Stock (Symbol) |

PepsiCo (PEP) |

Stock Price |

$161 |

Sector |

| Food & Necessities |

Data is as of |

| October 16, 2023 |

Expected to Report |

| January 8 |

Company Description |

PepsiCo, Inc. is a beverage and convenient food company. The Company’s segments include: PepsiCo, Inc. is a beverage and convenient food company. The Company’s segments include:

Source: Refinitiv |

Sharek’s Take |

PepsiCo (PEP) continues to deliver strong results, as the company delivered 9% profit growth on 7% revenue growth last quarter. Core revenue grew 9%. Core revenue excludes brand additions and deletions from the company’s large roster of brands. Note that this was the first time in 9 qtrs that organic revenue only grew by a single digit. Beverages delivered 8% organic sales growth during the quarter while snacks increased 9%. Investors fear that weight-loss drugs like Wegovy from Novo Nordisk and Mounjaro from Eli Lilly would impact PEP sales. These weight-reducing drugs work by elevating one’s feeling of fullness and decreasing the appetite. According to PEP management, the impact of these drugs has been negligible so far. Management believes structural trends like urbanization, increased snacking lifestyle, and more unstructured meals would continue to provide tailwinds, while the company’s move towards healthier products would help the company pivot its portfolio if needed in the future. PepsiCo (PEP) continues to deliver strong results, as the company delivered 9% profit growth on 7% revenue growth last quarter. Core revenue grew 9%. Core revenue excludes brand additions and deletions from the company’s large roster of brands. Note that this was the first time in 9 qtrs that organic revenue only grew by a single digit. Beverages delivered 8% organic sales growth during the quarter while snacks increased 9%. Investors fear that weight-loss drugs like Wegovy from Novo Nordisk and Mounjaro from Eli Lilly would impact PEP sales. These weight-reducing drugs work by elevating one’s feeling of fullness and decreasing the appetite. According to PEP management, the impact of these drugs has been negligible so far. Management believes structural trends like urbanization, increased snacking lifestyle, and more unstructured meals would continue to provide tailwinds, while the company’s move towards healthier products would help the company pivot its portfolio if needed in the future.

Founded in 1919, PepsiCo is one of the world’s largest food and beverage companies with more than $70 billion in annual sales. PepsiCo’s great worldwide brands include Pepsi, Frito-Lay, Tropicana, Quaker, and Gatorade, with each generating more than $1 billion in annual sales. While the company serves customers in more than 200 countries and territories worldwide, greater than 60% of its revenue comes from North America. Most of the company brands occupy the #1 and #2 spots in their respective categories. PEP just invested $550 million in Celsius Energy (CELH), which gives PepsiCo a new set of energy drinks to distribute. The investment is in preferred stock that will pay a 5% annual dividend and can convert into regular stock down the road. This gives PEP 8.5% of Celsius. PEP bought the Rockstar energy brands in 2020.Here are the revenue divisions of PEP as of last qtr:

PepsiCo’s one of the safest stocks in the world, with a Standard & Poors credit rating of A+. Currently, the Estimated Long Term Growth Rate is 9% per year and if we add in the dividend yield of 3%, that will push the total estimated return to 12%. PepsiCo is a S&P Dividend Aristocrat and has raised the payout each year since 1973. 2023 is the 51st year of dividend increases. Management also buys back stock to boost EPS. In 2022, management bought back $1.5 billion in stock and paid shareholders $6.2 billion in cash dividends. PEP is a core holding in the Conservative Growth Portfolio. |

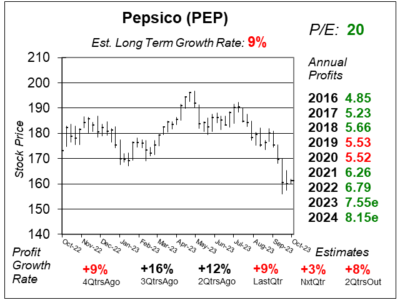

One Year Chart |

PEP is in a slump, as it fell to a one-year low of $158. Other conservative stocks have been hit hard during this period as well, including McDonald’s, and J&J. PEP is in a slump, as it fell to a one-year low of $158. Other conservative stocks have been hit hard during this period as well, including McDonald’s, and J&J.

