Booking.com (BKNG) is Seeing Substantial Growth in Airline Ticket Sales

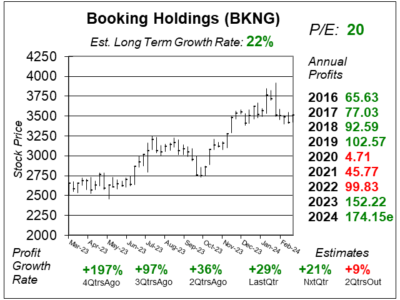

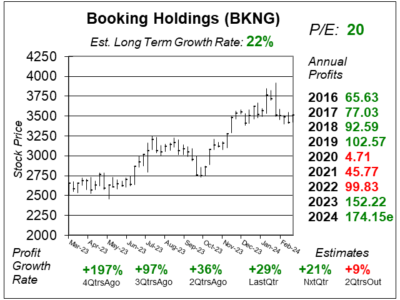

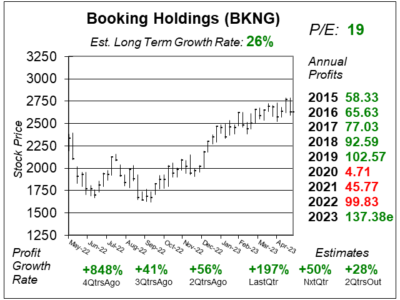

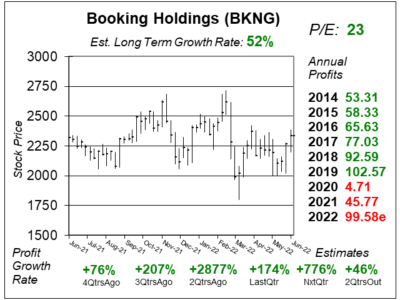

Booking (BKNG) had solid profit growth of 29% last quarter lead by bookings growth of 16% including a 46% jump in airline bookings.

Booking (BKNG) had solid profit growth of 29% last quarter lead by bookings growth of 16% including a 46% jump in airline bookings.

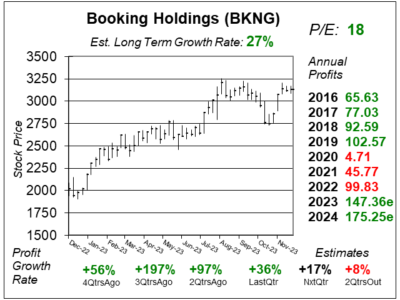

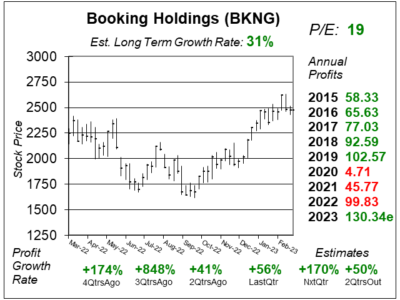

Booking.com (BKNG) continues to delivers strong growth. But is the travel trend slowing down? Let’s take a closer look.

Booking.com (BKNG) & Priceline are having great Summer travel seasons. But the stock is up a bunch in 2023. Does it still have upside?

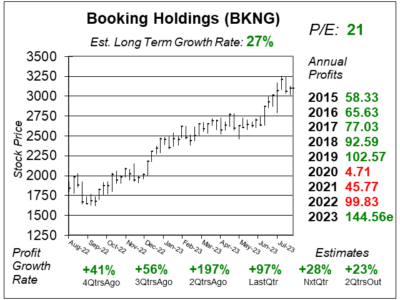

Booking.com (BKNG) just set quarterly records for room nights and gross bookings, as the Summer travel season is heating up.

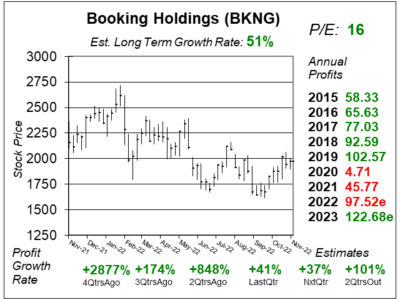

Booking (BKNG) is looking like a future stock market leader as people travel again. This stock has the potential to reach 3600 in 2024.

