Visa (V) Management Sees Enormous Opportunity in Consumer Payments

Visa (V) has been a steady grower sine its IPO in 2008. Now the company sees enormous opportunity in consumer payments.

Visa (V) has been a steady grower sine its IPO in 2008. Now the company sees enormous opportunity in consumer payments.

Visa (V) is growing good with stable growth in payments volume and processed transactions. Plus, its stock seems undervalued.

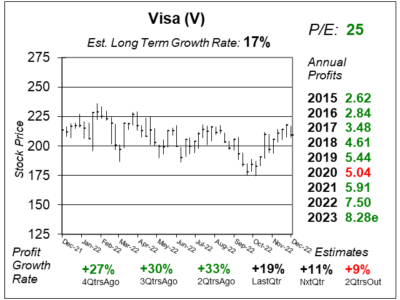

Visa (V) management stated business ticket up from July to September, which should put the question about a recession to rest.

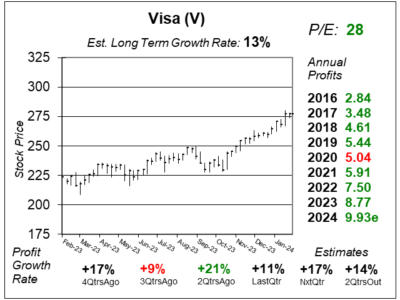

Visa’s (V) stock seems undervalued by 32% when I look out to 2024 (which is just one quarter away). Here’s my analysis as to why:

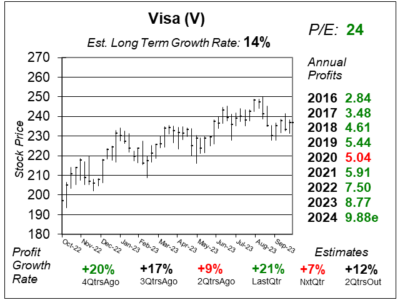

Visa (V) has proven to be a safe investment through the Banking crisis as cross-border travel remains strong, with Asia as a driver,

Visa Direct allows users to transfer money globally, and is becoming a new source of revenue growth for Visa (V) the company.

Visa (V) continues to see cross-border travel returning to normal after COVID, and China reopening could be a catalyst in 2023.

s

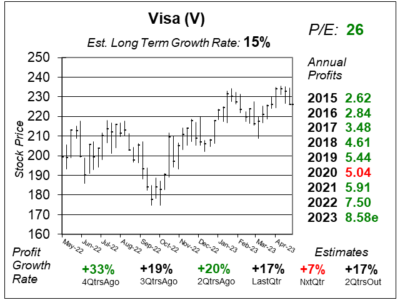

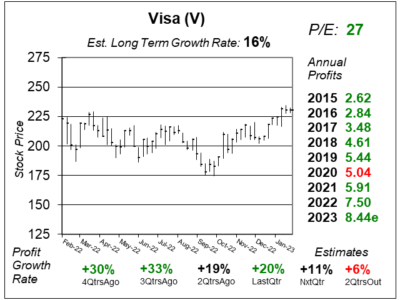

Visa (V) delivered excellent results last qtr as profits jumped 33% on 19% revenue growth as the afluent is spending on travel.

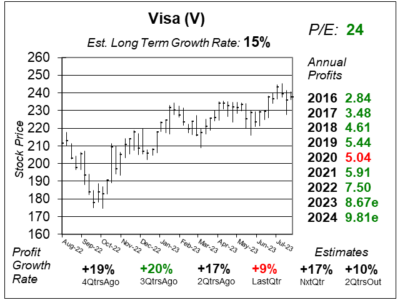

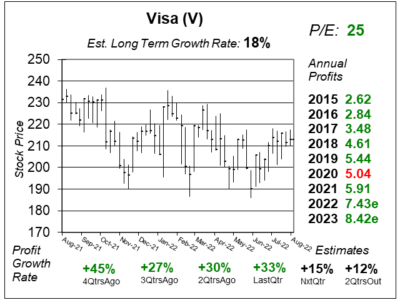

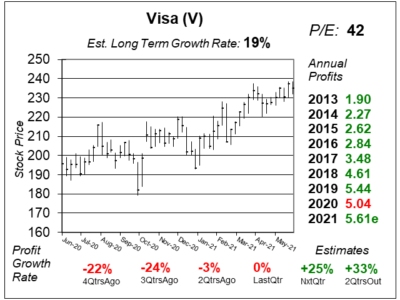

Visa (V) is set the benefit from the Summer travel season. That is unless a recession causes people to skip vacations this year.

Visa (V) is expanding its International transfer abilities, and that could mean bad news for dLocal, Global-E and Marqueta.

