Stock (Symbol) |

Amazon.com (AMZN) |

Stock Price |

$3391 |

Sector |

| Retail & Travel |

Data is as of |

| December 14, 2021 |

Expected to Report |

| January 31 |

Company Description |

Amazon.com, Inc. (Amazon.com) is an e-commerce company. The Company’s products are offered through consumer-facing Websites, which include merchandise and content that it purchases for resale from vendors and those offered by third-party sellers. It also manufactures and sells electronic devices, including Kindle e-readers, Fire tablets, Fire TVs, Echo and Fire phones. Amazon.com operates in two segments: North America and International. The North America segment focuses on retail sales earned through North America-focused Websites. It serves developers and enterprises through Amazon Web Services (AWS). It serves authors and independent publishers with Kindle Direct Publishing. Source: Thomson Financial Amazon.com, Inc. (Amazon.com) is an e-commerce company. The Company’s products are offered through consumer-facing Websites, which include merchandise and content that it purchases for resale from vendors and those offered by third-party sellers. It also manufactures and sells electronic devices, including Kindle e-readers, Fire tablets, Fire TVs, Echo and Fire phones. Amazon.com operates in two segments: North America and International. The North America segment focuses on retail sales earned through North America-focused Websites. It serves developers and enterprises through Amazon Web Services (AWS). It serves authors and independent publishers with Kindle Direct Publishing. Source: Thomson Financial |

Sharek’s Take |

Last qtr, Amazon (AMZN) missed profit estimates badly as added labor and raw material costs severely hurt profits. Overall, AMZN had -51% profit growth during the qtr even though revenue increased 15%. Due to labor shortages, cost increases in raw materials (such as steel) and services (such as trucking) the company’s operating costs skyrocketed by around $2 billion last qtr. For comparison, AMZN had $3 billion in net income last qtr versus $6 billion in the year-ago period. And expenses are expected to be even higher this qtr, as management incorporated nearly $4 billion in added costs to company guidance. Last qtr, Amazon (AMZN) missed profit estimates badly as added labor and raw material costs severely hurt profits. Overall, AMZN had -51% profit growth during the qtr even though revenue increased 15%. Due to labor shortages, cost increases in raw materials (such as steel) and services (such as trucking) the company’s operating costs skyrocketed by around $2 billion last qtr. For comparison, AMZN had $3 billion in net income last qtr versus $6 billion in the year-ago period. And expenses are expected to be even higher this qtr, as management incorporated nearly $4 billion in added costs to company guidance.

Founded in 1994, Amazon serves customers through its online and physical stores with a focus on selection, price, and convenience. The company with its 1.3 million full-time and part-time employees work to deliver hundreds of millions of unique products that are sold by Amazon itself and third party sellers. Amazon almost doubled its operating capacity since the start of the pandemic to satisfy increasing demand. Now, for the 1st time since the pandemic began the company isn’t constrained for physical space. During September alone, AMZN brought 100 new buildings online in the U.S. The growing demand is driven by Prime members who have increased their annual purchases and used their prime benefits extensively. Now, capacity constraints have been alleviated, but the company faces other challenges (labor shortages, higher steel costs, third-party trucking constraints). Amazon Web Services, AMZN’s cloud platform, was the company’s best operating segment last qtr, with a revenue growth of 39% year-over-year last qtr versus 10% growth in the North America retail sales and 16% growth in International sales.Here’s some other info about the company:

Amazon is sacrificing short-term profits to invest in the long-term well being of the company, thus profit estimates have declined. Last qtr, analysts felt AMZN would earn ~$53 in profits (EPS) in 2021. This qtr, they have estimates of ~$52 for 2022. So that’s a year’s worth of profit growth taken away! Still, the stock has a robust Estimated Long-Term Growth Rate of 36% per year, which is one of the highest amongst large enterprises. Amazon is part of my Conservative Growth Portfolio and Growth Portfolio. My analysis points to the stock being dead money in 2022. |

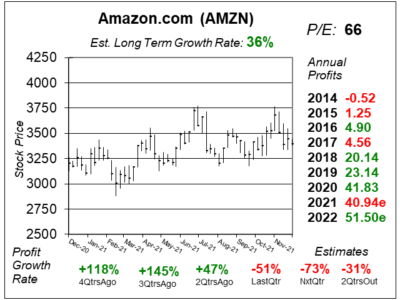

One Year Chart |

This stock has been flat for a year now,and that looks to continue as poor profit growth might keep the stock in check. AMZN has P/E of 66 when we look at 2022 profit estimates, and my Fair Value is a P/E of 65. Note, since we are in the company’s Q4, I’m calculating my P/E on 2022 estimates insead of 2021’s. This stock has been flat for a year now,and that looks to continue as poor profit growth might keep the stock in check. AMZN has P/E of 66 when we look at 2022 profit estimates, and my Fair Value is a P/E of 65. Note, since we are in the company’s Q4, I’m calculating my P/E on 2022 estimates insead of 2021’s.

