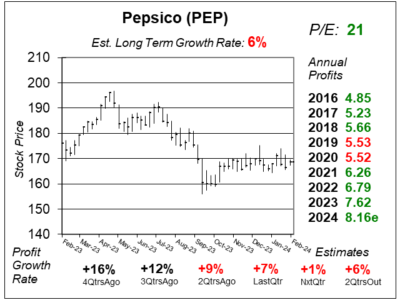

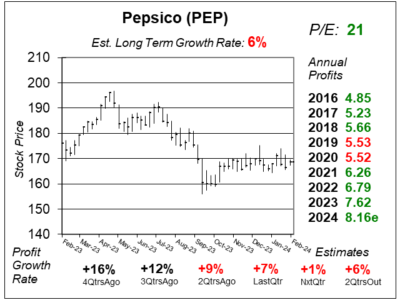

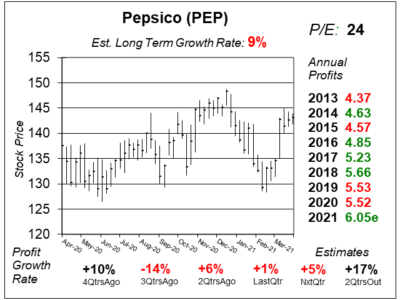

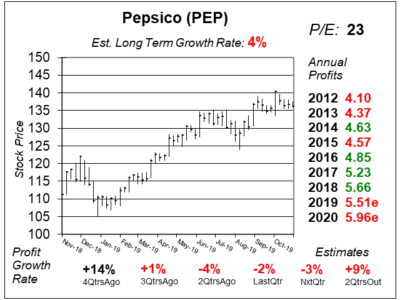

Pepsico (PEP) Goes Back to Being a Slow Grower as Inflation Simmers Down

Pepsico (PEP) has entered a slower growth phase. Still, with a P/E of only 21, this Blude Chip stock has some upside potential.

Pepsico (PEP) has entered a slower growth phase. Still, with a P/E of only 21, this Blude Chip stock has some upside potential.

PepsiCo (PEP) management believes the impact of weight-reducing drugs like Wegovy and Mounjaro has been negligible so far.

PepsiCo (PEP) is seeing good growth from brand innovations like Gatorade & Flamin Hot snacks as well as distributing Celsius drinks.

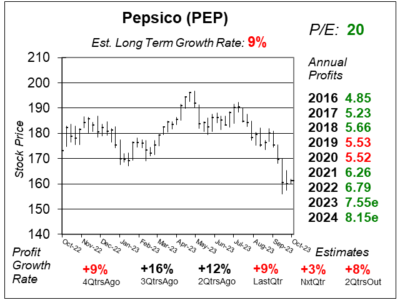

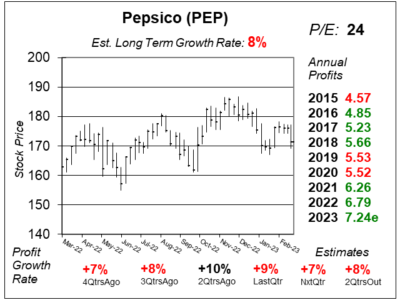

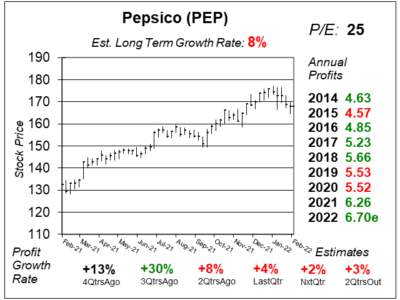

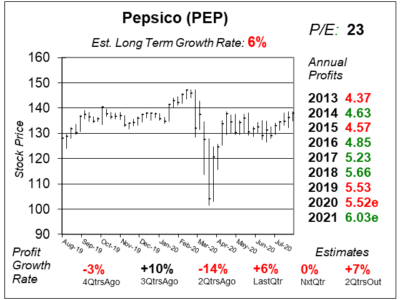

PepsiCo (PEP) is delivering strong results as business is getting easier, with more people wanting work and supply chains easing.

