Amazon (AMZN) Delivers Accelerated Growth in Retail, International, and AWS

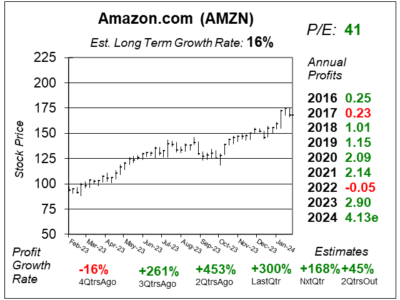

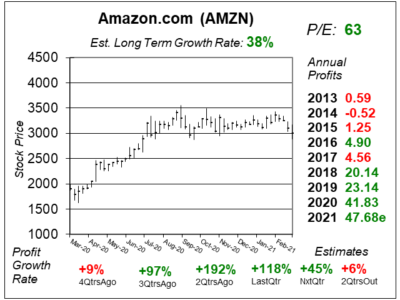

Amazon (AMZN) shows its past the sluggish growth of 2023 as it delivered accelerated revenue growth in every division last qtr.

Amazon (AMZN) shows its past the sluggish growth of 2023 as it delivered accelerated revenue growth in every division last qtr.

Amazon (AMZN) management sees AI adding tens of billions of dollars in revenue per year to AWS revenue in the upcoming years.

Amazon’s (AMZN) profit surged due to more effecient deliveries as the company went from 1 national US netrowk to 8 regional ones.

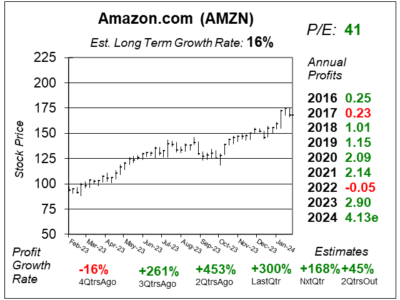

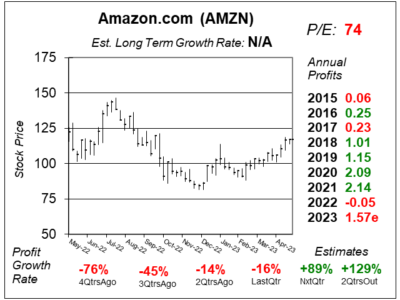

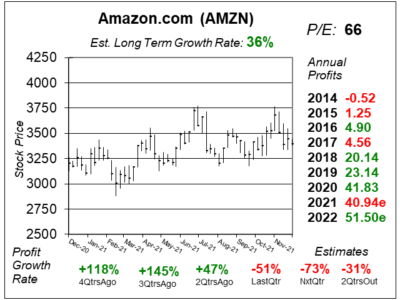

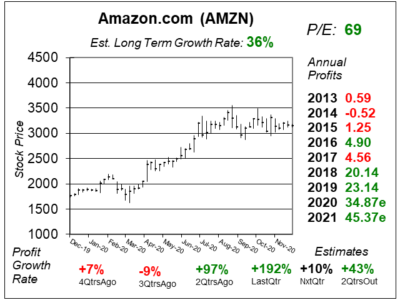

It’s been a tough road for Amazon (AMZN) recently as both its stock and profits have fallen. But a new day is now upon us.

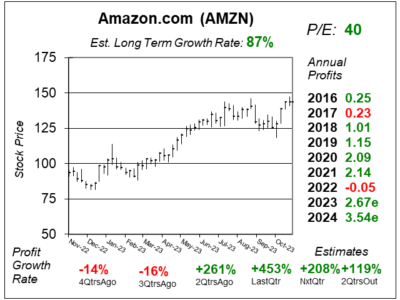

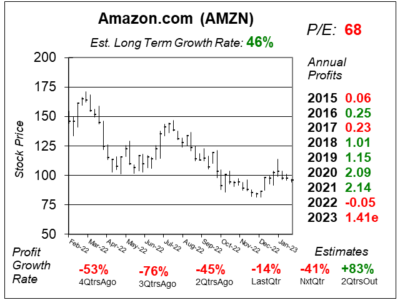

Amazon (AMZN) contininues to “deliver” some putrid results. All its operating segments had slowing revenue growth last quarter.

Amazon (AMZN) is losing money in its retail business, while AWS continues to make a profit. But this stock seems broken.