AMZN has an Estimated Long-Term Growth Rate of 36% which is outstanding. This figure is unchanged since last qtr. Note Estimates show profit growth has slowed in a big way. |

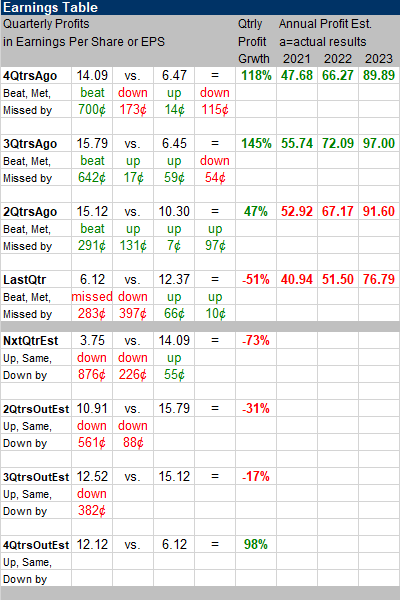

Earnings Table |

Last qtr, Amazon delivered -51% profit growth and missed estimates of -28%. Revenue increased 15% during the qtr, on top of 37% growth last year. Third-party sellers and products accounted for 56% of units sold. Last qtr, Amazon delivered -51% profit growth and missed estimates of -28%. Revenue increased 15% during the qtr, on top of 37% growth last year. Third-party sellers and products accounted for 56% of units sold.

Segment growth was:

Last qtr’s sales increase was driven by sustained strong usage and adoption for AWS as cloud provider for machine learning services, strong customer interest and adoption for Graviton2 processors, and strong vendor, seller, and authors adoption of Amazon Advertising. Revenue was adversely affected by shortage of available workers, wage increases, global supply chain challenges, and high shipping costs. Annual Profit Estimates declined this qtr. Here are profit estimates for the current and upcoming years: Qtrly profit Estimates are for -73%, -31%, -17%, and 98% profit growth the next 4 qtrs. For next qtr, management expects qtrly sales to grow around 4-12% with an additional $4 billion in operational costs due to labor and incentive costs, productivity losses, and raw material inflation. |

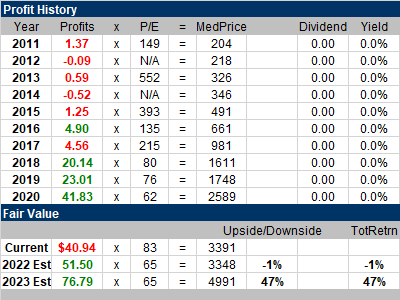

Fair Value |

The past four qtrs, this stock has had a P/E of 69, 63, 58, 60. This qtr, the P/E is 66 if we look at 2022 estimates (its 83 based on 2021 estimates, but we are two days away from 2022 so I’m now looking ahead to next year). My Fair Value P/E still stays at 65 this qtr. The past four qtrs, this stock has had a P/E of 69, 63, 58, 60. This qtr, the P/E is 66 if we look at 2022 estimates (its 83 based on 2021 estimates, but we are two days away from 2022 so I’m now looking ahead to next year). My Fair Value P/E still stays at 65 this qtr.

Last qtr, my 2022 Fair Value was 65 x $67.17 = $4366. This qtr, my Fair Value is 65 x $51.50 = $3348. These additional expenses have hurt the stock’s 2022 prospects. |

Bottom Line |

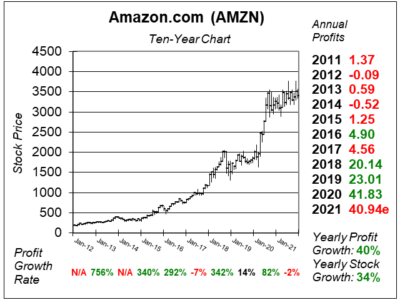

Amazon (AMZN) has been a terrific stock to own this past decade. Now the stock is basing, and that’s a good thing as its digesting some past gains. Amazon (AMZN) has been a terrific stock to own this past decade. Now the stock is basing, and that’s a good thing as its digesting some past gains.

Amazon has some tough quarters ahead, and that could keep the stock in this base during much of 2022. But with profits expected to soar from ~$40 to ~$150 by 2025, this is a great stock to buy-and-hold. AMZN stays at 19th in the Growth Portfolio Power Rankings. The stock moves from 6th to 8th in the Conservative Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

19 of 33Aggressive Growth Portfolio N/AConservative Stock Portfolio 8 of 37 |