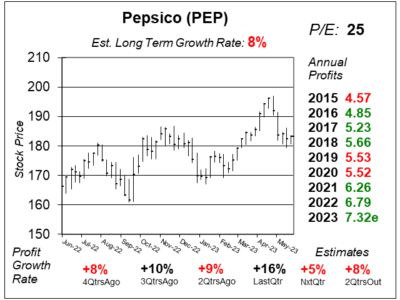

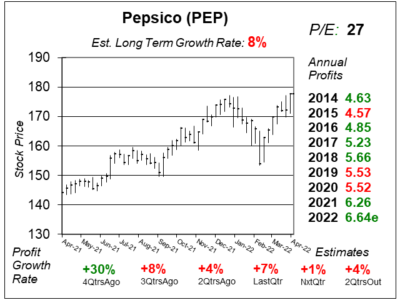

PepsiCo (PEP) has been achieving solid sales & profit growth as the company raised prices on its drinks & snacks to combat inflation.

Frito-Lay lead the way for PepsiCo (PEP) last qtr as the segment had sales growth of 20%, with strong sales in Doritos and Cheetos.

PepsiCo (PEP) is growing sales rapidly (13% & 14% the past 2qtrs). And now its investing in Celsius Energy for an added boost.

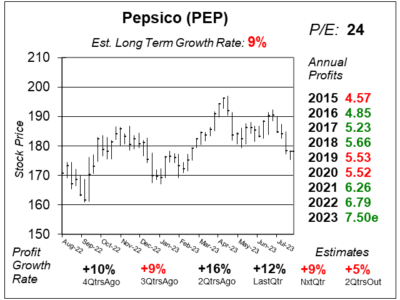

Wow! Pepsico (PEP) delivered 14% organic revenue growth last qtr. AND, this is a safe stock that should hold up in this Bear Market.

If you’re looking for a safe stock to put money, with the chance of growing it 10% a year, Pepsico (PEP) might be one to consider.

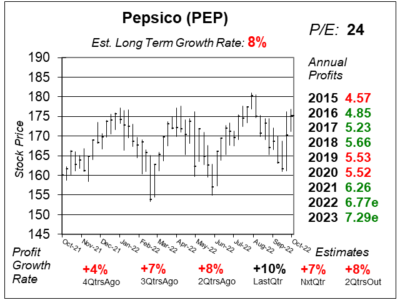

PepsiCo (PEP) management has been focused on selling off low-growth brands and expanding some of its most popular brands.

This is a new-and-improved Pepsico (PEP) as management is focused on changing up the brands and boosting profit margins.

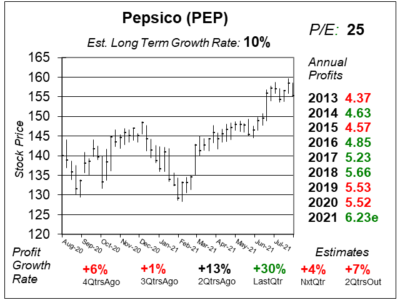

PepsiCo (PEP) is expected to have its best profit groth in a decade as small-portion multipacks are popular with consumers.

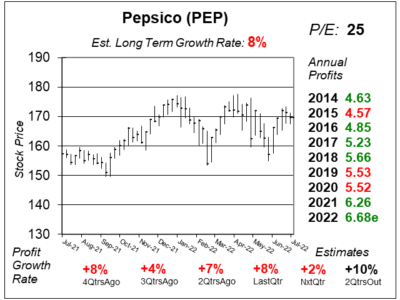

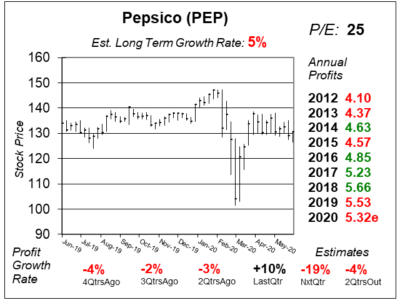

Pepsico (PEP) should see some nice profit growht in the upcoming qtrs as families get out on the road and travel again.

