The stock market inched up on Wednesday and recorded its longest winning streak since 2021. Oil prices continued to go down as it slipped to its lowest levels in three months due to demand concerns from China and the US.

The stock market inched up on Wednesday and recorded its longest winning streak since 2021. Oil prices continued to go down as it slipped to its lowest levels in three months due to demand concerns from China and the US.

Overall, S&P 500 and NASDAQ closed 0.1% higher to 4,383 and 13,650, respectively.

Tweet of the Day

Datadog has done an incredible job layering on additional products past their initial "wedge" to become a true platform – and they gave us some data on this today. As the market puts a greater emphasis on bundled platforms today vs point solutions, they appear to be an…

— Jamin Ball (@jaminball) November 8, 2023

Chart of the Day

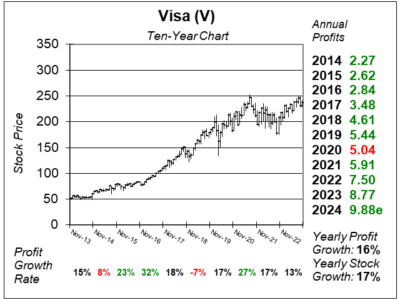

Here is the ten-year chart of Visa (V) as of October 25, 2023, when the stock was at $237.

Here is the ten-year chart of Visa (V) as of October 25, 2023, when the stock was at $237.

Visa is the world’s leader in digital payments, with more than 15,000 financial institutional clients. The company was founded more than 60 years ago with the idea to make payments between consumers and businesses, also known as C2B. Today, Visa is working on expanding the ways that money can flow digitally, via person-to-person payments (P2P), business-to-consumer transactions (B2C), and business-to-business (B2) transactions. Visa is also expanding its International payment functionality, to make International transactions easier. And that may be bad news for small competitors dLocal, Global-E and Marquetta.

Visa delivered solid results last quarter. Profit grew 21% year-over-year on revenue growth of 11%, with both beating analysts’ estimates. Although some investors are concerned that we will enter a recession in the first quarter of 2024, Visa management stated that consumer spend has remained stable since March. In addition, payment volume growth actually ticked up from July to September with the help from higher gas prices. These remarks, combined with the solid GDP growth of 4.9% last quarter, make us think that there is not a recession on the horizon.

Visa is part of the Conservative Growth Portfolio and Growth Portfolio.