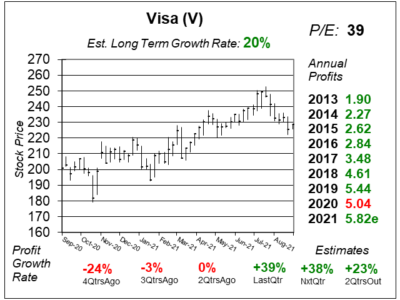

Visa (V) had a 38% increase in cross-border volume, lead by re-opening of borders for travelers around the world.

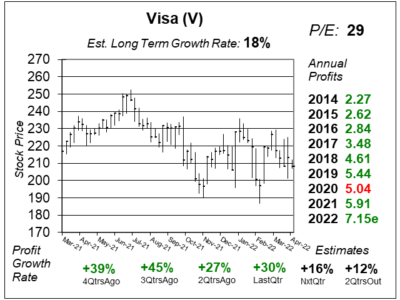

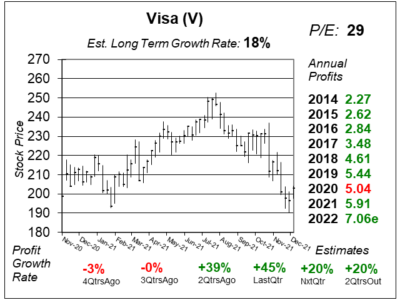

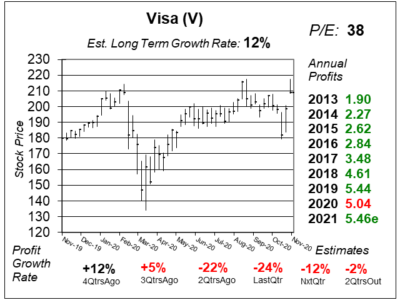

Visa (V) is back to growing profits again, but limited travel is still hampering results. Prepare for a return to traveling in 2022.

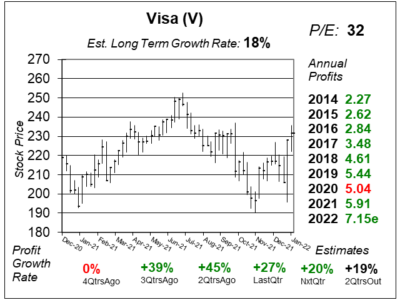

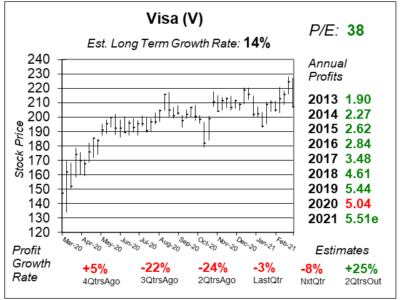

Visa’s (V) profits are expected to climb 25%, 33%, 20% and 24% the next 4 qtrs. Could the stock climb 25% as well?

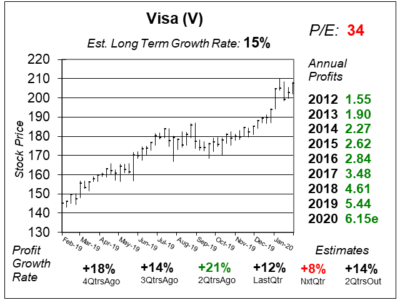

Visa (V) has been a hot stock recently as the shares hit an All-Time high this month. But with a P/E of 38, V seems expensive.

Visa (V) has had its profits hit hard due to COVID-19 travel restrictions. Which makes the stock a good play post-COVID.

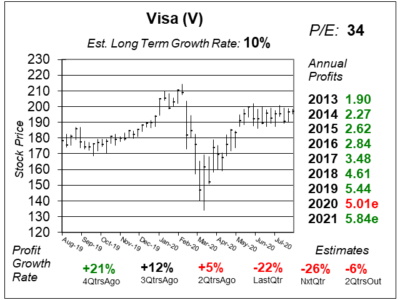

Visa (V) had a poor qtr as travel, entertainment, fuel and restaurants had spending decline more than 50% last qtr.

Closed restaurants and less travel are hurting Visa (V), but open “essential” retail stores are helping. Let’s look at the profits.

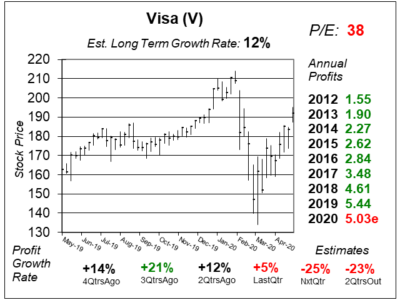

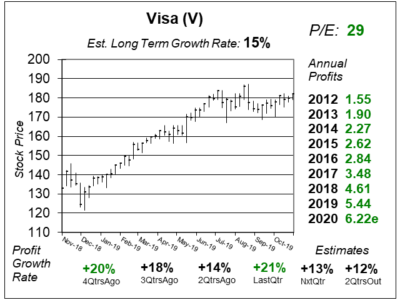

Visa (V) just delivered 12% profit growth, versus 21% a qtr earlier. This is now one of the slowest-growing FinTech stocks.

