Meta (META) Stock Breaks Through $500 as Profit Estimates Continue to Rise

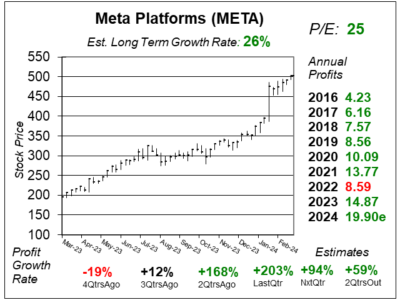

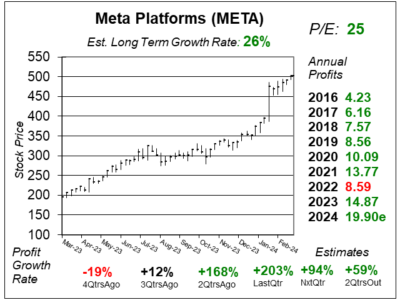

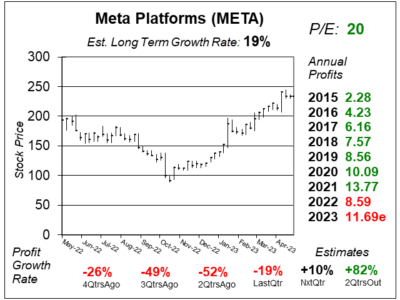

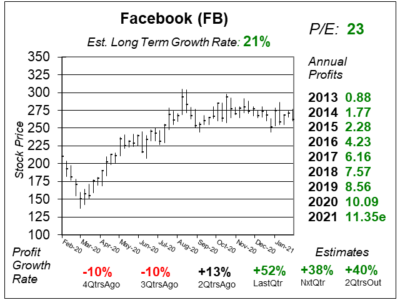

Meta (META) shares just broke through $500 as profit estimates continue to climb. With a P/E of just 25, this stock could push to $600.

Meta (META) shares just broke through $500 as profit estimates continue to climb. With a P/E of just 25, this stock could push to $600.

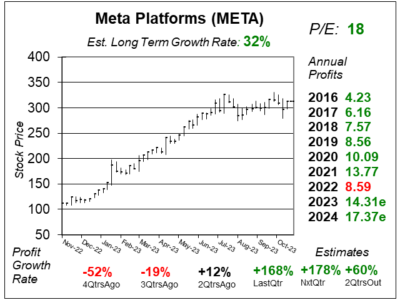

Meta Platforms (META) delivered an excellent quarter as management cut expenses while AI improved engagement and monetization.

Meta Platforms (META) is on the path for tremendous growth in the upcoming quarters as management has trimmed expenses.

Meta Platforms (META) is utilizing AI to get users to stay on its Facebook and Instagram longer, while helping ad campaigns.

Meta Platforms (META) reported some interesting numbers last qtr, including number of ads up 23% and price per ad down 22%.

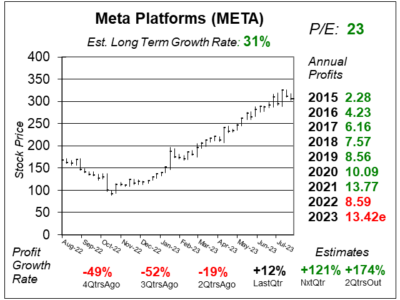

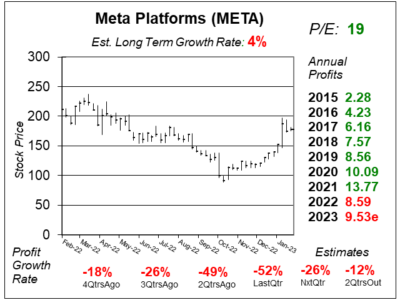

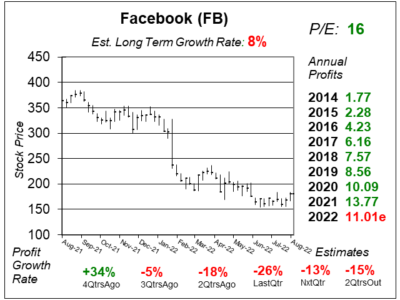

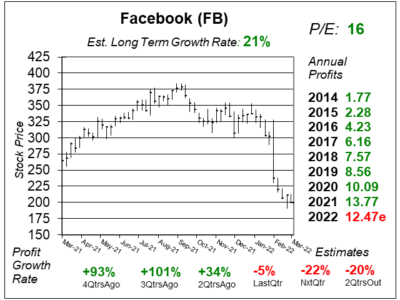

Facebook — uhm I mean Meta’s (FB) — profits are falling rapidly. And that negative trend looks to continue well into 2023.

Facebook (FB) continues to see its fundamentals erode as revenue growth was -1% last qtr while costs and expenses increased 22%.

Meta (FB) has been spending on the Metaverse and buying back stock at higher prices. Here’s two catalysts to get FB moving higher.

Facebook’s (FB) has problems Apple’s privacy protection limiting data, and FB’s metaverse might not become a catalyst.

