Stock (Symbol) |

Visa (V) |

Stock Price |

$139 |

Sector |

| Financial |

Data is as of |

| August 3, 2018 |

Expected to Report |

| Oct 23 |

Company Description |

Visa Inc. is a payments technology company. The Company is engaged in operating a processing network, VisaNet, which facilitates authorization, clearing and settlement of payment transactions across the world. The Company provides its services to consumers, businesses, financial institutions and governments in more than 200 countries and territories for electronic payments. Source: Thomson Financial Visa Inc. is a payments technology company. The Company is engaged in operating a processing network, VisaNet, which facilitates authorization, clearing and settlement of payment transactions across the world. The Company provides its services to consumers, businesses, financial institutions and governments in more than 200 countries and territories for electronic payments. Source: Thomson Financial |

Sharek’s Take |

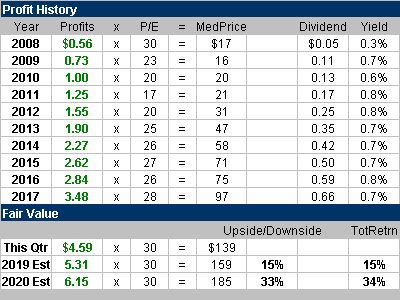

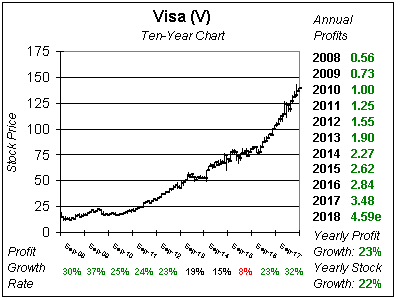

Visa (V) is on a roll, but the rising US Dollar could crimp profits. The company is growing smoothly, with sales up 14% last qtr and payment volume up 11%. Volume was strong in all geographies. The global opportunity to digitize cash and check is enormous — Visa CEO in an earnings call 7 qtrs ago. Visa is in my eyes a high-teens grower profit wise. The company had to deal with a strong U.S. dollar a two-to-three years ago, and this took profit growth down from 19% in 2014 to just 8% in 2016. Last year the USD was lower and the company had easy comparisons to the year-ago period, thus profits grew 23%. This year growth is strong, as analysts predict 32% profit growth, but part of that is due to a lower tax rate. In 2019 growth is expected to slow back to 16%, and since V usually beats the street, perhaps 18% growth can be had — but that depends on the USD staying consistent. Visa is a very safe stock that’s a core holding for both growth and conservative investors. With an Est. LTG of 20% plus a 1% yield this one of the best stocks for investors looking for growth and stability. Management spends money on stock buybacks in addition to paying a dividend. The yield is just under 1%. Visa has its fiscal year-end on September 30th, and since that’s right around the corner I’m now looking ahead to 2019. My Fair Value for 2019 is $159 a share, which is a P/E of 30. With the stock at $139 that leaves 15% upside (plus dividends) for the coming year. I own Visa in the Growth Portfolio and Conservative Growth Portfolio. It’s a safe, solid buy-and-hold stock. Visa (V) is on a roll, but the rising US Dollar could crimp profits. The company is growing smoothly, with sales up 14% last qtr and payment volume up 11%. Volume was strong in all geographies. The global opportunity to digitize cash and check is enormous — Visa CEO in an earnings call 7 qtrs ago. Visa is in my eyes a high-teens grower profit wise. The company had to deal with a strong U.S. dollar a two-to-three years ago, and this took profit growth down from 19% in 2014 to just 8% in 2016. Last year the USD was lower and the company had easy comparisons to the year-ago period, thus profits grew 23%. This year growth is strong, as analysts predict 32% profit growth, but part of that is due to a lower tax rate. In 2019 growth is expected to slow back to 16%, and since V usually beats the street, perhaps 18% growth can be had — but that depends on the USD staying consistent. Visa is a very safe stock that’s a core holding for both growth and conservative investors. With an Est. LTG of 20% plus a 1% yield this one of the best stocks for investors looking for growth and stability. Management spends money on stock buybacks in addition to paying a dividend. The yield is just under 1%. Visa has its fiscal year-end on September 30th, and since that’s right around the corner I’m now looking ahead to 2019. My Fair Value for 2019 is $159 a share, which is a P/E of 30. With the stock at $139 that leaves 15% upside (plus dividends) for the coming year. I own Visa in the Growth Portfolio and Conservative Growth Portfolio. It’s a safe, solid buy-and-hold stock. |

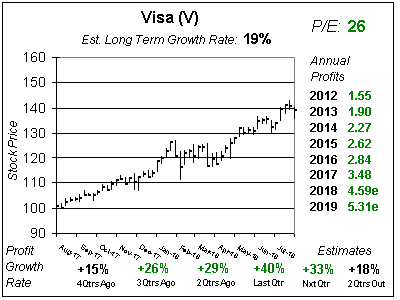

One Year Chart |

Profits increased a solid 40% last qtr, and whipped estimates of 27%. Management spent $2.2 billion on share repurchases and dividends, and the buybacks helped boost profits. Afterwards, 2018 estimates increased 9 cents, but Visa beat by 11 cents. I think that’s the strong dollar trying to peep its head. Qtrly Estimates are for 33%, 18%, 15% and 11% profit growth the next 4 qtrs. Growth is expected to slow back into the teens, which is another reason why I didn’t bump my Fair Value P/E to 30. Nice Est. LTG of 19% per year, and The P/E of 26 is lower than the 29 P/E last qtr (but I’m now looking ahead to 2019 est instead of 2018’s. Profits increased a solid 40% last qtr, and whipped estimates of 27%. Management spent $2.2 billion on share repurchases and dividends, and the buybacks helped boost profits. Afterwards, 2018 estimates increased 9 cents, but Visa beat by 11 cents. I think that’s the strong dollar trying to peep its head. Qtrly Estimates are for 33%, 18%, 15% and 11% profit growth the next 4 qtrs. Growth is expected to slow back into the teens, which is another reason why I didn’t bump my Fair Value P/E to 30. Nice Est. LTG of 19% per year, and The P/E of 26 is lower than the 29 P/E last qtr (but I’m now looking ahead to 2019 est instead of 2018’s. |

Fair Value |

My Fair Value on Visa is a P/E of 28 and that gives the stock modest upside for the next 12 months. And although the company has been upping estimates, that could go the other way next qtr. My Fair Value on Visa is a P/E of 28 and that gives the stock modest upside for the next 12 months. And although the company has been upping estimates, that could go the other way next qtr. |

Bottom Line |

Visa is a stock that offers a lot to both conservative and growth oriented investors with an Est. LTG of 19% per year in addition to a 1% yield. This is a safe and sound company that continues to grow sales qtr after qtr. The stock has been pretty much perfect in my opinion. V ranks 8th in the Conservative Portfolio Power Rankings and 29th in the Growth Portfolio Power Rankings and . Visa is a stock that offers a lot to both conservative and growth oriented investors with an Est. LTG of 19% per year in addition to a 1% yield. This is a safe and sound company that continues to grow sales qtr after qtr. The stock has been pretty much perfect in my opinion. V ranks 8th in the Conservative Portfolio Power Rankings and 29th in the Growth Portfolio Power Rankings and . |

Power Rankings |

Growth Stock Portfolio

29 of 40Aggressive Growth Portfolio N/AConservative Stock Portfolio 8 of 35 |