NVIDIA’s (NVDA) Demand for AI Computing Chips Continues to Increase

NVIDIA (NVDA) stated demand for Hopper during the quarter continued to increase. And up next, the next generation: Blackwell.

NVIDIA (NVDA) stated demand for Hopper during the quarter continued to increase. And up next, the next generation: Blackwell.

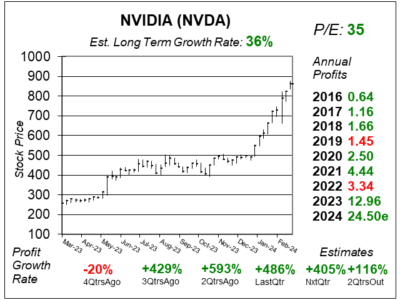

NVIDIA (NVDA) has gone from around $250 to around $850 durint the past year. And I think the stock is still undervalued.

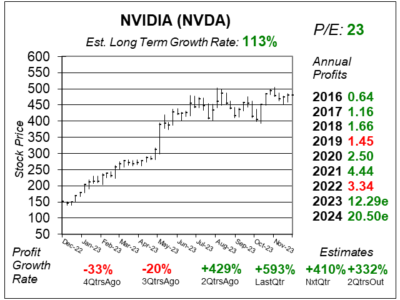

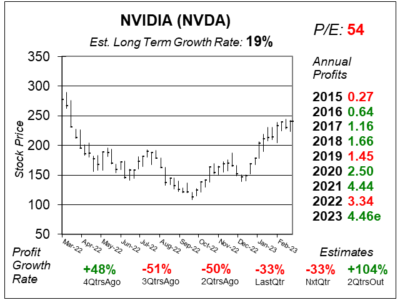

NVIDIA (NVDA) stock went on a serious run higher in early 2023. Now the stock is digesting its gains, and is poised to move in 2024.

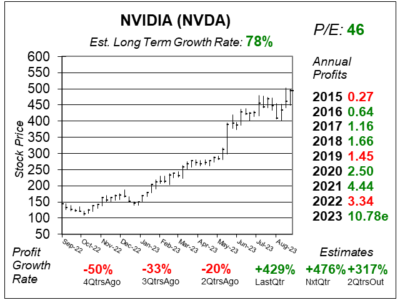

NVIDIA’s (NVDA) revenue and profit growth surged last quarter due to an insatiable thurst for Artificial Intelligence (AI) systems.

NVIDIA (NVDA) stock surged after forecasting $11 billion in revenue next quarter, way above analyst estimates of $7 billion.

NVIDIA’s (NVDA) DGX GPU is a catalyst the as hundreds or even thousands of these connect to become an AI supercomputer.

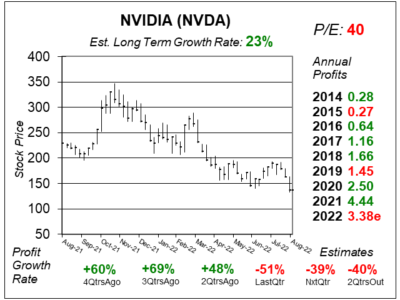

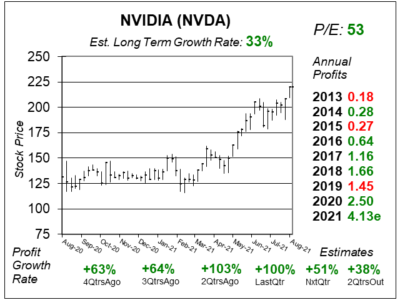

A year ago, NVIDIA’s (NVDA) Gaming was the company’s largest division. Now that division’s sales are sliding lower. Here’s why.

Datacenter and autonomous vehicle computing are the new leading segments for NVIDIA (NVDA), while the gaming division sags.

NVIDIA (NVDA) is seeing weakness in its Gaming division, but cloud titans helped boost Datacenter revenue 83% last qtr.

