The stock market closed lower on Thursday as concerns on interest rate path continued to trouble investors.

The stock market closed lower on Thursday as concerns on interest rate path continued to trouble investors.

Overall, S&P 500 declined 0.3% to 4,451, while NASDAQ fell 0.9% to 13,749.

Tweet of the Day

Find a group that's setting up if you want to increase your odds. Think outside the pattern! Cybersecurity related names look strong: $ZS, $PANW, $CRWD, $OKTA, $QLYS, $CYBR pic.twitter.com/pbNGnYwBR0

— Leif Soreide (@LeifSoreide) September 6, 2023

Chart of the Day

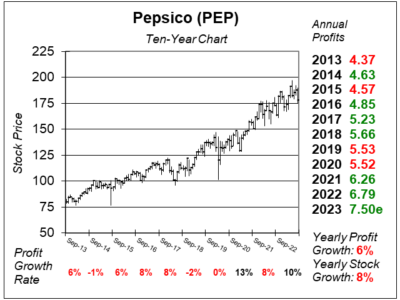

Here is the ten-year chart of Pepsico (PEP) as of August 23, 2023, when the stock was at $178.

Here is the ten-year chart of Pepsico (PEP) as of August 23, 2023, when the stock was at $178.

PepsiCo is one of the world’s largest food and beverage companies with more than $70 billion in annual sales. PepsiCo’s great worldwide brands include Pepsi, Frito-Lay, Tropicana, Quaker, and Gatorade, with each generating more than $1 billion in annual sales. It also invested $550 million in Celsius Energy (CELH), which gives PepsiCo a new set of energy drinks to distribute.

PepsiCo maintains strong performance momentum, with 12% profit growth on 10% revenue in the last quarter. Even more impressive was organic 13% revenue growth which excludes brand additions and deletions from the company’s large roster of brands. That was the 7th consecutive quarter of double-digit revenue growth.

Beverages delivered 11% organic sales growth during the quarter while snacks increased 15%. PepsiCo’s partnership with Celsius Energy has also seen impressive growth. The partnership has benefited from PepsiCo’s strong distribution system in the US. The partnership is now planning to expand Internationally.

PEP is a core holding in the Conservative Growth Portfolio. Business is so good management increased its Fiscal 2023 organic revenue growth to 10% from 8% previously.