Meta (FB) — formerly Facebook — is launching Facebook Reality Labs to mold a new playground for advertisers: the metaverse.

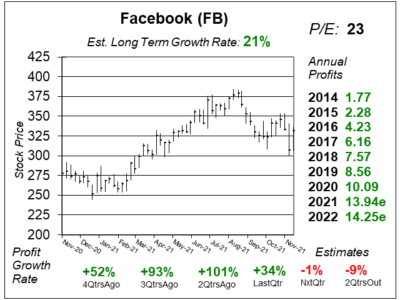

After a recent decline due to bad PR and a 5-hr outage, Facebook (FB) shares now has good upside, as the P/E is below 25.

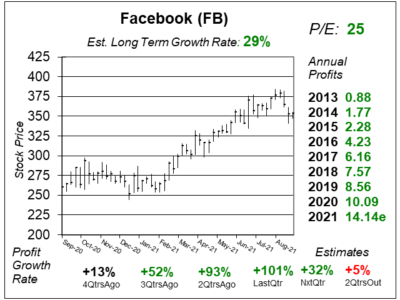

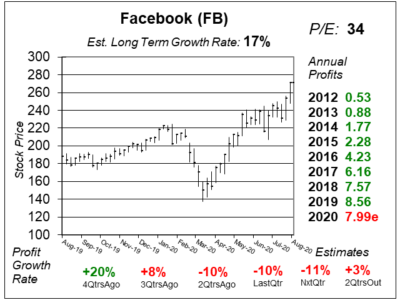

Facebook (FB) is rolling in profits again as Facebook Shops and the virtual reality platform Oculus are catalysts.

Facebook (FB) stock seems like a bargain. But the stock has a big cloud hanging over it: tracking user activity for ads.

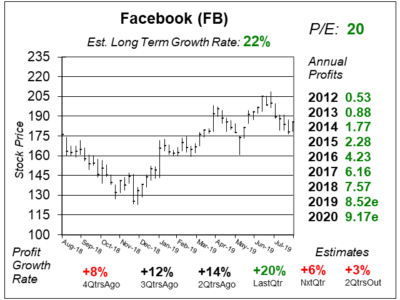

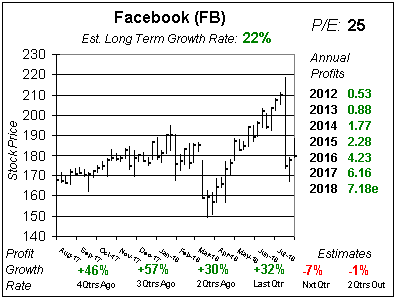

Facebook (FB) has nice momentum going into the holiday season as profits are expected to climb more than 20%.

Facebook (FB) could have another catalyst in its portfolio with the new Instagram Reels, which is similar to TikTok.

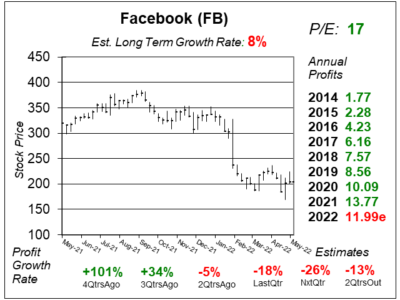

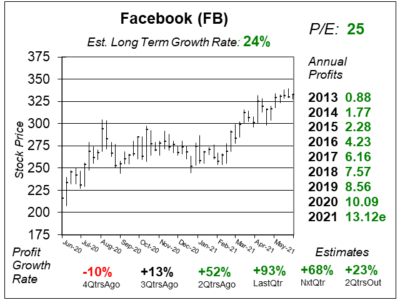

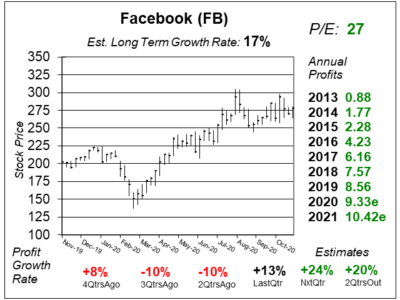

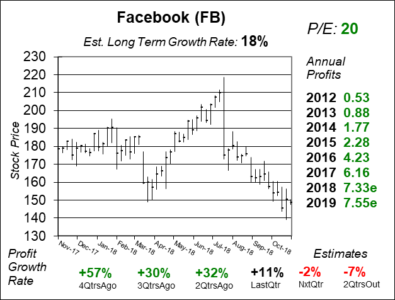

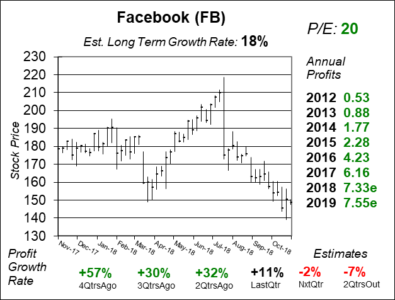

Facebook (FB) has been a strong stock lately, but profits declined. Let’s look into FB’s situation and see what’s up.

