Stock (Symbol) |

PepsiCo (PEP) |

Stock Price |

$138 |

Sector |

| Food & Necessities |

Data is as of |

| November 5, 2020 |

Expected to Report |

| February 11 |

Company Description |

PepsiCo, Inc. is a food and beverage company. The Company, through its operations, bottlers, contract manufacturers and other third parties, is engaged in making, marketing, distributing and selling a range of beverages, foods and snacks, serving in over 200 countries and territories. Pepsico’s brands include Agusha, Amp Energy, Aquafina, Aquafina Flavorsplash, Aunt Jemima, Cap’n Crunch, Cheetos, Chester’s, Chipsy, Chudo, Cracker Jack, Diet Pepsi, Diet Sierra Mist and Domik v Derevne. Source: Thomson Financial PepsiCo, Inc. is a food and beverage company. The Company, through its operations, bottlers, contract manufacturers and other third parties, is engaged in making, marketing, distributing and selling a range of beverages, foods and snacks, serving in over 200 countries and territories. Pepsico’s brands include Agusha, Amp Energy, Aquafina, Aquafina Flavorsplash, Aunt Jemima, Cap’n Crunch, Cheetos, Chester’s, Chipsy, Chudo, Cracker Jack, Diet Pepsi, Diet Sierra Mist and Domik v Derevne. Source: Thomson Financial |

Sharek’s Take |

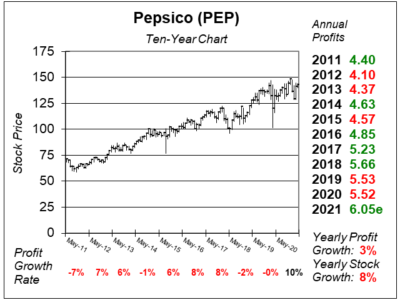

PepsiCo (PEP) is set to deliver accelerating profit growth later this year as the economy will likely show improvement in travel. I think travel is the key to growth as families will get in their cars and visit other cities, stopping at convenience stores for snacks along the way. Gas and convenient sore sales were hurting the company the prior two qtrs, as COVID-19 restrictions kept people inside. Now, the company continues to see strength in e-commerce while sales at convenience stores and gas stations have showed meaningful improvement since last Summer. PepsiCo (PEP) is set to deliver accelerating profit growth later this year as the economy will likely show improvement in travel. I think travel is the key to growth as families will get in their cars and visit other cities, stopping at convenience stores for snacks along the way. Gas and convenient sore sales were hurting the company the prior two qtrs, as COVID-19 restrictions kept people inside. Now, the company continues to see strength in e-commerce while sales at convenience stores and gas stations have showed meaningful improvement since last Summer.Founded in 1919, Pepsico is one of the world’s largest food and beverage companies with more than $70 billion in annual sales. Pepsico’s great worldwide brands include Pepsi, Frito-Lay, Tropicana, Quaker and Gatorade, with each generating more than $1 billion in annual sales while most of the company brands occupy the #1 and #2 spots in their respective categories. Quaker Foods includes well-known brands such as Cap’n Crunch, and Rice-A-Roni. Frito continuously innovates its flavor lineup by localizing taste profiles for different demographics. Greater than 60% of revenue comes from North America, while the company serves customers in more than 200 countries and territories worldwide. Looking ahead, the company looks to expand its sports drinks with Gatorade Zero and Bolt24, which in aggregate delivered more than $1 billion in sales last year. The company also acquired sports drink brand Rockstar last year. Other hits include Flamin’ Hot Flavor Cheetos and Doritos. PepsiCo’s one of the safest stocks in the world, but the stock is weak in terms of growth opportunity. Currently, the Estimated Long Term Growth Rate is 9% per year and the dividend yield of 3%, for a possible 12% total estimates return. But this stock might not grow 9% during the next decade. I kind of think 7% stock growth and a 3% dividend seems more realistic. Pepsico is a S&P Dividend Aristocrat and has raised the payout each year since 1973. This past April PEP raised the annual payout from $3.82 to $4.09. Although the company has repurchased stock in the past, this year it plans on prioritizing capital spending and dividends over share repurchases and acquisitions. PEP is a core holding in the Conservative Growth Portfolio. The stock has decent upside here as profit growth during the next 4 qtrs looks good. |

