Stock (Symbol) |

Visa (V) |

Stock Price |

$238 |

Sector |

| Financial |

Data is as of |

| August 2, 2023 |

Expected to Report |

| October 23 |

Company Description |

Visa is a payments technology company that provides digital payments across more than 200 countries and territories. Visa is a payments technology company that provides digital payments across more than 200 countries and territories.

The Company connects consumers, merchants, financial institutions, businesses, strategic partners and government entities to electronic payments. The Company’s transaction processing network, VisaNet, facilitates authorization, clearing and settlement of payment transactions and enables to provide its financial institution and merchant clients a range of products, platforms and value-added services. Its products/services include transaction processing services and Visa-branded payment products. The Company also offers Tink, an open banking platform that enables financial institutions, fintech and merchants to build financial products and services and move money. Tink enables its customers to move money, access aggregated financial data, and use smart financial services such as risk insights, and others. Source: Refinitiv |

Sharek’s Take |

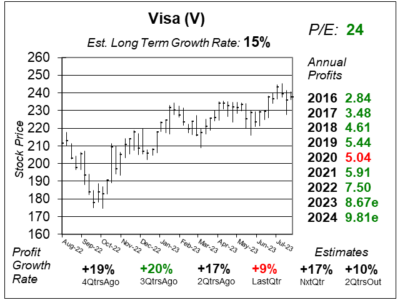

With a P/E of just 24, Visa’s (V) stock seems strangely undervalued. Why is that? Well, for one, Visa has a Fiscal Year end of September 30th. Since we are now in the company’s Q4, I’m now looking ahead to the next Fiscal Year — 2024 — when calculating my P/E. This qtr, V’s profits estimate for 2023 is $867, while 2024’s is $9.81. So $238 / $9.81 = 24. Looking back to the same quarter the past five years, the stock had a P/E of 25, 39, 34, 31 and 26. Note the stock market was in a Bear Market last year when the P/E was 25. And it was in a raging Bull Market two years ago when the P/E was 39. I think the P/E should be 32 and the stock seems to be worth $314, giving the shares 32% upside to my Fair Value. With a P/E of just 24, Visa’s (V) stock seems strangely undervalued. Why is that? Well, for one, Visa has a Fiscal Year end of September 30th. Since we are now in the company’s Q4, I’m now looking ahead to the next Fiscal Year — 2024 — when calculating my P/E. This qtr, V’s profits estimate for 2023 is $867, while 2024’s is $9.81. So $238 / $9.81 = 24. Looking back to the same quarter the past five years, the stock had a P/E of 25, 39, 34, 31 and 26. Note the stock market was in a Bear Market last year when the P/E was 25. And it was in a raging Bull Market two years ago when the P/E was 39. I think the P/E should be 32 and the stock seems to be worth $314, giving the shares 32% upside to my Fair Value.

Here are some other highlights from last qtr (with year-over-year growth rates):

Visa is the world’s leader in digital payments, with more than 15,000 financial institutional clients. The company was founded more than 60 years ago with the idea to make payments between consumers and businesses, also known as C2B. Today, Visa is working on expanding the ways that money can flow digitally, via person-to-person payments (P2P), business-to-consumer transactions (B2C), and business-to-business (B2) transactions. Visa is expanding its International payment functionality, to make International transactions easier. And that may be bad news for small competitors dLocal, Global-E and Marquetta. Visa Direct allows people to move money globally, and is being used in a number of ways:

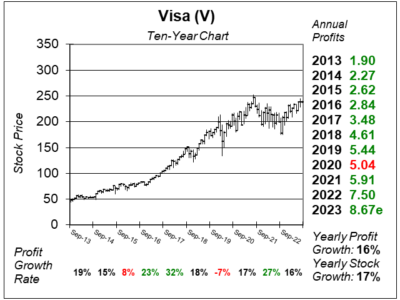

V has been a great stock for conservative investors — and growth investors too. The stock has an excellent safety rating, an Estimated Long-Term Growth Rate of 15%, a dividend yield of less than 1%, and a stock buyback program. This stock is appreciated among institutional investors for its consistent sales/profit/stock growth. Its business model doesn’t rely on a big sales or R&D budget, so management has loads of cash coming in to buy back stock. In Fiscal 2022, management returned $14.8 billion in share repurchases and cash dividends to shareholders. Visa is part of the Conservative Growth Portfolio and Growth Portfolio. |

One Year Chart |

This stock is a true value with a P/E of only 24. But note the stock was cheap a year ago (it was $213 on August 26, 2022. The P/E was 25 at the time). This stock is a true value with a P/E of only 24. But note the stock was cheap a year ago (it was $213 on August 26, 2022. The P/E was 25 at the time).

