The stock market sank on Wednesday after minutes from the Federal Reserve signaled at potentially higher rates. While officials are mindful of the risks of overtightening, they still remain firm on bringing the inflation down to their 2% target.

The stock market sank on Wednesday after minutes from the Federal Reserve signaled at potentially higher rates. While officials are mindful of the risks of overtightening, they still remain firm on bringing the inflation down to their 2% target.

Overall, S&P 500 fell 0.8% to 4,404, while NASDAQ decreased 1.2% to 13,475.

Tweet of the Day

$DDOG Bernstein believes that FY24 growth could be almost twice the consensus, raises PT to $133 from $127

"Today we lay out the evidence that investors should think GROWTH (not deceleration)!," said analyst Peter Weed. "And consensus' quarterly YoY growth expectations could be… pic.twitter.com/IhAIMSOF9G

— Hedge Vision (@HedgeVision) August 16, 2023

Chart of the Day

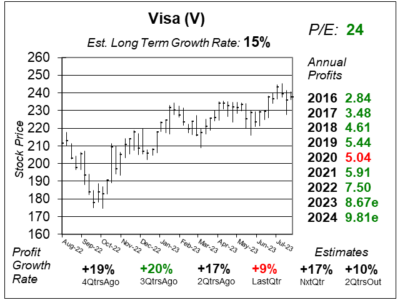

Here is the one-year chart of Visa (V) as of August 2, 2023, when the stock was at $238.

Here is the one-year chart of Visa (V) as of August 2, 2023, when the stock was at $238.

Visa is the world’s leader in digital payments, with more than 15,000 financial institutional clients. Today, the company is working on expanding the ways that money can flow digitally, via person-to-person payments (P2P), business-to-consumer transactions (B2C), and business-to-business (B2) transactions. Visa is expanding its International payment functionality, to make International transactions easier.

With a P/E of just 24, Visa’s stock seems strangely undervalued. Well, for one, Visa has a Fiscal Year end of September 30th. Since we are now in the company’s Q4, David Sharek is now looking ahead to the next Fiscal Year — 2024 — when calculating his P/E. This quarter, V’s profits estimate for 2023 is $867, while 2024’s is $9.81, giving a P/E of 24. Looking back to the same quarter five years ago, the stock had a P/E of 25, 39, 34, 31 and 26. Note the stock market was in a Bear Market last year when the P/E was 25. And it was in a raging Bull Market two years ago when the P/E was 39. David Sharek thinks the P/E should be 32 and the stock seems to be worth $314, giving the shares 32% upside to his Fair Value.

Visa is part of the Conservative Growth Portfolio and Growth Portfolio.