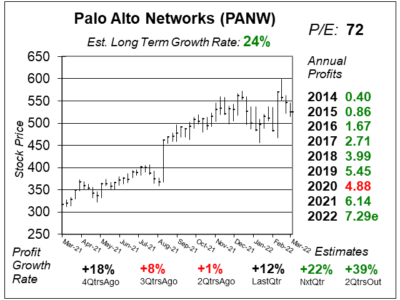

Palo Alto Networks (PANW) has a broad array of cybersecurity products that makes this stock a well-rounded growth stock.

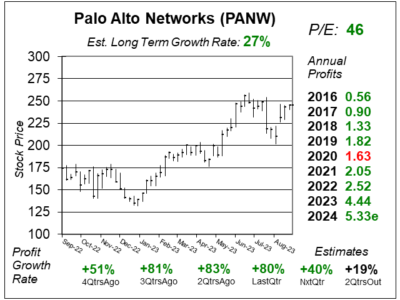

Palo Alto Networks (PANW) landed 160 deals of +$1 million last qtr as governments and companies up their cybersecurity.

Palo Alto Networks (PANW) scored a slew of new $1 million deals last qtr, and that means more revenue (and profits) ahead.

Palo Alto Networks (PANW) is a well-rounded cybersecurity company that secures networks and information on the cloud.

Palo Alto Networks (PANW) seems to be playing whack-a-mole with investors. One qtr is bad, the next qtr its good.

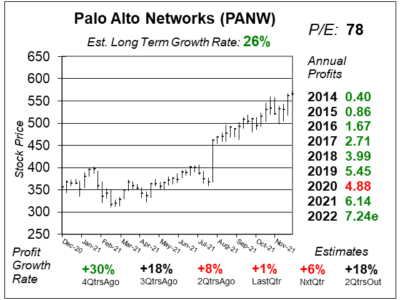

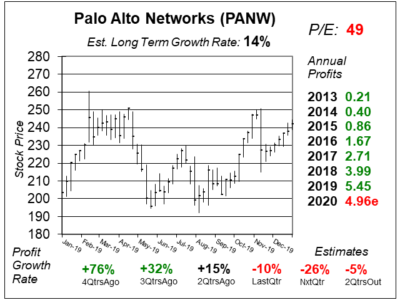

Cyber-security company Palo Alto Networks (PANW) has a whole bunch of issues it needs to work through.

Palo Alto (PANW) just ended fiscal 2019, and at its analyst meeting said 2020 would be an investment year as it slashed guidance.

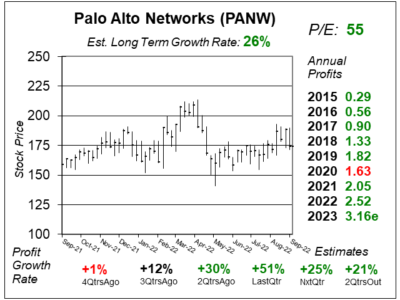

Shares of Palo Alto Networks (PANW) faltered after the company delivered sales growth of 28% with billings growth of just 14%.

Shares of Palo Alto Networks (PANW) spiked to an All-Time high after the cyber-security company romped profit estimates last qtr.

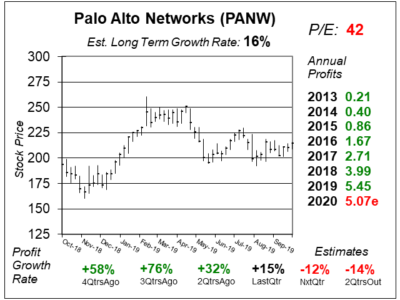

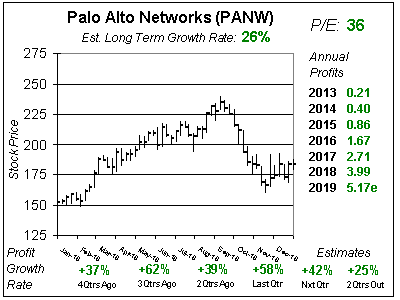

Cyber-security company Palo Alto Networks (PANW) is expected to grow profits 20% in 2019. Recession or not, companies have to spend on computer data security.

