Stock (Symbol) |

NVIDIA (NVDA) |

Stock Price |

$703 |

Sector |

| Technology |

Data is as of |

| June 4, 2021 |

Expected to Report |

| August 18 |

Company Description |

Nvidia Corporation focuses on personal computer (PC) graphics, graphics processing unit (GPU) and also on artificial intelligence (AI). The Company’s operates through two segments: GPU and Tegra Processor. The Company’s GPU product brands are aimed at specialized markets, including GeForce for gamers; Quadro for designers; Tesla and DGX for AI data scientists and big data researchers; and GRID for cloud-based visual computing users. The Company’s Tegra brand integrates an entire computer onto a single chip, and incorporates GPUs and multi-core central processing units (CPUs) to drive supercomputing for mobile gaming and entertainment devices, as well as autonomous robots, drones and cars. Source: Thomson Financial Nvidia Corporation focuses on personal computer (PC) graphics, graphics processing unit (GPU) and also on artificial intelligence (AI). The Company’s operates through two segments: GPU and Tegra Processor. The Company’s GPU product brands are aimed at specialized markets, including GeForce for gamers; Quadro for designers; Tesla and DGX for AI data scientists and big data researchers; and GRID for cloud-based visual computing users. The Company’s Tegra brand integrates an entire computer onto a single chip, and incorporates GPUs and multi-core central processing units (CPUs) to drive supercomputing for mobile gaming and entertainment devices, as well as autonomous robots, drones and cars. Source: Thomson Financial |

Sharek’s Take |

NVIDIA (NVDA) just delivered a fantastic quarter with strong demand seen in its Gaming business and Data Center. Data Center is the division that really has me excited for the stock, as Artificial Intelligence (AI) utilization expands from only a select few companies to hundreds of thousands in gaming, cloud computing, robotics, and self-driving cars, as well as genomics and biology. And in Gaming, the revolutionary NVIDIA RTX has reinvented computer graphics and is driving upgrades across gaming and design markets (source: NVDA 2022 Q1 earnings release). NVIDIA (NVDA) just delivered a fantastic quarter with strong demand seen in its Gaming business and Data Center. Data Center is the division that really has me excited for the stock, as Artificial Intelligence (AI) utilization expands from only a select few companies to hundreds of thousands in gaming, cloud computing, robotics, and self-driving cars, as well as genomics and biology. And in Gaming, the revolutionary NVIDIA RTX has reinvented computer graphics and is driving upgrades across gaming and design markets (source: NVDA 2022 Q1 earnings release).

Datacenter and Gaming are giving the NVIDIA two avenues for exceptional growth. And a catalyst for both divisions is NVIDIA’s A100-based platforms. NVIDIA’s A100 Tensor Core GPU is the world’s most powerful Artificial Intelligence (AI) platform, and offers unprecedented performance. The A100 is a miracle for artificial intelligence in data centers, with 54 billion transistors, and vastly improved Artificial Intelligence. Virtual Reality is a HUGE catalyst for NVIDIA. This state of the art GPU is needed to show the beautiful graphics of modern games. Moving from Gaming to Datacenter, Amazon Web Services, Google Cloud, Microsoft Azure, Oracle Cloud and Alibaba Cloud all announced availability of the A100. So these big-boys are buying the processors and clients of thiers are utilizing the NVIDIA processors via their cloud services. NVIDIA is trying to acquire Arm Holdings, which designs the blueprints for processors used in supercomputers and more than 90% of the world’s smartphones, but the deal might not pass through regulators. Here are NVDA main divisional stats from last qtr:

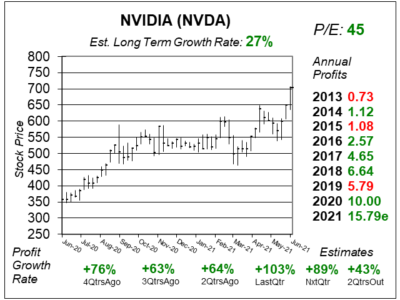

NVDA is seeing exceptional profit growth (+108% last qtr) and revenue growth (+84%) and with a P/E of jsut 45 the stock has huge upside. NVDA has an Estimated Long-Term-Growth Rate of 27%, which seems way too low. I think the P/E should be 65, and that equates to the stock perhaps surpassing $1000 this year. NVIDIA is a top holding in the Growth Portfolio and Aggressive Growth Portfolio. |

One Year Chart |

Note, these charts/tables are from June 4 when the stock was $703. Today is Sunday 6/13, and on Friday the stock closed at $713. Note NVDA was breaking out when these charts were done. With the shares now $10 higher, that breakout has been successful. AND the stock is still in a safe buy range for those looking to invest. Note, these charts/tables are from June 4 when the stock was $703. Today is Sunday 6/13, and on Friday the stock closed at $713. Note NVDA was breaking out when these charts were done. With the shares now $10 higher, that breakout has been successful. AND the stock is still in a safe buy range for those looking to invest.

