My Top Ten Conservative Stocks for 2024 is a very diversified group. I have a healthcare stock, a few financials (that aren’t banks), a couple of food stocks, an industrial supply company. and even a couple tech stocks.

My Top Ten Conservative Stocks for 2024 is a very diversified group. I have a healthcare stock, a few financials (that aren’t banks), a couple of food stocks, an industrial supply company. and even a couple tech stocks.

These stocks have some of the best upside in my Conservative Growth Stock Portfolio, which provided my investors with a 19% return in 2023. Note past performance is not an indication of future gains.

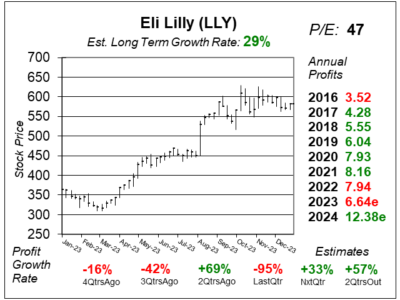

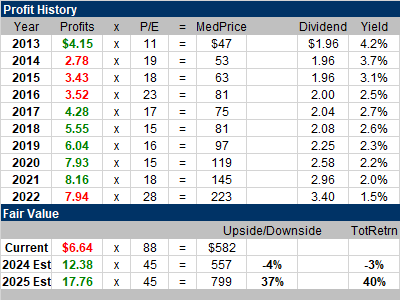

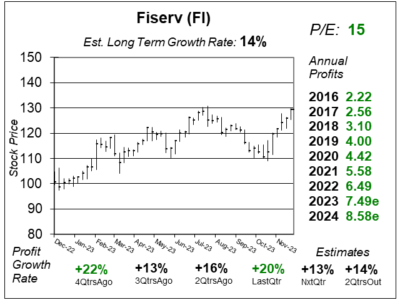

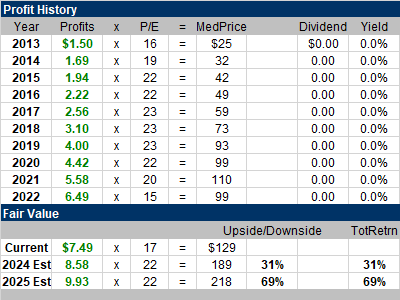

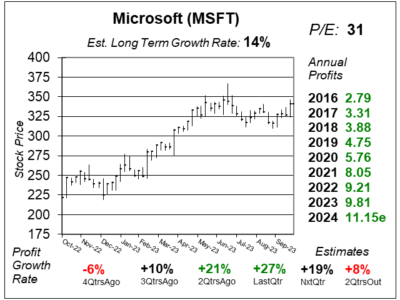

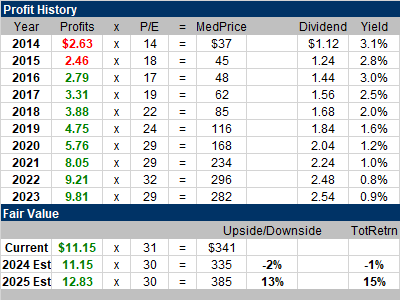

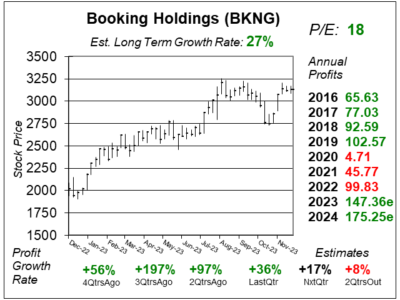

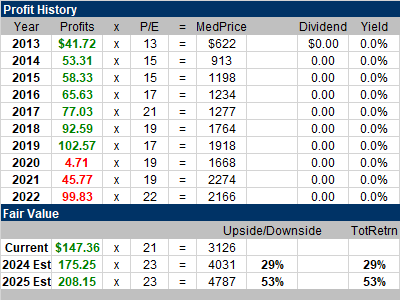

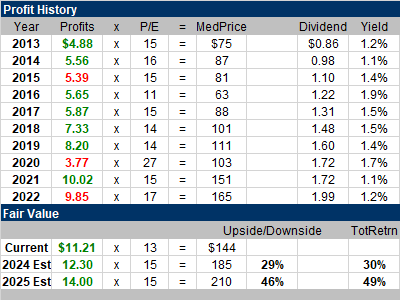

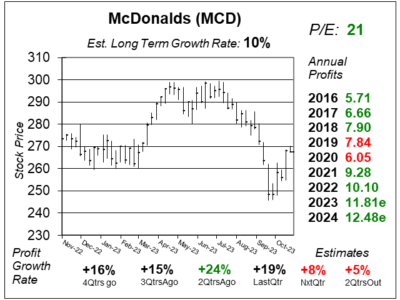

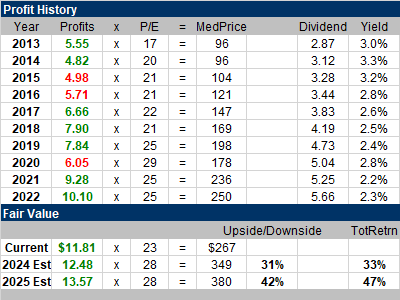

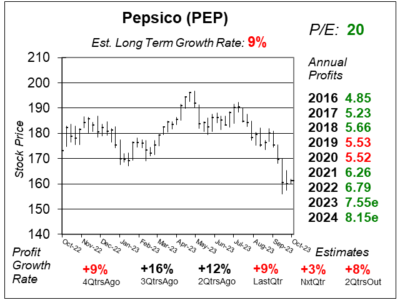

In the info below, these charts and tables were from our 2023 Q4 collection. We follow 75 to 100 stocks at a given time, and it takes us a full quarter to update each stock’s charts and then prepare research reports. So these stocks have moved in price since.

The charts are one-year charts, with quarterly profit growth along the bottom. The Estimated Long-Term Growth Rate is what analysts think profit can grow at during the next 3-5 years. But these may be unrealistic goals.

All stocks are owned in client accounts, which I manage (including family accounts).

So without further adieu, here’s my Top Ten Conservative Growth Stocks for 2024:

