The stock market ended Friday lower as investors assessed the impact of hotter-than-expected inflation data on the Federal Reserve’s policy decision next week. This marked the market’s second consecutive losing week.

The stock market ended Friday lower as investors assessed the impact of hotter-than-expected inflation data on the Federal Reserve’s policy decision next week. This marked the market’s second consecutive losing week.

Overall, S&P 500 fell 0.7% to 5,117, while NASDAQ declined 1.0% to 15,973.

Tweet of the Day

Tech funds saw their first outflows in nine weeks, with total outflows of $4.4 billion in the week ending March 6.

This was the largest weekly outflow on record for tech stocks, according to BofA. pic.twitter.com/RVN5ZAor6q

— Beth Kindig (@Beth_Kindig) March 13, 2024

Chart of the Day

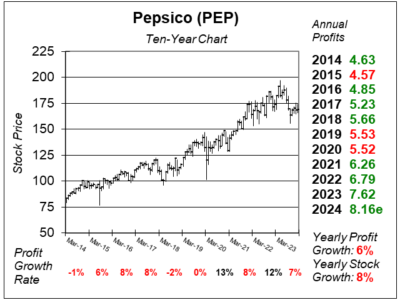

Here is the ten-year chart of Pepsico (PEP) as of February 20, 2024, when the stock was at $169.

Here is the ten-year chart of Pepsico (PEP) as of February 20, 2024, when the stock was at $169.

Investors are adjusting to PepsiCo’s slower growth. During the past three years, profits had grown an average of 11% per year. However, in 2024, profits are expected to climb only 7% overall. Some of this is due to lower disposable incomes in the US and some is from inflation simmering down.

Pepsico was a big beneficiary of inflation the past few years as the company marked up prices of drinks and snacks. Now those days are over, and the company could be headed back to being a high-single digit grower.

PEP is a core holding in the Conservative Growth Portfolio. This stock has a 21 P/E, which is below David Sharek’s Fair Value of 23, making the stock undervalued.