The stock market dropped on Monday as global recession fears mounted. After the Federal Reserve signaled more rate hikes next year, other central banks across the globe are also in hawkish modes.

The stock market dropped on Monday as global recession fears mounted. After the Federal Reserve signaled more rate hikes next year, other central banks across the globe are also in hawkish modes.

Overall, S&P 500 fell 0.9% to 3,818, while NASDAQ declined 1.5% to 10,546.

Tweet of the Day

$V Visa Q4 FY22:

Key metrics:

• Payment Volume +10% Y/Y.

• Revenue +19% Y/Y to $7.8B ($7.6B expected).

• Operating margin 66%.

• Operating cash flow margin 64% TTM.

• EPS 1.93 ($1.86 expected).

• Dividend +20% to $0.45.

• New $12B share buyback program. pic.twitter.com/tYWLYmwxCQ— App Economy Insights (@EconomyApp) October 25, 2022

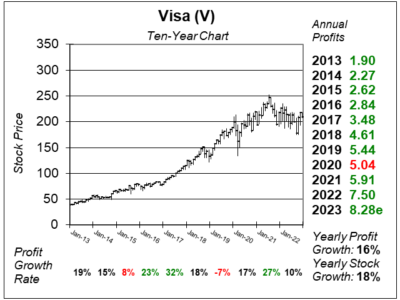

Chart of the Day

Our chart of the day is the ten-year chart of Visa (V) as of December 6, 2022, when the stock was at $209.

Our chart of the day is the ten-year chart of Visa (V) as of December 6, 2022, when the stock was at $209.

Visa is the world’s leader in digital payments, with more than 15,000 financial institutional clients. The company was founded more than 60 years ago with the idea to make payments between consumers and businesses, also known as C2B.

Looking back beyond this chart, V did decline from $22 to $11 during the Financial Crisis in 2008-2009. Hence, a worldwide recession could cause these shares to decline further. On the other hand, China could be a catalyst for the stock in the upcoming quarters as the country gets past COVID restrictions. Travel in-and-out of Asia recovered sharply in the quarter, with more recovery to come as China is lifting restrictions. Visa grew profits 19% last qtr on 19% revenue growth with strength seen ecommerce and cross-border travel.

Visa is part of the Conservative Portfolio and Growth Portfolio.