Eli Lilly (LLY) has a new blockbuster drug with its diabetes drug Mounjaro. Now the drug has been approved by the FDA for weight loss under the name Zepbound, and is now available.

Eli Lilly (LLY) has a new blockbuster drug with its diabetes drug Mounjaro. Now the drug has been approved by the FDA for weight loss under the name Zepbound, and is now available.

The medication behind both drugs, Tirzepatide, has proven effective not just for treating type 2 diabetes but also for helping non-diabetic patients lose a remarkable 22.5% of their body weight in 72 weeks.

What’s great is now insurance companies will be more likely to cover these drugs under insurance.

Together, Mounjaro and Zepbound have the potential to do $30 billion in sales in 2028 (source: IBD). In comparison, LLY is expected to do $34 billion in sales throughout all of 2023.

My Fair Value P/E is 45, which works out to $557 for 2024. With the stock at $582 this quarter, it seems slightly overvalued. 2025 Fair Value is $799 a share, equating to 37% upside. But I’m not confident in this assessment. A 45 P/E is high for a drug company.

Fiserv (FI) software controls ATM transactions, money transfers, and mobile banking to more than 13,000 banks and credit unions around the world.

The company Fiserv also owns Clover, a full point-of-sale system for merchants to ring up sales, take payments on point-of-sale devices, and keep track of numbers.

FI is a high quality stock that has delivered double-digit profit growth every year since 1986. That’s 37 years of profit growth 10% or higher! Remarkable.

Since the company went public in 1986, the stock’s gone from $0.28 to $125. Management does not pay a dividend, but instead buys back stock.

With a P/E of 15, the stock seems like a bargain even as it’s around All-Time highs. I think FI has close to 70% upside over the next 24 months.

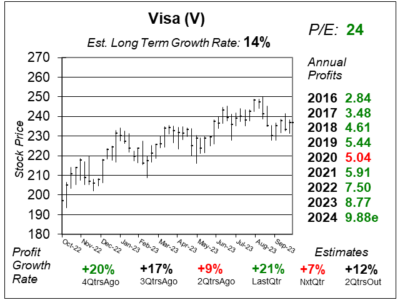

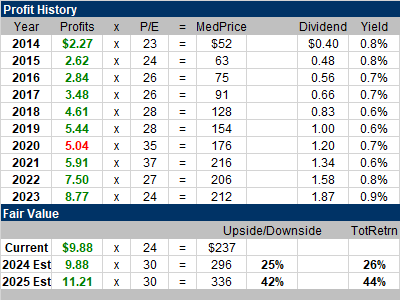

Visa (V) Visa (V) delivered solid results last qtr. Profit grew 21% year-over-year on revenue growth of 11%, with both beating analyst estimates.

Visa (V) Visa (V) delivered solid results last qtr. Profit grew 21% year-over-year on revenue growth of 11%, with both beating analyst estimates.

In terms of the economy moving forward, some investors are concerned we will enter a recession in 2024 Q1. But Visa management stated consumer spend has remained stable since last March.

And payment volume growth actually ticked up from July to September with help from higher gas prices.

V has been a great stock for conservative investors — and growth investors too. The stock has an excellent safety rating, an Estimated Long-Term Growth Rate of 14%, a dividend yield of less than 1%, and a stock buyback program.

The stock currently has a P/E of 24. I feel the P/E should be 30. My Fair Value for 2024 is $296 a share, or around 25% upside for this year.

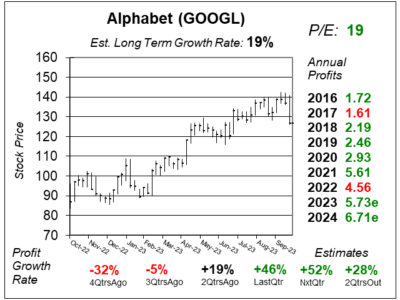

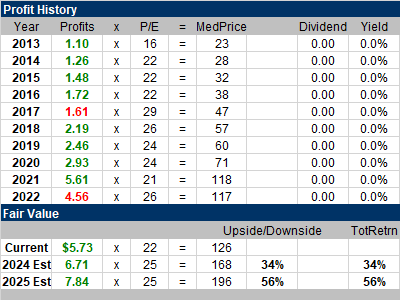

Alphabet (GOOGL) enjoyed an advertising rebound last qtr, and that could be a sign that overall ad spending will pick up in 2024.

Alphabet (GOOGL) enjoyed an advertising rebound last qtr, and that could be a sign that overall ad spending will pick up in 2024.

Google Search, which is the company’s largest segment making up 57% of its revenues, delivered 11% revenue growth versus 5% 2QtrsAgo. That’s great!

During the past four quarters, growth in Search has been accelerating, from -2% to +2%, +5% and now +11%.

AI is driving growth in search through solutions like Performance Max campaigns, which combines Google AI technologies for performance-based advertisers.

My Fair Value P/E is 25. I believe this stock has 34% upside for 2024.

Microsoft (MSFT) delivered strong gains across multiple businesses, particularly Azure.

Microsoft (MSFT) delivered strong gains across multiple businesses, particularly Azure.

Azure is MSFT’s public cloud platform that lets users manage cloud services such as storing data and transforming it.

Last quarter, MSFT’s profit grew 27% and crushed estimates of 13%. Revenue grew 13% and handily beat estimates of just 9%.

Azure took center stage with 29% revenue growth with a decent contribution from AI services as Microsoft announced general availability of its NVIDIA H100 virtual machines just last quarter.

With the stock around $341 and my Fair Value at $335 I don’t see much upside here. But this last report was so impressive, the stock might be worthy of a 35 P/E. A 35 P/E would be a $390 stock (if estimates remain stable).

Booking (BKNG) is the world leader in online travel and related services.

Booking (BKNG) is the world leader in online travel and related services.

One of the best Internet acquisitions ever was when Priceline (PCLN) acquired Bookings BV in 2005, which got PCLN a piece of the underdeveloped European online travel industry.

