The stock market closed higher on Thursday, as investors tried to shake off concerns over higher interest rates.

The stock market closed higher on Thursday, as investors tried to shake off concerns over higher interest rates.

Federal Reserve Bank of Atlanta President Raphael Bostic commented that the Federal Reserve may pause tightening by mid- to late summer. He also expressed that he is firmly in favor of 25 basis point rate hikes going forward.

Overall, S&P 500 was up 0.8% to 3,981, while NASDAQ increased 0.7% to 11,463.

Tweet of the Day

Yes, China Manufacturing PMI was the story yesterday, but looking under the hood things are improving across the globe.

13 out of 20 countries we track increased last month, with 9 out of 20 above 50 (vs. 7 last month).

Has manufacturing bottomed? Very well could have. pic.twitter.com/IA1ncYoAu1

— Ryan Detrick, CMT (@RyanDetrick) March 2, 2023

Chart of the Day

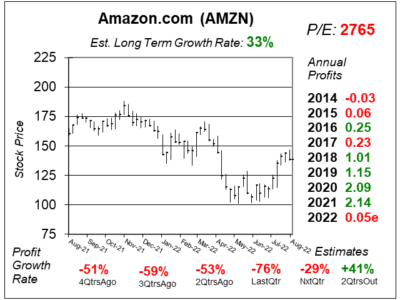

Here is the one-year chart of Amazon (AMZN) as of February 2, 2023, when the stock was at $96.

Here is the one-year chart of Amazon (AMZN) as of February 2, 2023, when the stock was at $96.

Amazon serves customers through its online and physical stores with a focus on selection, price, and convenience. The company with more than 1 million full-time and part-time employees work to deliver hundreds of millions of unique products that are sold by Amazon itself and third-party sellers.

Amazon’s growth is slowing big time. Last qtr, the company delivered only 9% revenue growth, versus 15% growth last qtr. Each of the company’s operating segments delivered slowing sales growth, with Amazon Web Services (AWS) recording its slowest growth ever (+20%). Profits were only seen in AWS, with North America retail and international retail losing money. The latter is a money losing operation (-$2.2 billion last qtr) that should be shut down.

David Sharek, Founder of School of Hard Stocks, have AMZN on the radar, as he thinks 2023 looks be a better year for the company.