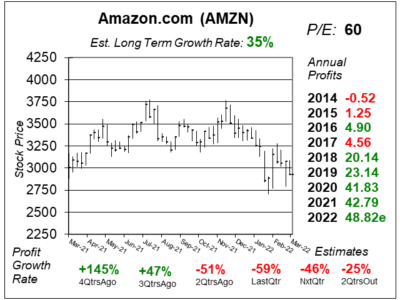

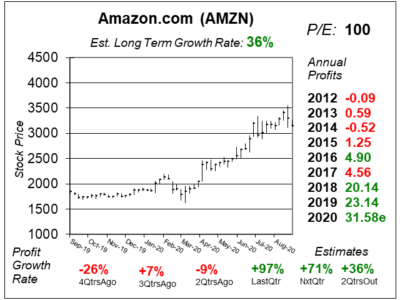

Could Amazon (AMZN) lose money this year? Wow! Let’s dive deep into the numbers and see why the company is having trouble.

OMG, Amazon (AMZN) stock has so many issues I had to list them in bullets. But notice profit growth is set to return September 30th.

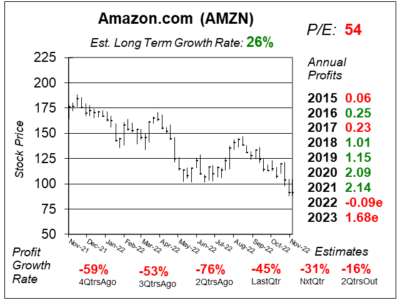

Higher labor and raw material costs have hurt Amazon’s (AMZN) profits. So I sold all shares in client accounts. Here’s the thesis:

Amazon’s (AMZN) facing higher labor, third-party shipping, and steel costs, which are taking a big bite out of profits.

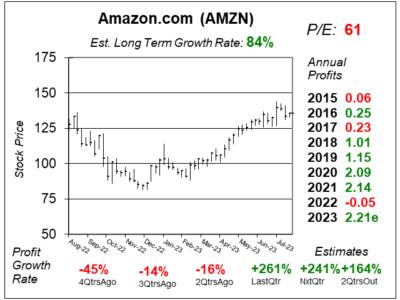

Amazon’s (AMZN) stock is flat for the year, and a reason for that might be profit growth is expected to be -5% the next 4 qtrs.

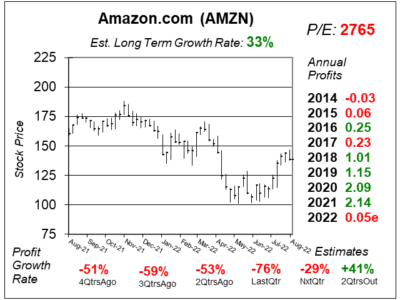

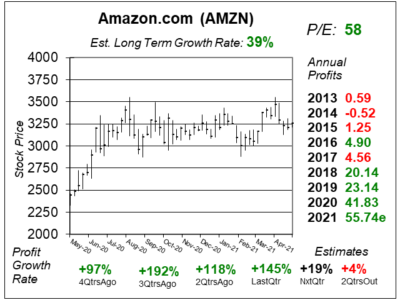

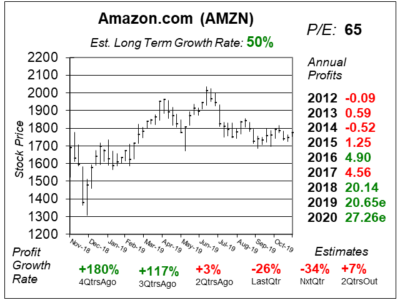

Amazon (AMZN) stock hasn’t moved much in the past year, but my analysis points to a potential triple by 2025.

Amazon’s (AMZN) profits are expected to soar to $152 a share by 2025. The stock sells for just 20x future estimates.

Many investors have put time into finding the next Amazon (AMZN). But the OG is the one to watch as it might triple in 4 years.

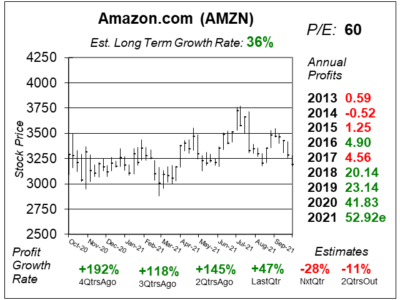

Amazon’s (AMZN) profits are surging, and if that continues the company might make $100 a share in profits in the near future.

The Coronavirus has crushed Amazon’s (AMZN) retail competition. Now the company is stronger than ever.

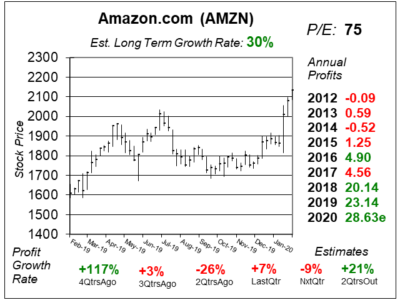

Amazon’s (AMZN) One-Day Prime Delivery has investors excited about the stock once again. Is the hype real?

Amazon (AMZN) has moved its Prime delivery time from 2-day to 1-day, but the cost of doing this is a lot of profits.

