Stock (Symbol) |

NVIDIA (NVDA) |

Stock Price |

$494 |

Sector |

| Technology |

Data is as of |

| August 31, 2023 |

Expected to Report |

| November 21 |

Company Description |

NVIDIA Corporation is a personal computer (PC) gaming market. NVIDIA Corporation is a personal computer (PC) gaming market.

The Company’s segments include Graphics and Compute & Networking. The Graphics segment includes GeForce graphics processing units (GPUs) for gaming and PCs, the GeForce NOW game streaming service and related infrastructure, and solutions for gaming platforms; Quadro/NVIDIA RTX GPUs for enterprise workstation graphics; virtual GPU software for cloud-based visual and virtual computing; automotive platforms for infotainment systems, and Omniverse software for building three-dimensional (3D) designs and virtual worlds. The Compute & Networking segment includes Data Center platforms and systems for artificial intelligence (AI), high-performance computing (HPC), and accelerated computing; Mellanox networking and interconnect solutions; automotive AI Cockpit, autonomous driving development agreements, and autonomous vehicle solutions; cryptocurrency mining processors (CMP); Jetson for robotics, and NVIDIA AI Enterprise. Source: Refinitiv |

Sharek’s Take |

NVIDIA’s (NVDA) surged last quarter due to the insatiable thrust for Artificial Intelligence (AI) Systems. Last quarter’s profits jumped 429% year-over-year on 101% revenue growth. NVIDIA’s explosive growth is driven by its Data Center segment, due to the strong demand for the HGX platform which runs Generative AI and large language models. In the company’s quarterly presentation, NVIDIA stated Amazon Web Services (AWS), Google Cloud, Microsoft Azure, Oracle Cloud and a number of cloud providers are deploying HGX systems in volume. NVIDIA’s (NVDA) surged last quarter due to the insatiable thrust for Artificial Intelligence (AI) Systems. Last quarter’s profits jumped 429% year-over-year on 101% revenue growth. NVIDIA’s explosive growth is driven by its Data Center segment, due to the strong demand for the HGX platform which runs Generative AI and large language models. In the company’s quarterly presentation, NVIDIA stated Amazon Web Services (AWS), Google Cloud, Microsoft Azure, Oracle Cloud and a number of cloud providers are deploying HGX systems in volume.

NVIDIA was originally focused on the computer graphics market, and invented the first graphics processing unit (GPU) in 1999 and made the company the leader in computer graphics. The company introduced its CUDA programming model in 2006 and ushered in parallel processing of its GPU for high-performance computing that could be used in fields including aerospace, biotechnology, and energy exploration. NVIDIA has since expanded its architecture to scientific computing, artificial intelligence, data science, autonomous vehicles, robotics, and virtual reality (or AR). Generative AI can do more than understand text and numbers. The computer can try to understand your words to program itself, and the NVIDIA GDX platform is the most robust AI platform today. It is the world’s first AI supercomputer. Here’s how it works:

NVIDIA has four operating segments : Gaming, Data Center, Professional Visualization and Automotive. Here are segment stats from last qtr:

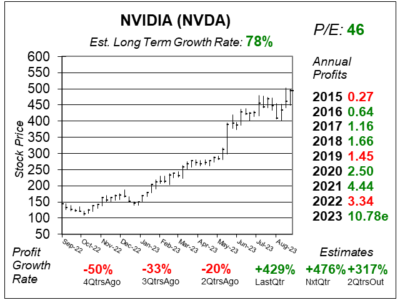

NVIDIA is in a golden era of a universal upgrade in computing. The company breaks down the four previous eras as (1) PC lead by IBM, (2) Internet, (3) Mobile & Cloud lead by the iPhone, and (4) AI. I consider NVIDIA a rapid grower, which in my opinion is a company growing year-over-year profits 65% or greater. Analysts give NVIDIA an Estimated Long Term Growth Rate of 78%. Management even buys back stock and pays a small dividend. In 2022, management returned $10.44 billion in stock buybacks and cash dividends. But the dividend is just $0.04 per share. This is one of the hottest stocks in the world. And even after the swift rise from roughly $150 to $500, the stock still is still reasonably priced with a P/E of 46. NVDA is part of the Growth Portfolio. I will add the stock to the Aggressive Growth Portfolio tomorrow. |

One Year Chart |

NVDA broke out an All-Time High for the second consecutive qtr. But the shares seem extended here. NVDA broke out an All-Time High for the second consecutive qtr. But the shares seem extended here.

The P/E is 46, compared to 55 last quarter. I think the P/E is reasonable. Quarterly profits are surging higher. But, comparisonas are easy as the company had a down year profit-wise in 2022. NVDA’s business is cyclical and during the previous qtrs the company has been delivering negative revenue and profit growth, primarily in the Gaming division. The Est. LTG is 78%, which in my opinion, makes NVIDIA a rapid grower. The Est. LTG is analysts’ 3-5 year guess of annual profit growth (not stock growth). |