Visa (V) management expects mid-teens profit growth in Fiscal 2020, which might mean 20% growth is on the horizon.

Visa (V) is a model of certainty, consistency and growth opportunity. The stock is a good fit for a number of different investors.

Visa (V) is at All-Time highs as the company is now a money mover via Visa Direct, which lets people transfer money.

After a brief decline during the 2018 Q4 Bear Market, Visa (V) is back on track as the stock has rallied to All-Time highs this year.

Visa (V) could prove to be a safe haven for investors looking for a safe stock that has the ability to grow greater than 15% per year.

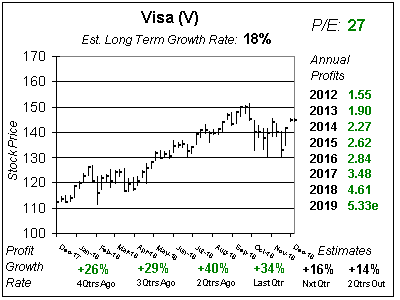

Visa (V) is growing strong this year (profits rose 40% last qr). The stock looks great. But will a rising USD hurt profits going forward?

Since going public back in 2008, VIsa (V) has really been a perfect stock. Profits have grown each year as revenues climbed steadily. But if you’re looking for a discount forget it.

Tax reform took Visa’s (V) profit growth from 17% to 26% last qtr as payment volume growth increased a solid 10%. But has V stock gone too high?

Visa (V) had a nice run of 20% plus profit growth as it benefited from the Visa Europe acquisition. But now the deal is more than a year old, and growth is back to normal.

Visa (V) has been flying high as it reaps benefits from its purchase of Visa Europe and its deal with Costco. But those happened almost a year ago. Growth could slow.

Visa (V) is flying high due to a number of catalysts, including Visa Europe, Costco, and global economic growth. Let’s review V’s latest qtrly results.

Visa Europe has kicked Visa’s (V) profit growth up a notch. For two straight qtrs, the company has beaten the street as profit growth has surged to 25%.

Shares of VIsa (V) are almost always overvalued — and justifiably so. But now for the first time in a long time V is a good value.

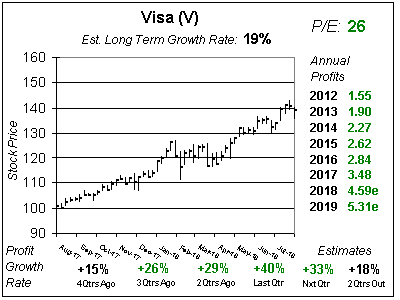

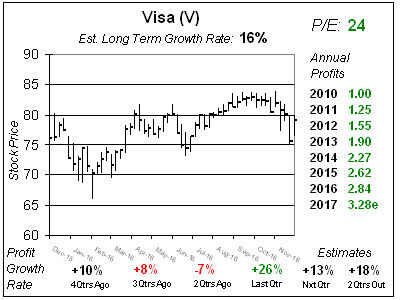

Visa’s (V) profit growth has been slow this year, but that looks to change as profits are expected to climb 18% on average the next 4 qtrs.

Shares of Visa were a better value years ago when profits were growing faster. But better growth may be on its way.

Headwinds such as the strong US dollar, reduced International volume from a strong dollar, China, and low oil prices are muting Visa’s (V) growth today.

Investors are in need of stocks they can count on, and Visa (V) fits the bill.

Visa (V) is everything you want in a stock: a stable growing business with consistent profit growth, a dividend, stock buybacks and safety.

Today I will use the market weakness to pick up three core holdings at a discounted price.

Shares of Visa (V) haven’t moved all year — and deservedly so. In fact, V could be lower a year from now.

Here’s a quick look at what Visa (V) looks like before V reports earnings tomorrow after the close.

I sold Visa (V) at $68 in 2009. This qtr V is $222. Each qtr I want to get back in, but I want a better value.

I think investors should wait to get into shares of Visa (V) as there’s not much upside to V’s Fair Value at the current price.

Visa (V) is a solid 20% grower, but is fairly valued here. I’m waiting (hoping) for a dip. Visa responds by saying when you’re ready, come and get it.

Visa (V) has a strong, steady business. V is now fairly valued at around $185 (24 times profits). $165 is my wish price.