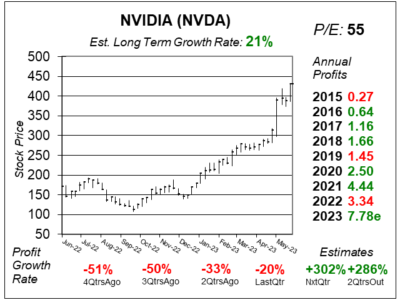

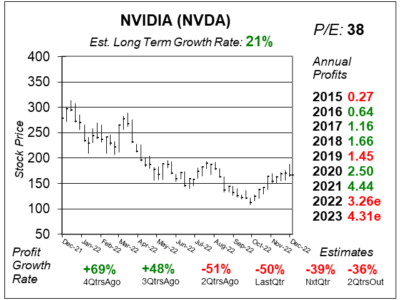

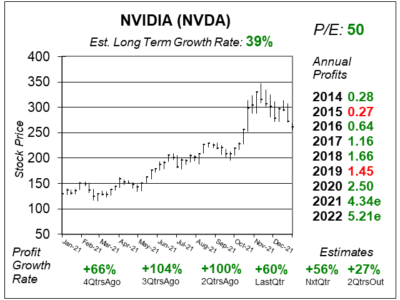

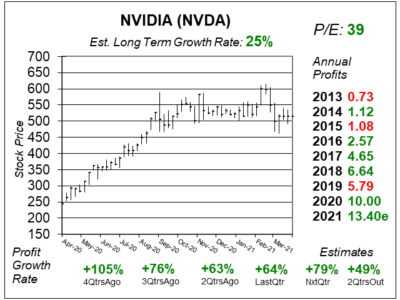

NVIDIA (NVDA) continues to deliver solid growth as the stock digests its prior gains. NVDA could lead the next Bull Market higher.

NVIDIA (NVDA) Omiverse Avatars — or digital robots — can assist a market of 40 million 3D designers worldwide at $1000 per year.

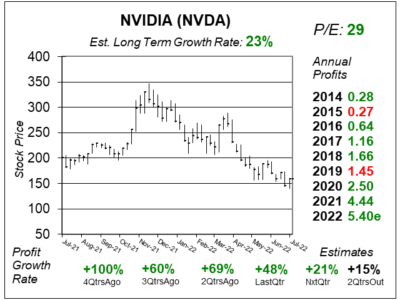

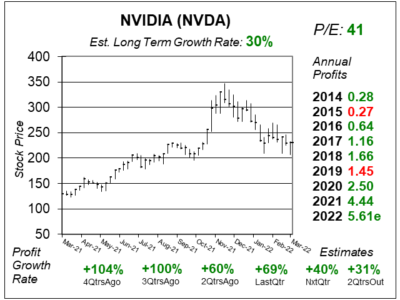

NVIDIA (NVDA) just delivered 100% profit growth as its Ampere GPUs seem to be in high demand for crypto mining.

NVIDIA (NVDA) is crushing it with its new processors that power Artificial Intelligence and bring advanced graphics to gaming.

NVIDIA (NVDA) stock hasn’t moved much the past 6 months, I think its ready to make a move higher as profits climb.

NVIDIA’s (NVDA) A100 is a miracle for artificial intelligence for cloud data centers — and a huge catalyst for NVDA stock.

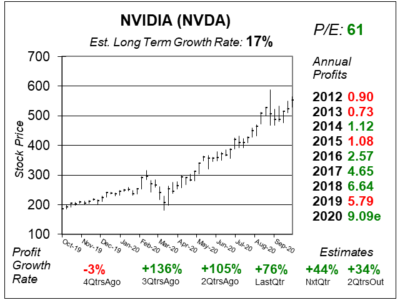

NVIDIA (NVDA) stock is on fire — and for good reason. Sales in its datacenter division surged 167% higher last qtr.

NVIDIA’s (NVDA) new Ampere graphics processing unit inside the NVIDIA A100 is a miracle for artificial intelligence in data centers.

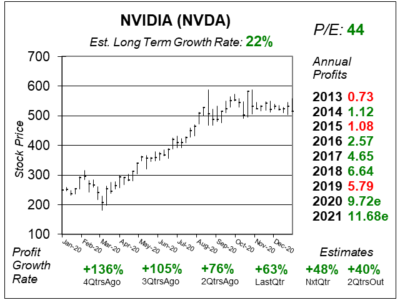

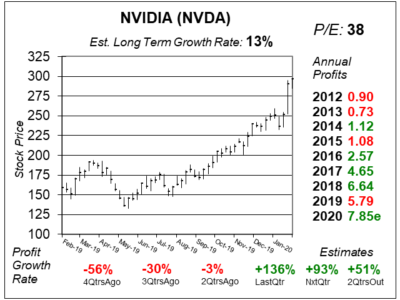

NVIDIA (NVDA) profits jumped 136% last qtr, so will it bounce back after being stock caught in this coronavirus downtraft?