Earnings Table |

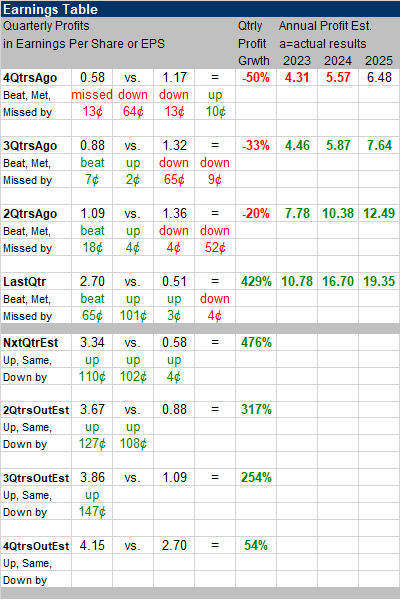

Last qtr, NVIDIA reported 429% profit growth and beat estimates of 302% growth. Revenue grew 101%, year-over-year, against estimates of 64%. To give you an idea of the magnitude of the revenue advance, Two qtrs ago, NVIDIA was expected to do $7 billion in revenue this past qtr. Management upped that to $11 billion, and in the end, the company did $13.5 billion. Gross margin expanded to 70.1% from 43.5% last year due to higher Data Center sales. Last qtr, NVIDIA reported 429% profit growth and beat estimates of 302% growth. Revenue grew 101%, year-over-year, against estimates of 64%. To give you an idea of the magnitude of the revenue advance, Two qtrs ago, NVIDIA was expected to do $7 billion in revenue this past qtr. Management upped that to $11 billion, and in the end, the company did $13.5 billion. Gross margin expanded to 70.1% from 43.5% last year due to higher Data Center sales.

Growth was driven by Data Center sales which almost tripled year-over-year as demand intensified for the DGX platform, the engine used to power generative AI and large language models. Cloud service providers and Internet companies like AWS, Google Cloud, Meta, Microsoft Azure and Oracle Cloud are deploying HGX systems in volume. Enterprises are also deploying generative AI, thus driving strong demand for NVIDIA-powered cloud instances and on-premise infrastructure. Networking revenue also almost doubled with growth driven by the InfiniBand networking platform. Annual Profit Estimates jumped big time this qtr. Check out these estimates for the upcoming years: 2023: $10.78 Qtrly Profit Estimates for the next 4 qtrs are 476%, 317%, 254%, and 54%. For next qtr, management expects revenue to be $16 billion, which represents around 170% growth year-over-year. Analysts think NVDA revenue will grow 171% next qtr to $16 billion. |

Fair Value |

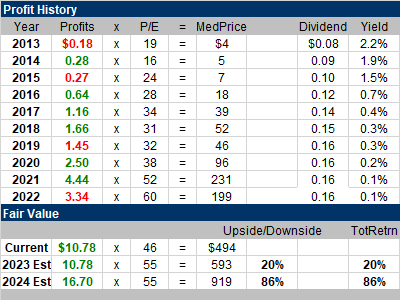

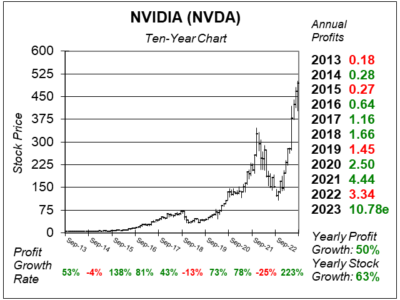

During 2016, the NVIDIA GeForce video processor created a surge in revenue and profits (from $0.27 to $0.64 that year) and helped the stock soar from $8 to $27 that year. The stock continued to soar into 2018 and peaked at $73. During 2016, the NVIDIA GeForce video processor created a surge in revenue and profits (from $0.27 to $0.64 that year) and helped the stock soar from $8 to $27 that year. The stock continued to soar into 2018 and peaked at $73.

Then the stock fell in late-2018 as the company had lots of returns of its high-end processors as the price of Bitcoin declined and cryptocurrency miners (and distributors) returned their gear back to NVDA. Notice profits fell in 2019. The 2022 slump was due to a downturn in sales in the Gaming division as (1) businesses were flush with cash in 2021 and had already upgraded computers and (2) Bitcoin miners found it unprofitable to mine with lower crypto prices combined with high electricity costs. My Fair Value P/E is a P/E of 55, same as last quarter. This gives me a Fair Value around $600 this year and greater than $900 for 2024. |

Bottom Line |

NVIDIA’s (NVDA) on a parabolic run, so the stock is dangerous to buy here. Note the exceptional Yearly Profit Growth and Yearly Stock Growth. NVIDIA’s (NVDA) on a parabolic run, so the stock is dangerous to buy here. Note the exceptional Yearly Profit Growth and Yearly Stock Growth.

AI has ushered in a new round of spending for advanced computers. and NVIDIA has a clear lead on the brains for this technology. It’s hard to fathom what this company’s revenue, profits, and even stock price could be in the coming years. NVDA stays 3rd in the Growth Portfolio Power Rankings. The stock was my #2 holding in the portfolio at the beginning of 2023. NVDA will be added back into Aggressive Growth Portfolio tomorrow. I sold the stock from this portfolio exactly one year earlier (September 6) because the stock was very weak and profit growth being down 51% the prior quarter. The stock hit a low of $134 that day and closed at $485 today. Selling was a monumental mistake on my part. But I feel this is one of the stock market’s top growth stocks and I’m trying to collect true market leaders (TML) in this portfolio. Thus, I will buy it back at much higher prices as the stock still has upside to my Fair Value. NVDA will rank 9th in this portfolio’s Power Rankings, as I want to buy half a position now and half later, as the stock is extended. |

Power Rankings |

Growth Stock Portfolio

3 of 30Aggressive Growth Portfolio 9 of 20Conservative Stock Portfolio N/A |