The stock market sank on Wednesday after the Bank of Canada unexpectedly raised interest rates in a long while. Such raised concern that the Federal Reserve might not be done on its tightening policy.

The stock market sank on Wednesday after the Bank of Canada unexpectedly raised interest rates in a long while. Such raised concern that the Federal Reserve might not be done on its tightening policy.

Overall, S&P 500 declined 0.4% to 4,268, while NASDAQ decreased 1.3% to 13,105.

Tweet of the Day

$SMCI Getting real tight after a massive bull snort, this is showing real strength. This stock is clearly under accumulation by institutions since April. Not your Aunt Edith buying, these are heavy institutional fingerprints. A stock that showed clear RS during bear and is… pic.twitter.com/MXX8nKxTRG

— StockChartArt (@CasualtyWar) June 7, 2023

Chart of the Day

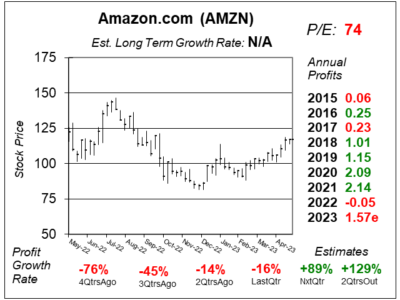

Here is the one-year chart of Amazon (AMZN) as of May 24, 2023, when the stock was at $117.

Here is the one-year chart of Amazon (AMZN) as of May 24, 2023, when the stock was at $117.

Amazon serves customers through its online and physical stores with a focus on selection, price, and convenience. The company with more than 1 million full-time and part-time employees work to deliver hundreds of millions of unique products that are sold by Amazon itself and third-party sellers.

Amazon’s has been a dog of a stock since January 2022. Along the way, its profits have gone away, bounced back, and now are expected to grow again. It seems to the Founder of The School of Hard Stocks, David Sharek, that the stock has turned the corner and is set to move higher. However, the valuation is still high, as AMZN’s P/E of 74 seems way too high.

Last qtr, the company delivered just 9% revenue growth, the same figure as 2QtrsAgo. Profit growth was -16% versus -14% 2QtrsAgo.

AMZN is on the radar for the Growth Portfolio.