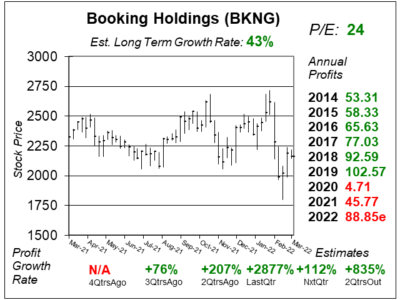

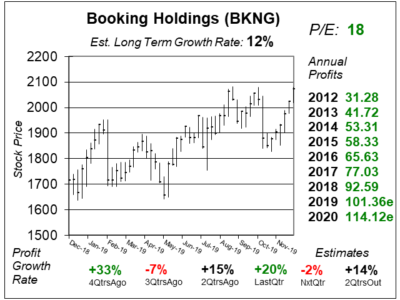

Booking (BKNG) isn’t seeing a poor economy for travel. In fact, business is getting better as its seeing strong bookings for 2023 Q1.

Booking (BKNG) is bouncing back from slow travel COVID times. But looking ahead, bookings growth seems to be simmering down.

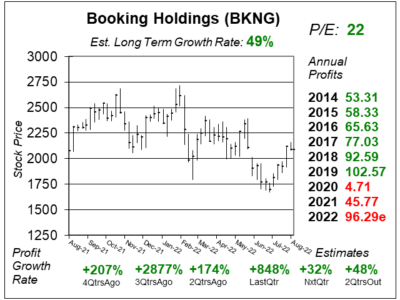

Booking.com (BKNG) is preparing for a busy Summer travel season ahead as airports are packed and hotels are selling out.

Booking.com (BKNG) could see unparalleled demand for travel this Summer as American families travel once again.

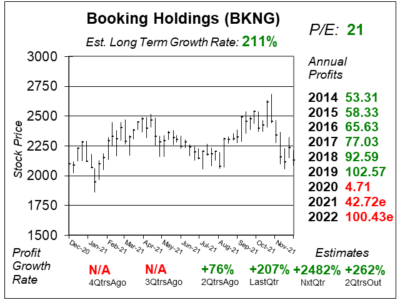

Booking (BKNG) stock might be in for a HUGE 2022 as International travel could soar with COVID variants weakening.

Booking.com (BKNG) & Priceline could see a boon in business as travel restrictions ease around the world. 2022 could be big.

Business travel has been slow to pick back up after COVID-19, and that’s hurting profits at Booking (BKNG) and Priceline.

Booking (BKNG) stock — parent of Priceline — is looking good right now as Summer travel is expected to soar again.

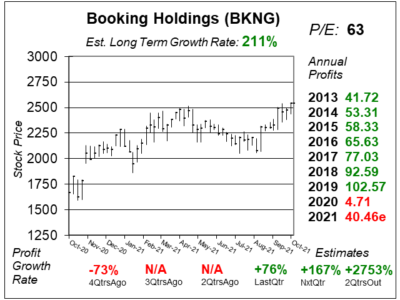

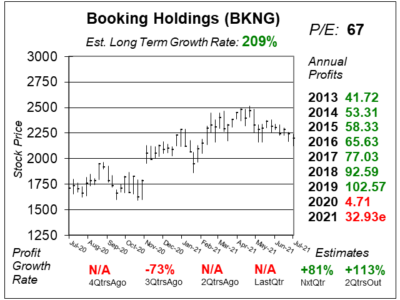

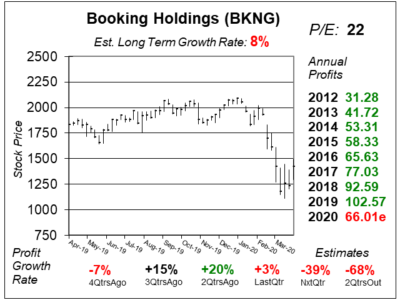

COVID-19 vaccines are now being distributed. So travel looks to surge surge in 2021, and Booking (BKNG) should thrive.

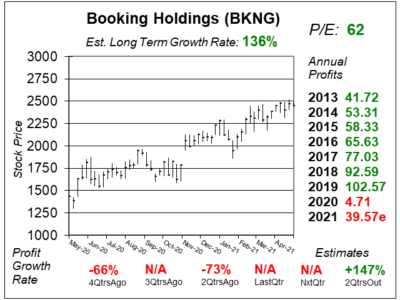

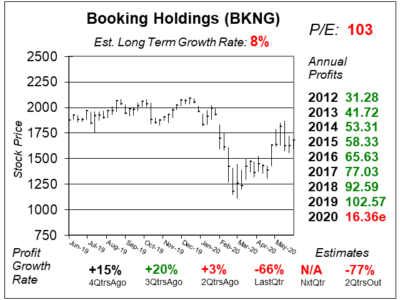

Booking.com (BKNG), formerly Priceline, might not have profits return to normal until 2022. Time to sell the stock?