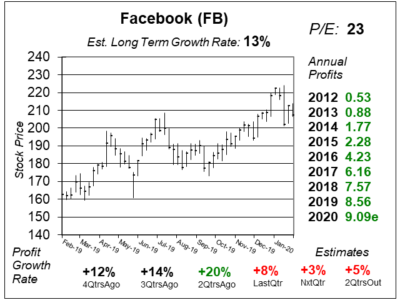

Facebook’s (FB) qtrly profit growth rate just slipped from 20% to 8%. Is this a cause for concern? Yes, it is.

Facebook’s (FB) profit growth accelerated to 20% last qtr. Yeah! But don’t get too excited as growth is expected to slow.

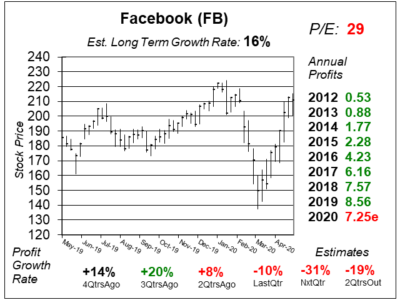

Facebook’s (FB) profit growth rate has been <15% for four straight qtrs. What would FB be worth if it could grow 20% again?

Facebook (FB) has bounced from $125 to $195 since last December. Is it a top-tier growth stock again? Well no.

Facebook (FB) stock has broken its downtrend and just hit a 6-month high. Is it now time to load up on FB? Does it have the juice to power higher?

Facebook (FB) has been under pressure for security issues. Now FB’s stepping back to address this. But that’s pushing down estimates.

Facebook (FB) slashed profit estimates, sighting higher expenditures on safety and security. So is FB a buy at these levels?

So much for privacy concerns. Faecebook (FB) whipped profit estimates last qtr — produced 30% growth — and the stock’s back on top.

If you wanted Facebook (FB) stock, you would have already owned it. Also, annual profit growth is expected to slow from 46% last year to 18% this year. Here’s my take on FB stock.

Facebook (FB) reported profits that blew past estimates, then claimed expenses would be high in 2018 and eart into profits. But they always say this, then beat the street.

Facebook (FB) lowered profit estimates last qtr as it switched to GAAP accounting. But still the company was able to deliver 36% profit growth last qtr. Impressive.

I was shocked o see Facebook’s (FB) profit estimates just got slashed — across the board. So I looking into its earnings release to find the reason why.

Last qtr Facebook (FB) warned of slower growth ahead. But after posting 78% profit growth this qtr, FB cemented itself as the best stock in the market.

Facebook (FB) grew profits 91% last qtr on a 55% increase in sales. Management says it can’t keep growing that fast. No kidding.

Facebook (FB) hit an all-time high after it reported a sizzling 94% gain in profit growth. Here’s my Fair Value on the stock for 2016 & 2017.

Facebook (FB) once again delivered spectacular results and although the stock hasn’t been moving of late I think it’s setting up for a catch up run.

Facebook (FB) is looking fabulous, and the stock continues to be my top selection for 2016.

Facebook (FB) has great growth opportunity with Facebook, Instagram and WhatsApp and is my top stock for 2016.

Facebook’s (FB) could have 30% profit growth returning in 2016, which could push the stock well past $100.

Facebook (FB) is wasting an opportunity to push profits higher because it is spending to stay #1.

Facebook’s (FB) expenses soared last qtr — as expected — and FB may not go anywhere in 2015.

Facebook’s (FB) higher spending and slower sales growth = slower profit growth in 2015.

If you’re advertising — or investing — Facebook (FB) is the best business in the world to put your money in.

Facebook (FB) stock has come down with tech sector, but the company is still hitting on all cylinders. And now its on sale.

Last qtr with Facebook (FB) at $47 I said it would see $67 by 2014. Today its $67 and here’s my current call.

Shares of Facebook (FB) lost their mojo after saying teens aren’t on so much. But FB’s numbers have never looked better.

Shares of Facebook (FB) have gone from having no momentum to all the momentum during the last month. My analysis shows $60 is in FB’s future.

Facebook (FB) turned in a game changing quarter last night, and the shares have jumped from $27 to $34 after hours. Now the run has begun.

With Facebook (FB) around $24, the shares have no momentum. If you like FB, go ahead and buy it around this price and wait.

Let’s take a look at shares of Facebook (FB), figure out what the stock’s really worth, and see if its a good buy or not.

Facebook (FB) popped on 9% profit growth last quarter (meh). Growth is now set to accelerate to 40%. I think FB is worth 30x earnings, or $19 a share.

I just researched Facebook (FB). Now I know why the stock has been free-falling. This thing looks terrible.

Facebook (FB) doesn’t yet have enough data to get a Fair Value. Right now the stock has a P/E of 63 and profits are expected to grow 18% this year.

Meta Platforms (META) is expected to report qtrly profits (EPS) and revenues:

Profits Estimates: $4.27 vs. $2.20 = +94%

Revenue Est: +26%