The stock market dropped on Thursday as Fed Chair Jerome Powell signaled rate hikes to be kept unchanged at least at its next policy meeting. Meanwhile, the benchmark Treasury yield reached 4.987% – its highest level since July 2007.

The stock market dropped on Thursday as Fed Chair Jerome Powell signaled rate hikes to be kept unchanged at least at its next policy meeting. Meanwhile, the benchmark Treasury yield reached 4.987% – its highest level since July 2007.

Overall, S&P 500 declined 0.9% to 4,278, while NASDAQ fell 1.0% to 13,186.

Tweet of the Day

In a recent analysis by @sentimentrader titled "Defensive stocks witness a historic amount of damage", the XLP McClellan Summation indicator is used to identify market trends in the Consumer Staples sector. Dive in: https://t.co/DNjRKLpdNf pic.twitter.com/RvINwJFmX6

— SentimenTrader (@sentimentrader) October 16, 2023

Chart of the Day

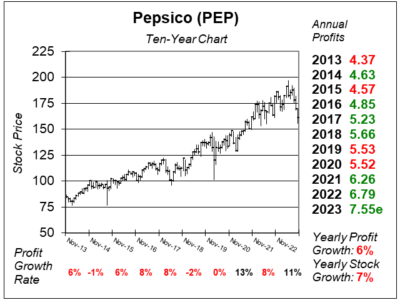

Here is the ten-year chart of Pepsico (PEP) as of October 16, 2023, when the stock was at $161.

Here is the ten-year chart of Pepsico (PEP) as of October 16, 2023, when the stock was at $161.

PepsiCo is one of the world’s largest food and beverage companies with more than $70 billion in annual sales. Its great worldwide brands include Pepsi, Frito-Lay, Tropicana, Quaker, and Gatorade, with each generating more than $1 billion in annual sales.

PepsiCo (PEP) continued to deliver strong results. It delivered 9% profit growth on 7% revenue growth in the last quarter. Core revenue grew 9% which excludes brand additions and deletions from the company’s large roster of brands. Note that this was the first time in nine quarters that organic revenue only grew by a single digit.

Carbonated soft drink volume declined 3% on a 7.7% avg price increase for 4 wks thru Sep 23, per NieslenIQ data. That's down from avg price hikes of +10.9% for 12 wks and +15.4% over 52 wks.

— Beverage Insights (@BevInsights) October 13, 2023

Sports drinks volume declined 4.2% while avg prices were up 9.6% for 4 wks thru Sep 23, per NielsenIQ. Gatorade volume off 8.3% on a 10.6% avg price gain while Coke's brands (Powerade and BodyArmor) had a 5.3% volume drop with a 1.3% avg price decrease.

— Beverage Insights (@BevInsights) October 17, 2023

For PepsiCo, beverages delivered 8% organic sales growth during the quarter, while snacks increased 9%.

Investors fear that weight-loss drugs, like Wegovy from Novo Nordisk and Mounjaro from Eli Lilly (LLY), would impact PepsiCo’s sales. These weight-reducing drugs work by elevating one’s feeling of fullness and decreasing the appetite. According to PepsiCo’s management, the impact of these drugs has been negligible so far. Management believes structural trends like urbanization, increased snacking lifestyle, and more unstructured meals would continue to provide tailwinds, while the company’s move towards healthier products would help the company pivot its portfolio if needed in the future.

PEP is a core holding in the Conservative Growth Portfolio.