Amazon (AMZN) just missed profit estimates for the first time in two years. More importantly, estimates got slashed.

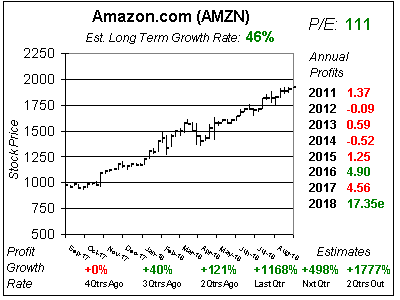

Amazon (AMZN) has increased its profit margins, which has helped fuel triple-digit profit growth. But sales growth has slowed.

Amazon (AMZN) looks to be setting up for another run higher, lead by Amazon Web Services which delivered more than 50% of total company profits last qtr.

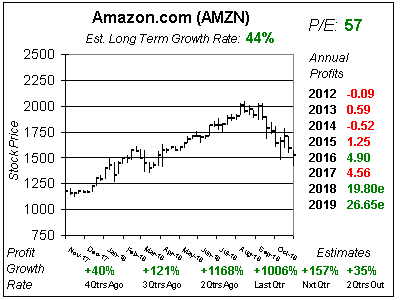

Amazon (AMZN) continues to be the best stock in my coverage, and I expect AMZN to be THE stock market leader in 2019.

Don’t be impressed with Amazon (AMZN) hitting $2000. Profits are flowing in so rapidly that the stock could be $3000 shortly.

Amazon (AMZN) is suddenly rolling in the profits, and with the stock just having broke out, there’s a chance it could go to $2000 and beyond.

I think Amazon (AMZN) stock is destines to decline somewhat as it just completed a parabolic move. Also, FANG stocks have just gone from being leaders to laggards.

Amazon (AMZN) broke out after a strong holiday season that saw sales jump 34% last qtr with help from Whole Foods and 42% sales growth in Amazon Web Services.

As Amazon’s (AMZN) invests to grow its business, the company reduces the amount it pays in taxes, giving AMZN even more money to invest and grow with.

Amazon’s (AMZN) proposed acquisition of Whole Foods would crush the other players in the supermarket industry, but AMZN dominates everywhere.

Amazon.com (AMZN) is now getting into groceries and home repairs — while profit estimates come down. Will this affect AMZN stock? Let’s take a look.

Amazon (AMZN) missed profit estimates last qtr, and analysts lowered estimates going forward. But does this hurt AMZN long term?

Amazon.com (AMZN) smashed earnings estimates last qtr and delivered a stunning 837% profit growth. Let’s take a deeper look inside the numbers.

Amazon (AMZN) is growing profits at a triple-digit pace. With AMZN near an All-Time high, does it have what it takes to break out?

Investors have shunned growth stocks recently, but estimates show a windfall of profits could be coming Amazon’s (AMZN) way, and if that happens it would make headlines.

Amazon’s (AMZN) stock has been soaring, and so are its profits. I will add AMZN to the Growth Portfolio and Aggressive Growth Portfolio.

Amazon’s (AMZN) web services division is growing fast and is tremendously profitable, and is pushing AMZN stock higher.

Thinking about buying Amazon (AMZN) after Cyber Monday? Think again.

Amazon’s (AMZN) Fire TV doesn’t matter to me. My focus is getting AMZN during this market correction.

I don’t think any of us really know what Amazon.com (AMZN) is worth. Right now the chart shows a good buy point — but the P/E is 200.

Amazon.com (AMZN) lost money last year, and likely won’t make much this year. So how could I say its an earnings juggernaut? Here’s how:

Amazon.com (AMZN) continues to build new order fulfillment centers across the globe. That’s hurting profits now, but will help profits in the (far) future.

Amazon.com (AMZN) popped after beating the street and posting profit growth of -36%. Yes, negative thirty six percent. This stock is a tough read.

Amazon.com (AMZN) lowered earnings estimates once again. Whew, the numbers are almost all red. This stock is a speculative investment for now.

Amazon (AMZN) just lowered earnings estimates — again. Yet the stock keeps trending higher — again. Investors are really looking towards the future with this stock. Here’s a look at AMZN, a stock on my radar.

Amazon (AMZN) isn’t breaking old security analysis rules by pushing higher with its 80-something P/E. The company — and the stock — are making new rules.

Amazon.com (AMZN) just grew profits 7% and AMZN stock has a P/E of 55. Amazon is set to correct.

Amazon.com (AMZN) just had profit estimates lowered, now 20% profit growth may not happen again until four quarters from now due to expansion costs. A 48 P/E is high, to be nice. Although I love AMZN’s long-term perspective, I will sell the stock from the Growth Portfolio today. Here’s why: