Microsoft (MSFT) Stock Climbs Higher as Profit Growth Remains Strong

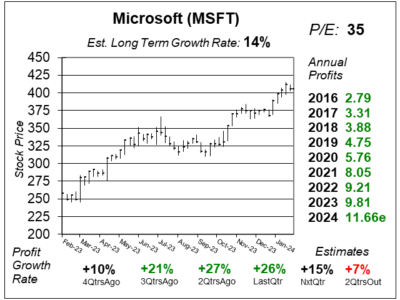

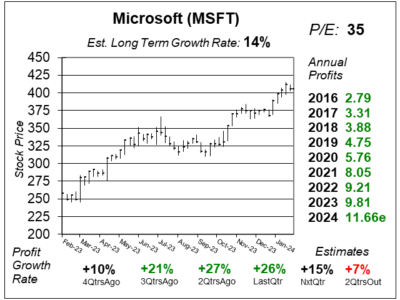

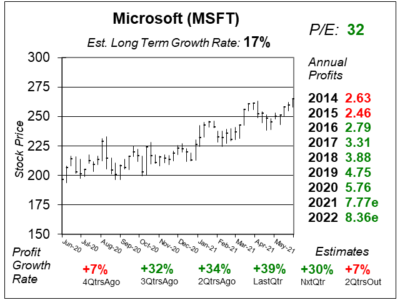

Microsoft (MSFT) continues to climb higher as profits grow 20%-plus a quarter. But does the stock have the power to go higher?

Microsoft (MSFT) continues to climb higher as profits grow 20%-plus a quarter. But does the stock have the power to go higher?

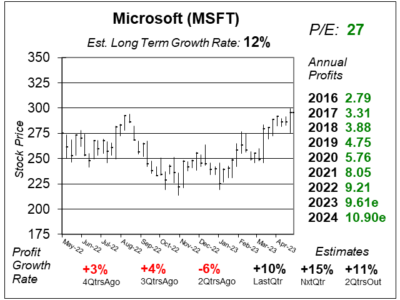

Microsoft (MSFT) delivered an excellent earnings report as profits (+27%) and revenue (+13) both exceeded analyst estimates.

Microsoft (MSFT) continues to gain new customers for its AI products, which look to be causing profit growth to accelerate.

Microsoft’s parternship with OpenAI is combining Azure, Bing, and Office with with ChatGPT, giving MSFT growth opporunity ahead.

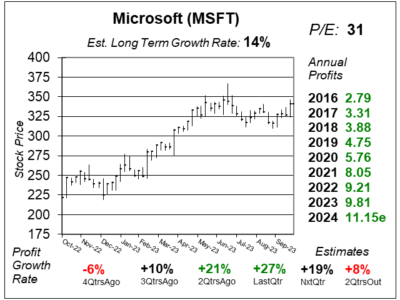

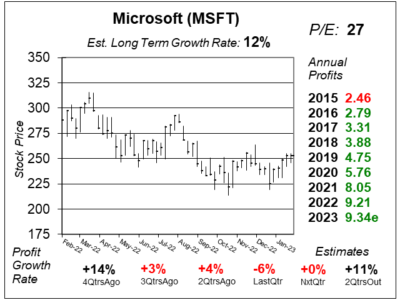

Microsoft (MSFT) got a lot of hype this week for using ChatGPT in Bing, taking attention away from company’s poor fundamentals.

Microsoft (MSFT) is getting hurt by a strong USD (which took sales growth from 16% to 11%) and weak Windows sales post-COVID.

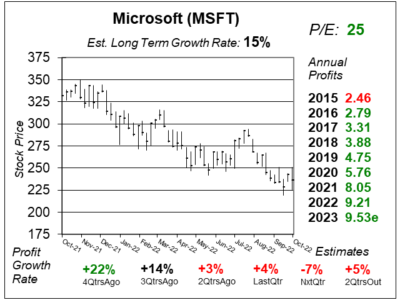

Microsoft (MSFT) is feeling the recession pinch in reduced ad revenue and slow PC sales. But Cloud revenue rose a solid 20% last qtr.

Microsoft’ (MSFT) differentiated businesses (PC software, LinkedIn, Video games, cloud storage) can keep growth chugging along.

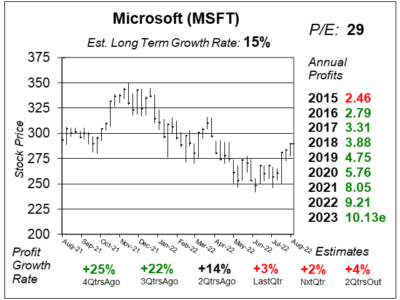

Microsft (MSFT) helped turn the Bear Market into a Bull Market when it released its earnings as the Cloud division shined.

Microsoft’s (MSFT) Intelligent Cloud lead the way in company sales growth last qtr, driven by Azure and other cloud services.

Big companies are utilizing Microsoft (MSFT) products more now than they ever have, especially Microsoft 365 and Azure.

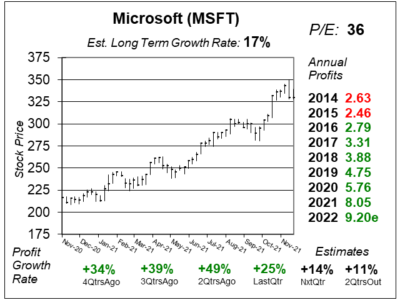

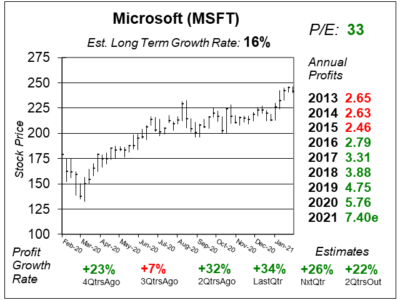

Microsoft (MSFT) delivered profit growth greater than 30% the past three qtrs, and Cloud computing is leading the way.

Microsoft (MSFT) had a spended qtr with 34% profit growth as the company is benefiting from digital transformation.

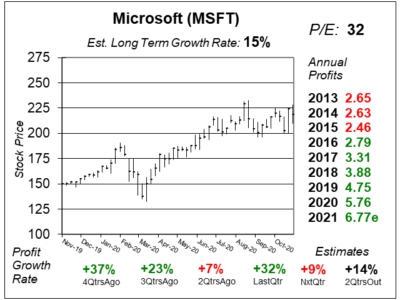

Microsoft (MSFT) is feeling the positive affects of this new economy as profits jumped 32% last qtr.

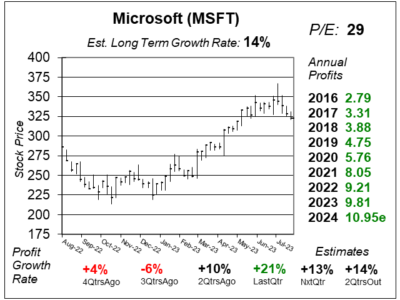

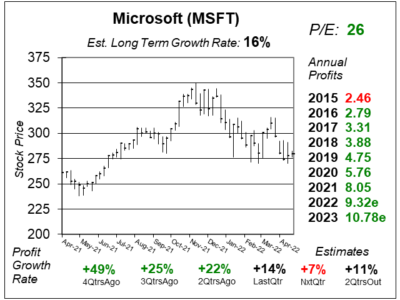

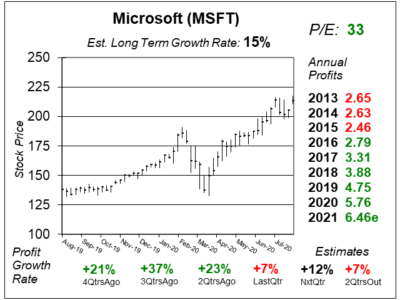

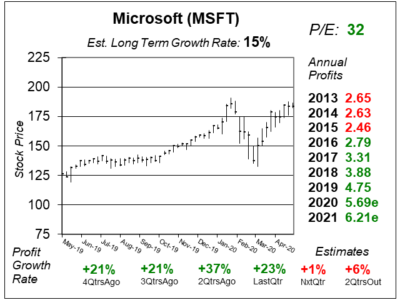

Microsoft (MSFT) just had qtrly profit growth slow from 37% to 23% and now 7%. That’s bad. Is this time to sell the stock?

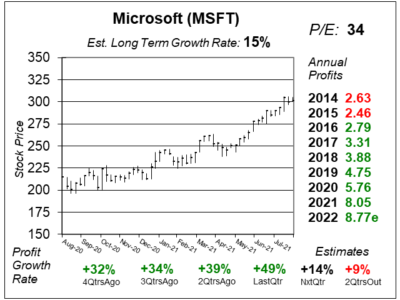

Microsoft (MSFT) saw two years of digital transformation take place the in two months. That’s good news for MSFT stock.

Microsoft (MSFT) is tearing-it-up as profits jumped 37% last qtr. Wow, that’s profit growth like it had in the 1990’s.