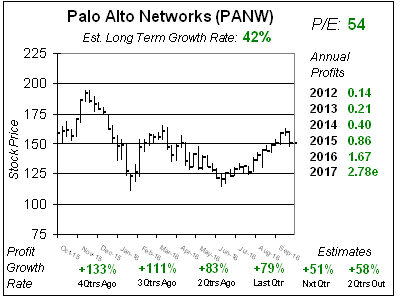

Cyber-security company Palo Alto Networks (PANW) is growing profits around 40%, and strong growth could continue into 2019.

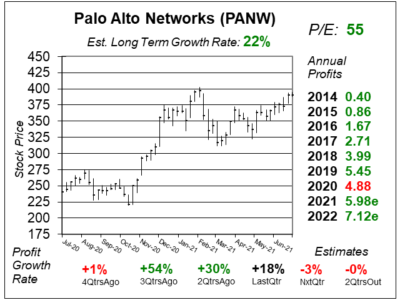

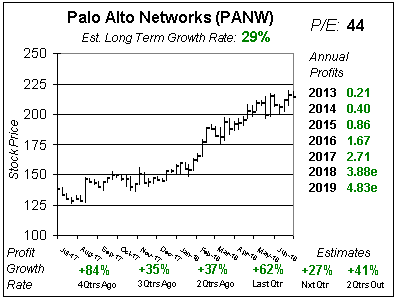

Palo Alto Networks (PANW) is achieving strong growth worldwide for its cyber-security products, but the stock’s not cheap with a P/E or 44.

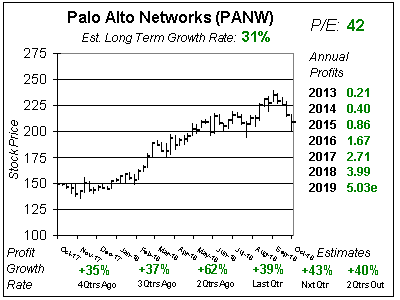

Shares of Palo Alto Networks (PANW) are priced to perfection as the cyber-security company is clicking on all cylinders again.

Palo ALto Networks (PANW) has some good numbers. LIke profit growth of 48%, 45%, 84% and 35% the last 4 qtrs. But is it worth a P/E of 46?

In March Palo Alto Networks (PANW) slashed profit estimates — then it ended up beating the street. PANW stock cratered then jumped higher. What the?

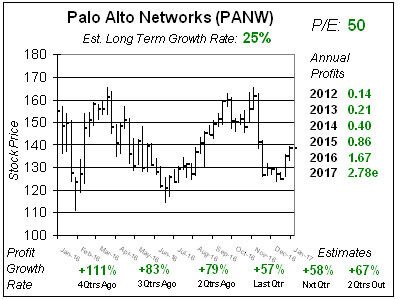

Palo Alto Networks (PANW) slashed profit guidance after it reported profits last qtr — and the stock dove. But profits are still expected to be strong in 2017.

A year-and-a-half later, Palo Alto Networks (PANW) is still well below its All-Time high of $200. Why? Palo Alto has a case of the shrinking P/E.

Palo Alto Networks (PANW) is growing so rapidly it could past Cisco as the #1 cyber-security company in the world in 2-to-3 years. Let’s look at PANW stock.

Cyber Security stocks Palo Alto Network’s (PANW) numbers point up but the stock points down. What gives?

In past qtrs my research has showed Palo Alto Networks (PANW) with perfect fundamentals. Now I see some chinks in the armor.

Breaking out today is a company growing profits 100% that has a stock with a P/E of 100. I’m buying in.

Palo Alto Networks (PANW) is on a dip so let’s take a look at PANW and see if this is a good time to buy.

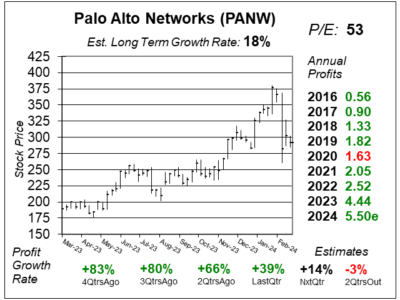

Palo Alto Networks (PANW) is expected to report qtrly profits (EPS) and revenues:

Profits Estimates: $1.25 vs. $1.10 = +14%

Revenue Est: +14%