The stock market snapped its win streaks after it sank on Friday. Invetors weighed the renewed recession fears, elevated inflation data, and Fed’s hawkish stance.

The stock market snapped its win streaks after it sank on Friday. Invetors weighed the renewed recession fears, elevated inflation data, and Fed’s hawkish stance.

Overall, S&P 500 fell 0.8% to 4,348, while NASDAQ decreased 1.0% to 13,493.

Tweet of the Day

O'Neil Global Advisors, #IBD founder's hedge fund, caught some of the big gainers since Q1:$NVDA +54% $SMCI +116%$TSLA +26%$META +33%$IOT +46%

Its strategies helped it avoid the down market in 2022 & timely re-enter the market in Q1.👇🏼https://t.co/JuHHfx0Mhz pic.twitter.com/URdp9bhCMt

— HedgeMind (@HedgeMind) June 21, 2023

Chart of the Day

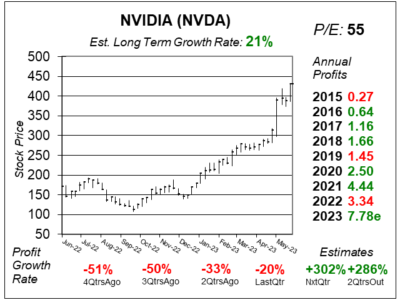

Here is the one-year chart of NVIDIA (NVDA) as of June 14, 2023, when the stock was at $430.

Here is the one-year chart of NVIDIA (NVDA) as of June 14, 2023, when the stock was at $430.

NVIDIA was originally focused on the computer graphics market, and invented the first graphics processing unit (GPU) in 1999 and made the company the leader in computer graphics. It has since expanded its architecture to scientific computing, artificial intelligence (AI), data science, autonomous vehicles, robotics, and virtual reality (or AR). The DGX is the world’s AI supercomputer.

NVIDIA stock surged after management upped next quarter’s revenue guidance due to incredible demand for the company’s suite of AI products. The highlight of the earnings release was management’s revenue guidance for next quarter: $11 billion versus analyst’s estimates of $7 billion. This was one of the biggest increases on quarterly estimates ever from a large enterprise company.

Generative AI drove significant upside in demand for NVIDIA’s products. Cloud service providers including Microsoft Azure, Google Cloud, Oracle Cloud have introduces the availability of the H100 on their platforms. In addition, Meta (META) has deployed its h100 Grand Teton AI supercomputer for its research teams. Enterprise demand is also strong in automotive, financial services, healthcare and telecom industries where AI is quickly becoming integral to innovation. In the earnings call, management mentioned with Bloomberg, AT&T and ServiceNow in AI.

NVIDIA is part of the Growth Portfolio. This is one of the hottest stocks in the world.