PepsiCo (PEP) should see a boost in business when families jump into their vehicles, go on vacations, and buy drinks & snacks.

Pepsico (PEP) had a poor qtr as the Coronavirus hurt beverage sales convenience stores and gas stations.

Pepsico (PEP) had its best revenue growth in a year with broad-based growth worldwide in both snacks and beverages.

Pepsico (PEP) is a safe choice for investors with Coronavirus fears rocking the stock market. And a 3% yield is nice too.

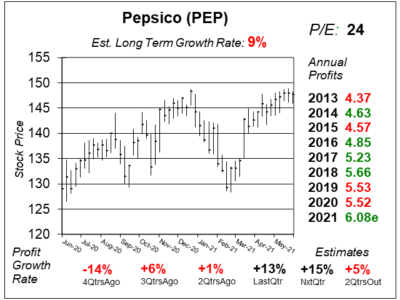

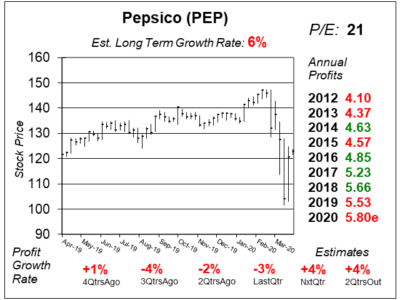

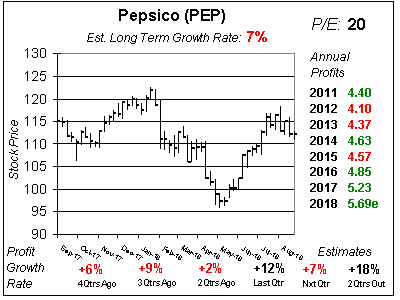

Pepsico (PEP) just delivered -2% profit growth, yet the stock is oh-so-close to an All Time high as investors look ahead.

Pepsico (PEP) just delivered -4% profit growth. But investors don’t seem to mind as PEP is around an All-Time High.

Investors are viewing Pepsico (PEP) with rose colored glasses, as the stock has hit All-Time highs as profit growth has lagged.

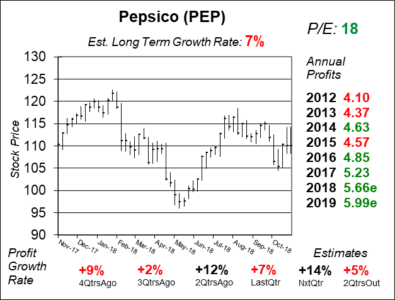

Pepsico (PEP) is doing very well with its snack lines and NEW healthier drink choices. But management just cut 2019 estimates. Let’s see why.

Pepsico (PEP) is dealing with a health conscious consumer who is wanting healthier drinks, and a US dollar which is crimping sales and profits. Still, PEP has good upside.

Pepsico (PEP) just purchased Sodastream (SODA), and this acquisition gives PEP stock a fresh jolt of growth opportunity.

Pepsico (PEP) has been in a downtrend all year, and this recet fall has made the stock a value. But it may not be the deal it seems to be.

Pepsico (PEP) is promoting some new brands such as Mountain Dew Ice and Doritos Blaze in 2018. These plus a lower tax rate could push profits up a solid 9% on the year.

Pepsico (PEP) is down a bit due to the consumers’ shift away from carbonated beverages. But snack sales are strong, and Pepsico has more non-carb beverages to offer.

The Growth vs. Value debate was raging last weekend, with many pundits thinking value stocks are due to rise. Pepsico (PEP) is a great example of why that thesis is flawed.

Pepsico (PEP) is a great buy-and-hold stock for conservative investors, providing market returns with less risk. But at its highs, I won’t be buying up here.

Pepsico (PEP) has delivered higher returns, a better yield, and less risk than the stock market in general. But that’s in the past, let’s now assess the future.