Stock (Symbol) |

Amazon.com (AMZN) |

Stock Price |

$143 |

Sector |

| Retail & Travel |

Data is as of |

| November 15, 2023 |

Expected to Report |

| January 31 |

Company Description |

Amazon.com provides a range of products and services to customers. Amazon.com provides a range of products and services to customers.

The products offered through its stores include merchandise and content that it purchased for resale and products offered by third-party sellers. It also manufactures and sells electronic devices, including Kindle, Fire tablet, Fire TV, Echo, and Ring, and it develops and produces media content. It operates through three segments: North America, International and Amazon Web Services (AWS). The AWS segment consists of global sales of compute, storage, database, and other services for start-ups, enterprises, government agencies, and academic institutions. It provides advertising services to sellers, vendors, publishers, authors, and others, through programs, such as sponsored advertisements, display, and video advertising. It serves consumers through its online and physical stores. Customers access its offerings through websites, mobile applications, Alexa, devices, streaming, and physically visiting its stores. Source: Refinitiv |

Sharek’s Take |

Amazon (AMZN) is implementing Artificial Intelligence (AI) across its Amazon Web Services (AWS) network. Companies that are already using AWS AI with the Amazon Bedrock Platform include Booking.com, GoDaddy and United Airlines. Management sees AI adding tens of billions of dollars in revenue per year to AWS. An the company just introduced Q. Q is Amazon’s new Artificial Intelligence chatbot for Amazon Web Services (AWS) customers that can perform functions such as customer service, marketing, and finance. It can even help developers solve issues. Q has just been announced, so I don’t have much to comment on. In terms of current results, AMZN is saving on shipping costs as its transitioned the fulfillment network from 1 national network in the US to 8 separate regions. This is helping profits and profit margins climb. Shorter distances and fewer touches helped profits come in at $0.94 per share last quarter and beat estimates of $0.58. Let’s take a look at the numbers from last qtr:

Founded in 1994, Amazon serves customers through its online and physical stores with a focus on selection, price, and convenience. The company with more than 1 million full-time and part-time employees work to deliver hundreds of millions of unique products that are sold by Amazon itself and third-party sellers. Here’s some other info about the company:

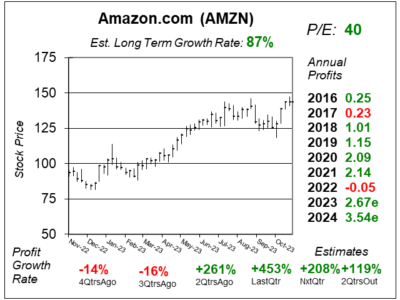

I sold AMZN stock from my Conservative Growth Portfolio and Growth Portfolio on March 11, 2022 ~$146. At the time the company had high cost pressures from labor supply shortages and inflationary pressures on gasoline. Profit growth was -59% in the latest quarter. Today the stock is ~$146 and profit growth in he latest quarter was +453%. Also, profit estimates were falling when I sold and they are rising now. 2023 est. have risen from $1.41 to $2.67 the past four quarters. AMZN stock has an outstanding Estimated Long-Term Growth Rate of 87%. Do note that’s an estimate of profit growth for the next 3-5 years, not stock growth. And the P/E of 40 is low by historical standards. Amazon will be added to the Growth Portfolio and Aggressive Growth Portfolio tomorrow. |

One Year Chart |

AMZN stock is around a 52-week high. AMZN stock is around a 52-week high.

The Estimated Long-Term Growth Rate of 87%. is superb. Note that’s a 3-5 year outlook on profit growth, not stock growth. The P/E of 40 is reasonable. The P/E was 61 last quarter. Note this quarter the P/E is being calculated on 2024 profit estimates, as opposed to 2023 estimates last qtr. The reason for this is we are in AMZN’s Fiscal Q4, with 2024 Q1 only a month away. Quarterly profit growth has been exceptional the past two quarters and that’s expected to continue. |