Travel isn’t bouncing back anytime soon, and that’s bad for Booking Holdings (BKNG). Still, long-term upside is solid.

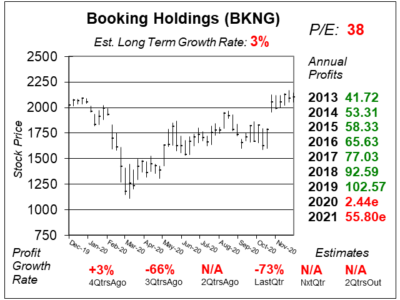

Booking (BKNG) is down-and-out as travel plans have been zapped worldwide. But there’s 70% upside to our 2021 Fair Value.

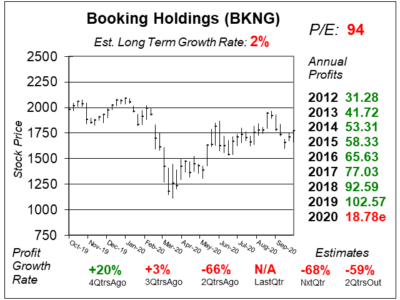

Booking (BKNG), formerly Priceline, delivers a perfect blend of safety and growth for both conservative and growth investors.

Booking (BKNG) grew profits 15% last qtr even though a strong U.S. dollar trimmed sales growth from 12% to 7%.

Booking.com (BKNG) has a lot of little things bringing down profits last qtr. Should we be concerned or will profits bounce back?

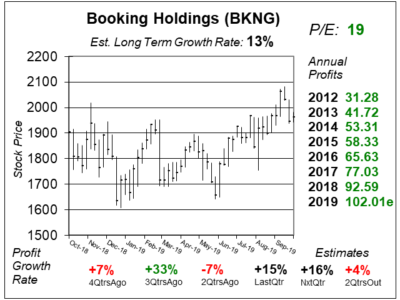

Booking (BKNG) management is spending to grow its brand, and will incur some currency expenses, which will hut profits. But BKNG always underpromises.

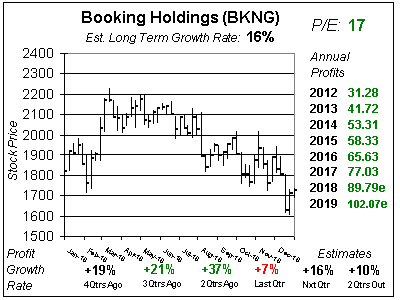

Although it doesn’t grow as fast as it used to, Booking (BKNG) has still increased every since year since 2003. Now that it’s dipped, BKND is lookin good for 2019.

The word-on-the-street Booking’s (BKNG) growth was slowing. Apparently not. BKNG delivered 37% profit growth last qtr.

Booking (BKNG) has been growing like a weed the last decade, yet even at this large scale was still able to deliver 21% profit growth last qtr.

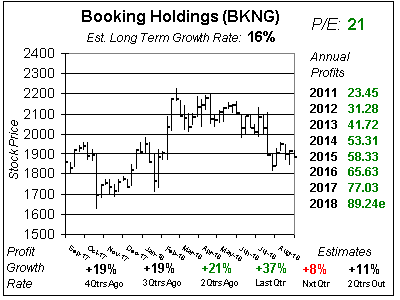

Priceline (PCLN) has changed its company name to Booking Holdings (BKNG) as Booking.com drives a significant majority of operating results.

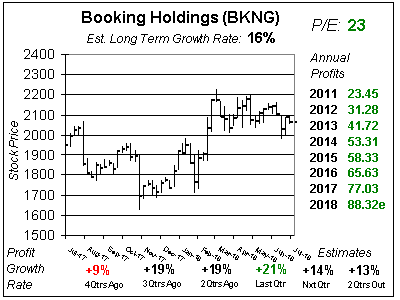

Booking Holdings (BKNG) is expected to report qtrly profits (EPS) and revenues:

Profits Estimates: $14.07 vs. $11.60 = +21%

Revenue Est: +12%