Stock (Symbol) |

Amazon.com (AMZN) |

Stock Price |

$3148 |

Sector |

| Retail & Travel |

Data is as of |

| December 9, 2020 |

Expected to Report |

| January 28 |

Company Description |

Amazon.com, Inc. (Amazon.com) is an e-commerce company. The Company’s products are offered through consumer-facing Websites, which include merchandise and content that it purchases for resale from vendors and those offered by third-party sellers. It also manufactures and sells electronic devices, including Kindle e-readers, Fire tablets, Fire TVs, Echo and Fire phones. Amazon.com operates in two segments: North America and International. The North America segment focuses on retail sales earned through North America-focused Websites. It serves developers and enterprises through Amazon Web Services (AWS). It serves authors and independent publishers with Kindle Direct Publishing. Source: Thomson Financial Amazon.com, Inc. (Amazon.com) is an e-commerce company. The Company’s products are offered through consumer-facing Websites, which include merchandise and content that it purchases for resale from vendors and those offered by third-party sellers. It also manufactures and sells electronic devices, including Kindle e-readers, Fire tablets, Fire TVs, Echo and Fire phones. Amazon.com operates in two segments: North America and International. The North America segment focuses on retail sales earned through North America-focused Websites. It serves developers and enterprises through Amazon Web Services (AWS). It serves authors and independent publishers with Kindle Direct Publishing. Source: Thomson Financial |

Sharek’s Take |

Amazon’s (AMZN) stock has been flying under the radar lately as investors have plowed money into software stocks and ecommerce companies from other countries. But don’t sleep on shares of AMZN, as the stock might soon be on its way to $10,000 a share. Amazon’s (AMZN) stock has been flying under the radar lately as investors have plowed money into software stocks and ecommerce companies from other countries. But don’t sleep on shares of AMZN, as the stock might soon be on its way to $10,000 a share.

Business is booming at Amazon, as sales are expected to climb around 35% this year to $380 billion. And this growth spurt is expected to continue as the company plans to grow its fulfillment and logistics network square footage by approximately 50% this year (2020). Amazon has created over 400,000 jobs this year alone. Small and medium sized businesses which make up third-person sellers (also known as 3P sellers) represent 54% of the unit mix last qtr as more than half-a-million sellers are seeing record sales in Amazon stores this year. And grocery growth rates continue to accelerate. Amazon Fresh — the grocery store with no cashiers — will be a future catalyst for the company. Amazon opened its first large-scale Go Grocery in Seattle in February, and the company is looking to license its technology to other retailers. Here’s a peek at the new Amazon Fresh in Woodlands, California. Here’s company segment growth from last qtr:

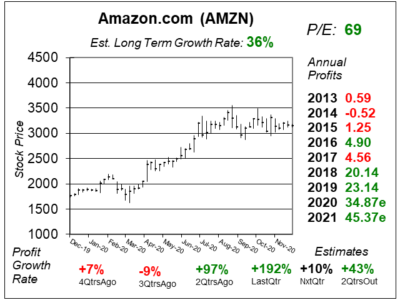

AMZN stock has an Estimated Long-Term Growth Rate of 36% per year, which is one of the highest of any growth stock regardless of size. And the profit picture backs up this estimated growth rate. Amazon’s profits are expected to climb from $23 last year to around $35 this year. Looking out to future years, analysts estimate profits going to (approximately) $45 in 2021, $65 in 2022, $90 in 2023 and $120 in 2024. That last figure is one hundred twenty dollars a share in profits just four years from now! A P/E of 84 on $120 in profits would get us to a $10,000 stock. Yes, that’s a high P/E, but AMZN currently sells for 90x 2020 profit estimates. Amazon is part of my Growth Portfolio and Aggressive Growth Portfolio. Today I will add the stock to the Conservative Growth Portfolio as the company has weathered the COVID-19 “recession” with great certainty and consistency. During these tough times, Amazon has “delivered”. The company is also evolving, and expanding into different industries. Thus, its hard for us to estimate what new catalysts Amazon might have three to five years from now — and what additional profits may come from it. |

One Year Chart |

I love the six-month base this stock has built. AMZN has completely fallen off the radar of hot-stock investors. That’s good, as it gives the stock a set of investors that could be looking to buy if there’s good news about Holiday sales (or profits). I love the six-month base this stock has built. AMZN has completely fallen off the radar of hot-stock investors. That’s good, as it gives the stock a set of investors that could be looking to buy if there’s good news about Holiday sales (or profits).