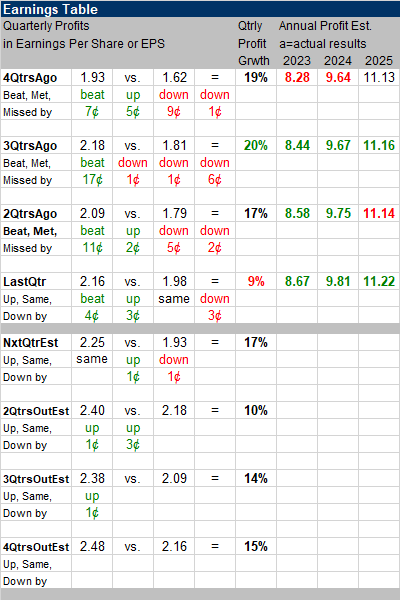

Profits were up 9% last qtr, but they jumped 33% a year ago so the two year stack is fine with me. Estimates for next quarter look good (+17%). The Est. LTG of 15%, same with last qtr. Visa is really a high-teens grower, and that’s been the case for many years. This 15% figure is fine as the economy is slow right now. |

Earnings Table |

Last qtr, Visa delivered 9% profit growth and beat expectations of 7% growth. Revenue increased 12%, year-on-year, and beat estimates of 11%. Here’s how much the company grew in terms of its revenues sources: Last qtr, Visa delivered 9% profit growth and beat expectations of 7% growth. Revenue increased 12%, year-on-year, and beat estimates of 11%. Here’s how much the company grew in terms of its revenues sources:

Growth was led particularly by the cross-border business, boosted by the ongoing recovery of the tourism industry and summer season. Growth was driven by increasing payments volume (+9%), processed transactions (+10%), and cross-border volume (+17%) which was fueled by the increase in travels due to the summer season and the continuing recovery of the tourism industry. Consumer spending has also remained stable. Visa’s three growth engines (consumer payments, new flows, and value-added services) continued to see gains. New business wins drove increasing consumer payments. But growth from new flows and value-added services were much faster than Visa’s payment business. Revenue from new flows was up 20% in constant currency. Revenue from value-added services was up 19% due to higher volume, strong advisory services, and select pricing actions. Annual Profit Estimates are up this qtr. Profits are expected to climb 16% this year. For fiscal 2023, management expects low double-digit revenue growth. Qtrly profit Estimates are for 17%, 10%, 14%, and 15% profit growth the next 4 qtrs. For next qtr, analysts think revenue with climb 10%. Management assumes ongoing trends in payments volumes and cross-bross volume. Management noted that though cross-border business is recovering relative to 2019, the year-over-year growth will continue to decelerate due to delayed recognition of service fees, an expected slowdown in cross-border growth, and currency volatility. |

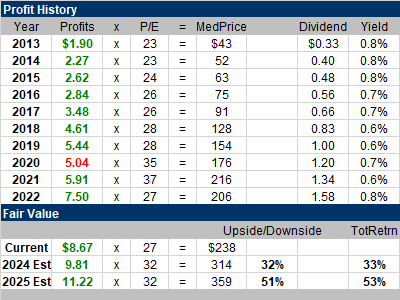

Fair Value |

The stock currently has a P/E of 24 and I feel the P/E can get to 32. The stock currently has a P/E of 24 and I feel the P/E can get to 32.

V has a Fiscal Year end on September 30th, so I am now looking at 2024 revenues. My Fair Value for 2024 is $314 a share, or around 32% upside for this year. The $359 Fair Value for 2024 implies around 51% upside. In comparison, our MasterCard spreadsheet was updated on the same day as Visa’s (8/2), and that stock has a 32 P/E based on 2023 profit estimates (as it has a Decmber 31 Fiscal Year end). |

Bottom Line |

Visa’s (V) a well oiled machine, with consistent revenue and profit growth. I believe 2020 is the only year this company had negative profit growth since its IPO in 2008. Management that buys back billions in stock and pays a dividend that’s risen every year since 2009. Sometimes, the stock market gives us opportunities to buy quality companies at low prices. I believe this is one of them. V ranks 6th in the Conservative Portfolio Power Rankings. It’s a mid-teens profit-grower, which is a good growth rate for a safe stock. Visa moves up from 14th to 11th in the Growth Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

11 of 28Aggressive Growth Portfolio N/AConservative Stock Portfolio 6 of 31 |