The P/E of 45 is very good for a state-of-the-art company such as this. The P/E was 39 last qtr. The Est. LTG of 27% is too low, but analysts did increase this number from 25% a qtr ago and 22% 2QtrsAgo. There is huge growth opportunity ahead the this company. |

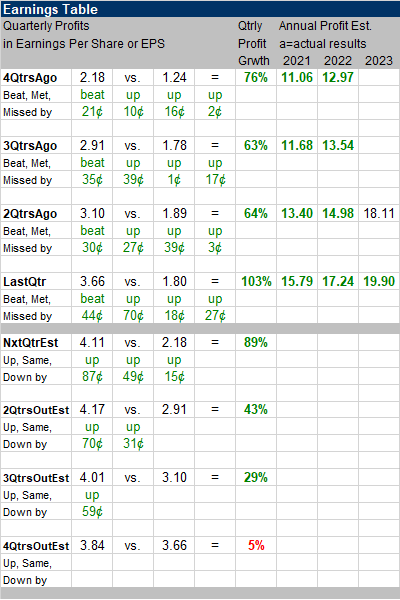

Earnings Table |

Profits hit a record high last qtr, and grew 103% vs estimates of 79%. The company made $3.66 per share, which was 56 cents better than the previous high hit 2QtrsAgo. Revenue jumped an astounding 84%, and sales growth continues to accelerate (from 61%, 57% and 50% the prior three qtrs). Profits hit a record high last qtr, and grew 103% vs estimates of 79%. The company made $3.66 per share, which was 56 cents better than the previous high hit 2QtrsAgo. Revenue jumped an astounding 84%, and sales growth continues to accelerate (from 61%, 57% and 50% the prior three qtrs).

Annual Profit Estimates continue to climb at a brisk pace. Analysts expect NVDA to rake in more than $30 share by 2024. Check it out these estimates for the upcoming years: 2021 $15.79 Qtrly profit Estimates for the next 4 qtrs are 89%, 43%, 29% and 5%. These estimates got increased big time for the 2nd straight qtr. This Earnings Table is almost perfect. That 4QtrsOut estimate needs time for analysts to adjust it. |

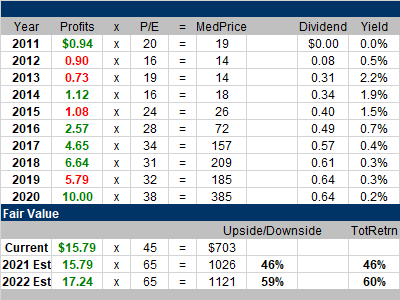

Fair Value |

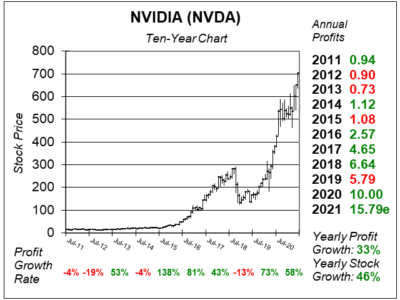

During 2016 the NVDIA GeForce video processor created a surge in revenue and profits (from $1.08 to $2.57 that year) and helped NVDA stock soar from $33 to $107 that year. The stock continued to soar into 2018 and peaked at $292. Then the stock fell in late-2018 as the company had lots of returns of its high-end processors as the price of Bitcoin declined and Bitcoin miners (and distributors) returned their gear back to NVDA. Notice profits fell in 2019. Now, this new AI GPU is the next big catalyst for the company. During 2016 the NVDIA GeForce video processor created a surge in revenue and profits (from $1.08 to $2.57 that year) and helped NVDA stock soar from $33 to $107 that year. The stock continued to soar into 2018 and peaked at $292. Then the stock fell in late-2018 as the company had lots of returns of its high-end processors as the price of Bitcoin declined and Bitcoin miners (and distributors) returned their gear back to NVDA. Notice profits fell in 2019. Now, this new AI GPU is the next big catalyst for the company.

My Fair Value is a P/E of 65. I don’t think the stock will actually get a 65 P/E, I think it will earn close to $20 in profits this year and will geta P/E of 50 or more. Also, analysts expect 2022 profits to climb just 9%. I think that’s proposterous. Also, recall the $30 in profits estimate a few years from now? A 50 P/E x $30 in profits would be a $1500 stock. |

Bottom Line |

NVIDIA’s chipsets and processors are the brains behind advanced gaming and artificial intelligence. And with AI growing exponentially, datacenter is prime to be the company’s largest division. NVIDIA’s chipsets and processors are the brains behind advanced gaming and artificial intelligence. And with AI growing exponentially, datacenter is prime to be the company’s largest division.

Notice these shares have gone on runs higher, then settled back and digested gains. With the stock just now breaking past $650, I think it can move towards $1000 in short order. NVDA stays at 1st in the Growth Portfolio Power Rankings. The stock stays at 2nd in the Aggressive Growth Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

1 of 39Aggressive Growth Portfolio 2 of 25Conservative Stock Portfolio N/A |