Earnings Table |

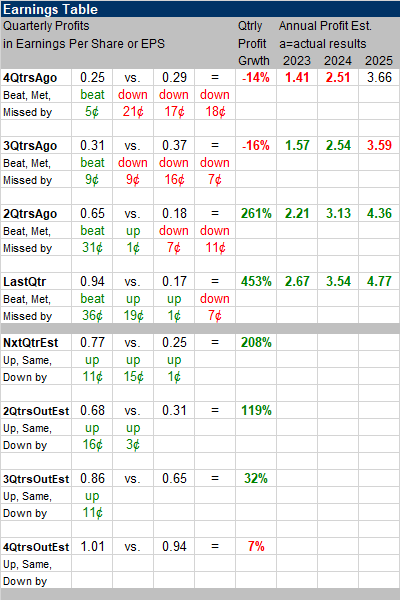

Last qtr, Amazon reported 453% profit growth and beat estimates of 241% growth. Revenue increased 13%, year-over-year against 11% estimates. Advertising was strong with 25% growth excluding F/X driven by Sponsored Products. North America Operating margin was 4.9% last qtr. This figure has been up 6 consecutive quarters, and is up from -2.3% in 2022 Q1. Last qtr, Amazon reported 453% profit growth and beat estimates of 241% growth. Revenue increased 13%, year-over-year against 11% estimates. Advertising was strong with 25% growth excluding F/X driven by Sponsored Products. North America Operating margin was 4.9% last qtr. This figure has been up 6 consecutive quarters, and is up from -2.3% in 2022 Q1.

Segment growth last qtr was:

Amazon had its biggest Prime day last quarter with 375 million items sold and $2.5 billion in savings. AMZN also sees strong demand in Health & Beauty as well as Personal Care. Management is seeing lower inflation in shipping rates. Annual Profit Estimates jumped across the board. Very impressive. Quarterly estimates moved up too. Qtrly profit Estimates are for 208%, 119%, 32%, and 7% profit growth the next 4 qtrs. Analysts think that AMZN revenue will grow 11% next quarter. |

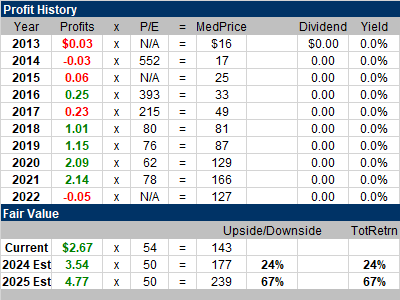

Fair Value |

My Fair Value P/E increases to 50 from 45. That gives the stock 24% upside to my 2024 Fair Value. Note 2025’s upside is an exceptional 67%. My Fair Value P/E increases to 50 from 45. That gives the stock 24% upside to my 2024 Fair Value. Note 2025’s upside is an exceptional 67%.

AMZN’s P/E is currently 54 when we use 2023 profit estimates. So I’m assuming the P/E will actually decline. Also, 2024’s profit estimates went from around $2.50 to around $3.50 the past four quarters. |

Bottom Line |

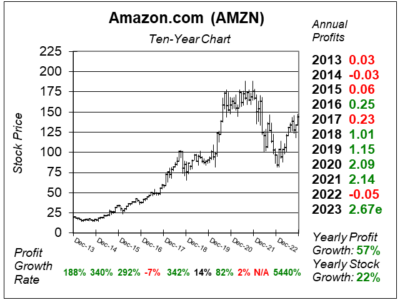

Amazon (AMZN) had been a terrific stock to own historically. But the stock hasn’t done well the past 4 years. Note profit growth slowed to just 2% in 2021 then the company lost money in 2022. Amazon (AMZN) had been a terrific stock to own historically. But the stock hasn’t done well the past 4 years. Note profit growth slowed to just 2% in 2021 then the company lost money in 2022.

Today’s Amazon has grown more efficient, and is focused on profitability. Profits are zooming higher in a big way. AMZN will be added to the Growth Portfolio and rank 14th in the Power Rankings. The stock will rank 10th in the Aggressive Growth Portfolio. Right now, the market is closed so I will place these trades tomorrow. |

Power Rankings |

Growth Stock Portfolio

14 of 31Aggressive Growth Portfolio 10 of 18Conservative Stock Portfolio N/A |