Profit growth has accelerated the last three qtrs from -9% to 97% and 192%. Whew! And although growth is expected to slow, the company whipped analyst estimates the past two qtrs. The P/E of 69 is very nice for a juggernaut like this. The P/E was 100 last qtr. One difference in the calculations is I’m using 2021 profit estimates this qtr. Last qtr I used 2020 estimates. As I mentioned above, the stock has a P/E of 90 based on 2020 profit estimates, but smart analysts think ahead to what’s around the corner — and that’s 2021. AMZN has an Estimated Long-Term Growth Rate of 36% which is amazing. The Est. LTG is a 3-5 year estimate analyst think profits will grow at (not the stock). |

Earnings Table |

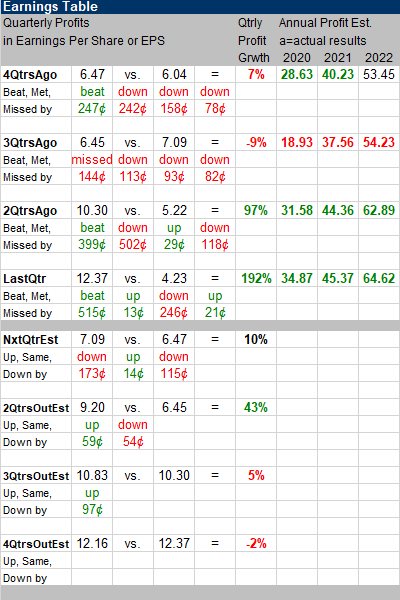

Last qtr, profits soared 192% and crushed estimates of 71%. But the company did have easy comparisons to the year-ago period when profit growth was -26%. Revenue increased 37%. Last qtr, profits soared 192% and crushed estimates of 71%. But the company did have easy comparisons to the year-ago period when profit growth was -26%. Revenue increased 37%.

Annual Profit Estimates continue to climb higher. Here are profit estimates for the current and coming years: Estimates are for 10%, 43%, 5% and -2% profit growth the next 4 qtrs. I think these figures are too low and AMZN will continue to beat the street. This qtr, revenue is expected to climb to $120 billion from $87 billion a year ago. You’re telling me sales are gonna climb 37% or so and profits are gonne grow just 10%? C’mon man! I think profit growth will be much higher than 10%. It’s Christmas season! During COVID! |

Fair Value |

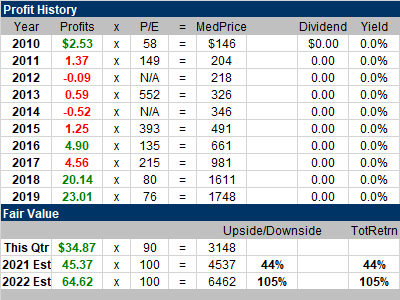

LAst qtr, my Fair Value P/E increased from 85 to 100 as this company is more dominant than ever and profits are expected to soar in the coming years. This qtr I keep my 100 multiple. LAst qtr, my Fair Value P/E increased from 85 to 100 as this company is more dominant than ever and profits are expected to soar in the coming years. This qtr I keep my 100 multiple.

AMZN stock has 44% upside to my 2021 Fair Value of $4537 a share. And I envision the stock doubling in value by 2022. So as investors search for (and invest in) what might be the future Amazon, they are overlooking the obvious. |

Bottom Line |

Amazon (AMZN) has been a terrific stock to own this past decade, as it grew 33% a year on average. But note profit growth was 30% a year during that time. Amazon (AMZN) has been a terrific stock to own this past decade, as it grew 33% a year on average. But note profit growth was 30% a year during that time.

In my book, profit growth leads to stock growth. And with analysts thinking profit will grow 36% a year during the next 3-5 years, this stock could follow suit. AMZN moves up from 5th to 1st in my Growth Portfolio and Aggressive Growth Portfolio Power Rankings. I will move Teslafrom #1 into the #5 spot, and use some proceeds from the sale of Tesla stock earlier this week to add to my AMZN position. I will add the stock to the Conservative Portfolio today and it will also rank #1 heading into Christmas. |

Power Rankings |

Growth Stock Portfolio

1 of 54Aggressive Growth Portfolio 1 of 22Conservative Stock Portfolio 1 of 35 |