This stock has a 20 P/E, which is below my Fair Value of 24 making the stock undervalued. The Est. LTG is 9%. In past years, this was considered to be a 5-7% grower. But management has been effective in improving efficiency. |

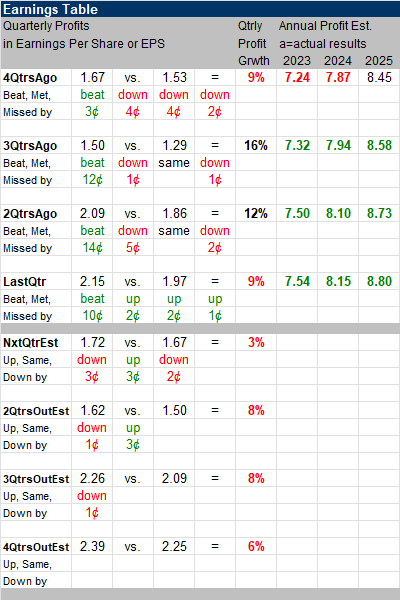

Earnings Table |

Last qtr, PepsiCo delivered 9% profit growth, in line with analyst estimates. Revenue increased 7%, also in line with estimates. Excluding the effects of acquisitions and foreign exchange pressure, core revenue growth was 12%. Last qtr, PepsiCo delivered 9% profit growth, in line with analyst estimates. Revenue increased 7%, also in line with estimates. Excluding the effects of acquisitions and foreign exchange pressure, core revenue growth was 12%.

Revenue growth reflects PEP’s diversified portfolio, broad geographic reach, strong omnichannel presence, and productivity initiatives. In North America, Frito-Lay and PepsiCo Beverages benefited from double-digit increase in ad and marketing spend. Internationally, revenue growth was led by the Africa, Middle East, and South Asia regions, particularly in Pakistan and Egypt which delivered double-digit organic revenue growth. Outside these regions, the Philippines, Turkey, Mexico, Brazil, and Poland also delivered double-digit growth. Annual Profit Estimates increased across the board. Management expects 2023 organic revenue growth of 10%. Qtrly Profit Estimates for the next four qtrs are 3%, 8%, 8%, and 6%. It looks like profit growht might be in the single digits again next quarter. Perhaps the company can get back over 10% after that. Analysts think PEP revenue will grow 2% next quarter. |

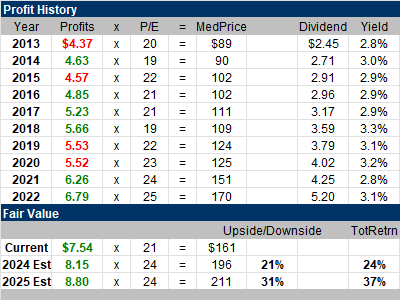

Fair Value |

My Fair Value P/E is 24, down from 26 last qtr. Notice PEP is getting a higher P/E now than it did years ago. That’s because the growth rate increased. My Fair Value P/E is 24, down from 26 last qtr. Notice PEP is getting a higher P/E now than it did years ago. That’s because the growth rate increased.

This stock has a Fair Value of $196 for 2023, which is around 21% above where the stock is now. My 2024 Fair Value is $211, which equates to 31% upside. Note the company also pays a juicy 3% dividend. These shares are quite the value. |

Bottom Line |

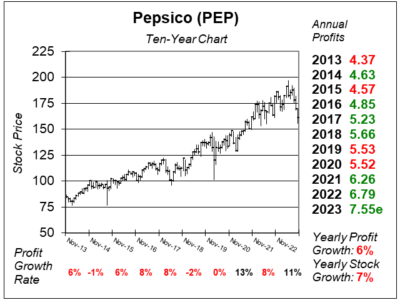

Pepsico (PEP) has proven to be a steady-grower the past decade, even though profits haven’t always been. This chart is beautiful. Pepsico (PEP) has proven to be a steady-grower the past decade, even though profits haven’t always been. This chart is beautiful.

PepsiCo’s gotten some selling pressure as investors feel snack sales might simmer down. And looking at the numbers in this report, it does seem like growth is slowing. Revenue growth is expected to be just 2% net quarter. But the stock has fallen too much, and is now a bargain in my eyes. PEP moves up from 22nd to 19th in the Conservative Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Stock Portfolio 19 of 31 |