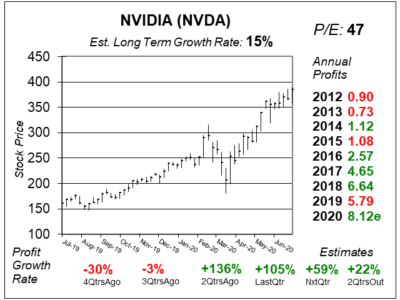

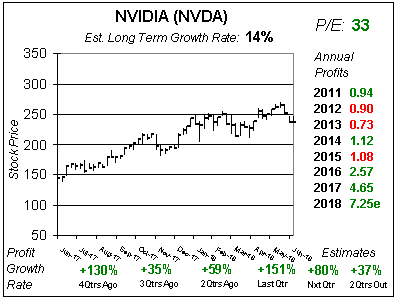

NVIDIA’s (NVDA) growth was poor the last 4 qtrs. Now growth is expected to return, but is the good news already priced in?

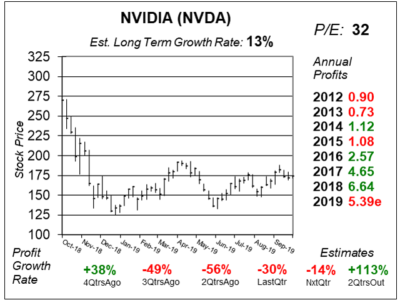

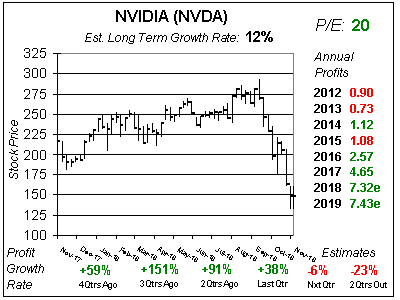

NVIDIA (NVDA) is dealing with three big issues that are holding back business — and the stock as well.

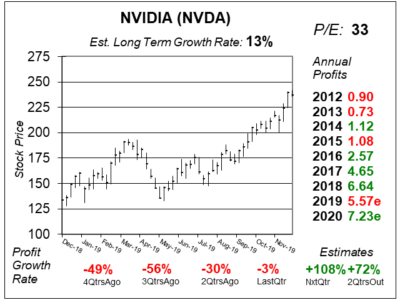

NVIDIA (NVDA) is halfway through its 4 qtrs of (perhaps) lower sales and profits. Has the stock turned the corner? I dunno.

NVIDIA (NVDA) is having issues. The company just slashed profit estimates, with 2019’s dropping from $7.43 to $5.30. What should we do with the stock?

Years ago I came the conclusions that semiconductor stocks — aka chip stocks — weren’t worth owning. NVIDIA (NVDA) is an example.

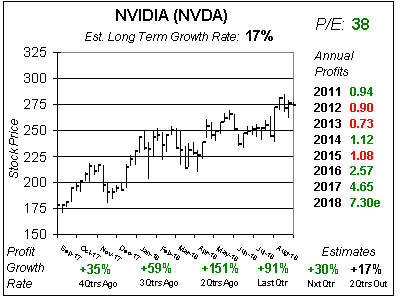

NVIDIA (NVDA) stock soared in 2016 after the company launched its last new gaming chip, and now the company has an even better one.

NVIdia (NVDA) usually has a soft first qtr, where profits are lower than the 4th qtr from the prior year. But this year things are different.

Shares of NVIDIA (NVDA) are in a dip, is it time to buy into this chip company? But the stock has more than doubled in the last year, and is high.

NVDA is up ten-fold in two years, and I’ve missed it all the way up. This company is the brains behind the new AI economy, with facial recognition, autonomous cars, and Bitcoin.

Alphabet, Amazon and Microsoft breaking out today after reporting earnings last night. These companies dominate — other companies can’t keep up — because of NVIDIA (NVDA).

Let’s take a look at NVIDIA (NVDA), the chip stock that’s transforming the world with the brains for automated cars, advanced games, and artificial intelligence.

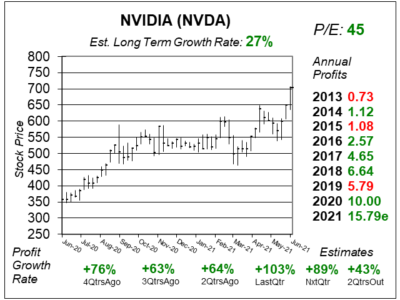

NVIDIA (NVDA) is expected to report qtrly profits (EPS) and revenues:

Profits Estimates: $6.33 vs. $2.70 = +134%

Revenue Est: +110%