Microsoft (MSFT) was a fantastic stock from its IPO until 2000. Then it was dead money. Now MSFT is back baby!

Microsoft (MSFT) is in the sweet spot of software with a balanced attack including Office 365, LinkedIn, and Xbox gaming,

Microsoft (MSFT) speaks softly by giving us beatable expectations. Then the company carries a big stock that’s up 31% this year.

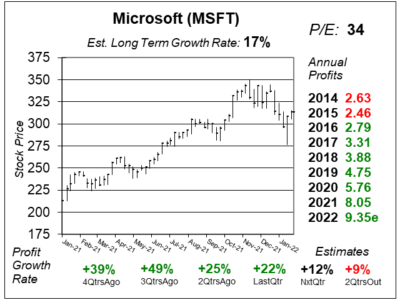

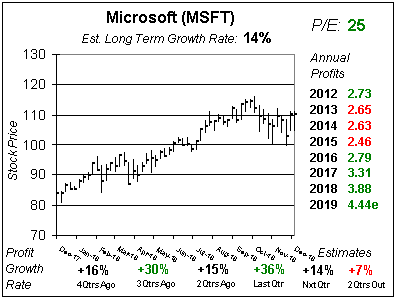

Microsoft’s (MSFT) profit growth just slowed from 36% to 15% and estimates are for 5% growth next qtr. Here’s Sharek’s updated take on MSFT.

Microsoft (MSFT) is doing great, and with Apple’s struggles, MSFT now replaces AAPL as a top tech stock to own.

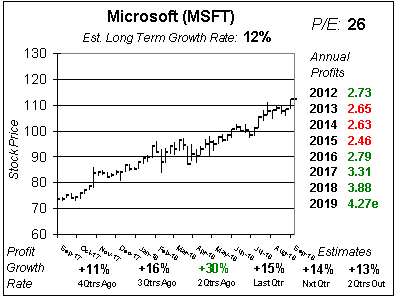

Microsoft’s (MSFT)continues to grow faster than analysts expect, so my “analysis” has to include how much the company might make.

Microsoft (MSFT) is tricking its investors, But it’s ok, it’s in a good way. Management has been underpromising (+4% EPS growth) and overdelivering (+19% instead) for two years.

Last qtr, Microsoft (MSFT) had 56% sales growth in its commercial cloud division. Wow. No wonder the stock is up 50% in a year. LinkedIn has also played a part in sales/profit growth.

Investors were all giddy about Microsoft’s (MSFT) latest qtr, as sales jumped 12%. But without the help of LinkedIn, sales would have increased just 7%.

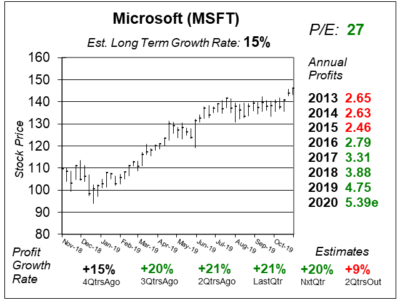

Microsoft’s (MSFT) up around 25% during the last year — as profits rose 19% on a 5% gain in sales. But with a P/E if 22 and profits set to decline, MSFT could take a breather.

A more modern Microsoft (MSFT) is getting the attention of investors as the company is riding the success of cloud computing, Office products and video games.

I’m not as impressed with Microsoft (MSFT) as other investors are, and feel the recent run-up is because of the stock market’s rally.

Microsoft (MSFT) has done a valiant job of transforming itself into a company which profits in the New Economy. Let’s look at MSFT stock.

Microsoft (MSFT) put out 15% profit growth last qtr and also acquired LinkedIn. But what guys like me really want is consistent double-digit growth.

Just as I thought Microsoft (MSFT) was gonna grow again, the company pooped out a poor qtr and it’s back to the drawing board.

Microsoft (MSFT) is back, as Office 365, Surface and Azure lead the company into a new frontier of computing.

Want to know why the Dow was down 300 yesterday? Look at how high Microsoft (MSFT) is.

Microsoft (MSFT) is transitioning itself from software to the cloud, but doesn’t disclose pertinent figures.

Microsoft’s (MSFT) got a new CEO. Here’s what the guy has to work with, I mean deal with.

Microsoft (MSFT) is at its highs, and I don’t see why. This just isn’t a good buy.

Late last year/early this year, Microsoft (MSFT) was $27 and worth $31. Now the stock’s $32. The run is done. The move is over.

Microsoft (MSFT) is expected to report qtrly profits (EPS) and revenues:

Profits Estimates: $2.82 vs. $2.45 = +15%

Revenue Est: +15%