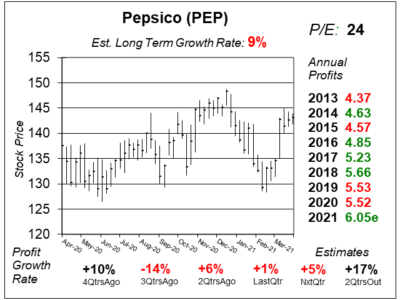

One Year Chart |

PEP rallied nicely during the past month, but with 1% profit growth last qtr it might not have the fuel to move much higher. Things are looking better the next 2 qtrs as profit growth is expected to accelerate to 5% and 17%. PEP rallied nicely during the past month, but with 1% profit growth last qtr it might not have the fuel to move much higher. Things are looking better the next 2 qtrs as profit growth is expected to accelerate to 5% and 17%.

The Est. LTG of 9% is up from 6% last qtr. That’s a big deal. It would be great if this company could deliver a 12% total return (including dividends). The P/E of 24 around where its been the past sice months. is down from 26 last qtr, but this qtr I’m looking ahead to 2021 estimates. |

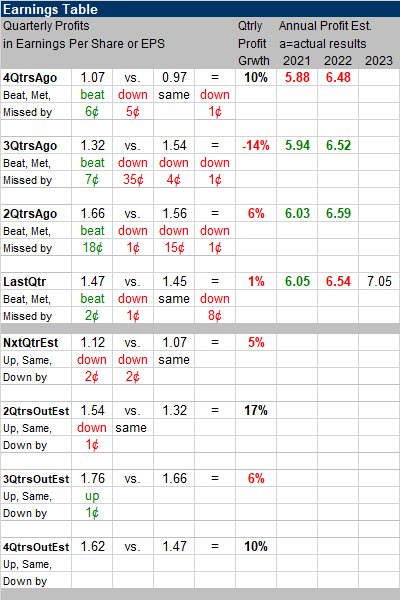

Earnings Table |

Last qtr PEP delivered 1% profit growth which beat estimates of 0%. Revenue increased 9%. I like that strong revenue growth. Pepsico is typically a mid-single digit revenue grower. Last qtr PEP delivered 1% profit growth which beat estimates of 0%. Revenue increased 9%. I like that strong revenue growth. Pepsico is typically a mid-single digit revenue grower.

Annual Profit Estimates are around where they were last qtr. Qtrly profit Estimates of 5%, 17%, 8% and 10% looks great. |

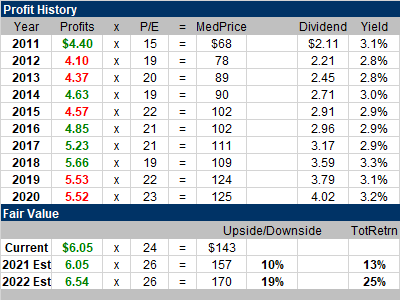

Fair Value |

My Fair Value P/E movesup from 25 to 26 as growth is looking good in the upcoming qtrs. I also think the company might beat estimates as people are looking forward to getting out and traveling again. My Fair Value P/E movesup from 25 to 26 as growth is looking good in the upcoming qtrs. I also think the company might beat estimates as people are looking forward to getting out and traveling again.

This stock has 10% upside to my 2021 Fair Value and 19% upside to 2022’s Fair Value. The stock also pays a nice dividend, so total return over the next two years might be 25% (hypothetically). |

Bottom Line |

Pepsico (PEP) has proven to be a steady-grower the past decade, even though profits haven’t always been. But now with the pandemic behind us, record profits could be headed our way this year. Pepsico (PEP) has proven to be a steady-grower the past decade, even though profits haven’t always been. But now with the pandemic behind us, record profits could be headed our way this year.

I think PEP is usually considered to be a slow-growing stock. I’m impressed with these numbers we’ve seen today. This cold be a double-digit grower for the next year or two. PEP moves up from 34th to 32nd in the Conservative Portfolio Power Rankings. It’s a small position in my portfolio. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Stock Portfolio 32 of 36 |