BKNG went on to become a catalyst in two years, from 2005 Q3 to 2007 Q3 as domestic qtrly bookings grew from $378 million to $602 million (+59%), while International revenue ballooned from $156 million to $758 million (+380%).

My Fair Value on BKNG is $4031 for 2024. I originally purched the stock on May 2006 at $29, sold in March 2009 at $83 and jumped back in May 2009 at $105. I’ve held it for clients since.

American Express (AXP) is delivering excellent results, with profits up 34% last quarter on 13% revenue growth.

American Express (AXP) is delivering excellent results, with profits up 34% last quarter on 13% revenue growth.

What makes American Express special is its Membership Rewards program, which include benefits such as airport lounge access, dining experiences, and other travel benefits.

Millennial and Gen Z customers are catalysts for the company as they spent 18% more than a year ago and accounted for 60% of new accounts.

My Fair Value is a P/E of 15, and if we use 2024 profit estimates, that equates to a $185 stock, which is around 30% higher than the recent quote (November 1, 2023).

McDonald’s (MCD) posted impressive results last quarter with profits up 19% on 14% revenue growth.

Sales increased 11% while same store sales jumped 9%. Same store sales increased 11% a year ago, so last quarter’s feat was impressive.

McDonald’s is the world’s leading global food service retailer with over 40,000 locations in over 100 countries.

In a typical franchise arrangement, McDonald’s owns the real estate, long-term lease on the land, and building with the franchisee paying for equipment, signs, seating, and decor. Currently, franchised restaurants represent 95% of McDonald’s restaurants worldwide.

My Fair Value is a PE of 28. With MCD having a 21 P/E now, the stock has 31% upside to 2024’s Fair Value of $349.

This stock is rarely “on sale”. It recently dipped when Blue Chip conservative stocks sold off in late 2023.

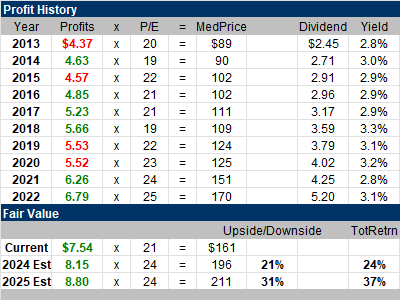

Founded in 1919, Pepsico (PEP) is one of the world’s largest food and beverage companies with more than $70 billion in annual sales.

PepsiCo’s great worldwide brands include Pepsi, Frito-Lay, Tropicana, Quaker, and Gatorade, with each generating more than $1 billion in annual sales. The company also has a large investment in Celsius Energy drink.

The stock recently fell on concerns weight loss drugs like Eli Lilly’s Mounjaro will curb people’s appetite for drinks & snacks. PEP management says the effect has been neglegible so far.

Notice this stock had a 24/25 P/E the past two years. Last qtr it was a deal with a P/E of 21, My 2024 Fair Value is $196.

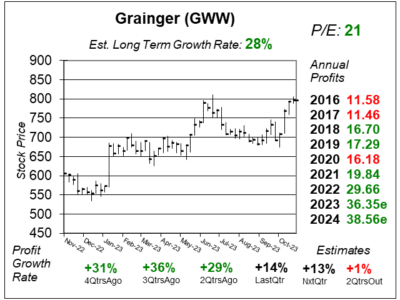

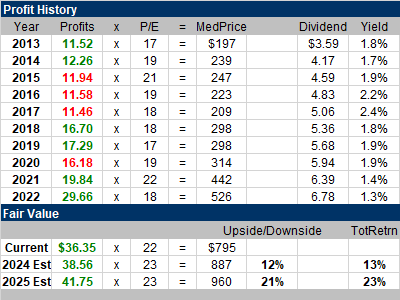

Grainger (GWW) is is the leading supplier of maintenance supplies in North America, Japan and the United Kingdom.

The company stocks more than 1.5 million products from more than 4,500 suppliers.

Customers include manufacturing plants, retail distribution centers, hospitals and governments.

The company has adapted its strategy the last several years to implement new technology and data analytics. This has been a real catalyst for profits the past three years.

My Fair Value on this stock is a P/E of 23, which suggests 12% upside for 2024.