McDonald’s (MCD) Launches the Beverage Centric CosMc’s Concept

McDonald’s (MCD) has a new concept called CosMc’s that just launched. CosMc’s specializes in cold drinks, like slushes and teas.

McDonald’s (MCD) has a new concept called CosMc’s that just launched. CosMc’s specializes in cold drinks, like slushes and teas.

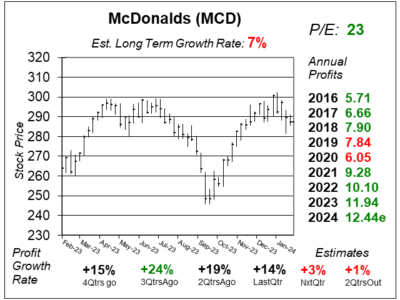

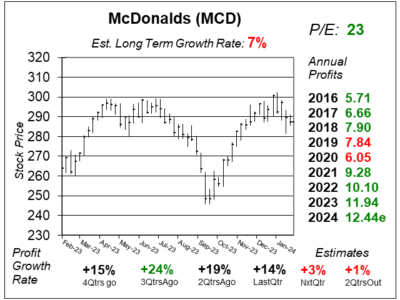

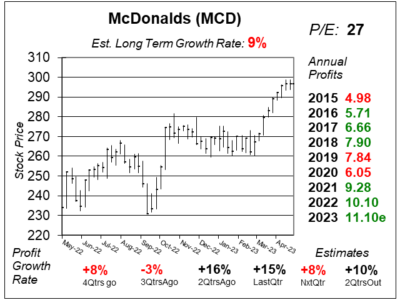

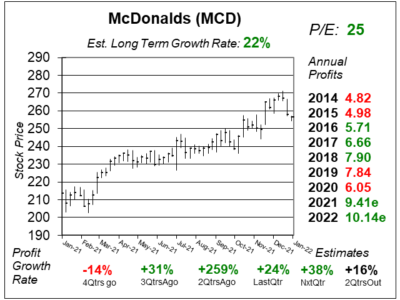

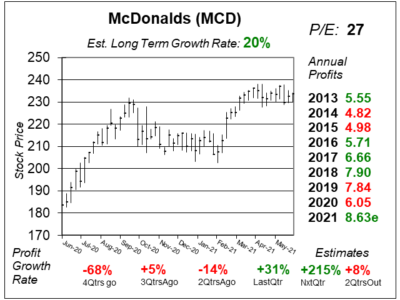

McDonald’s (MCD) posted 24% profit growth and 14% revenue growth as same store sales increased a solid 9% last quarter.

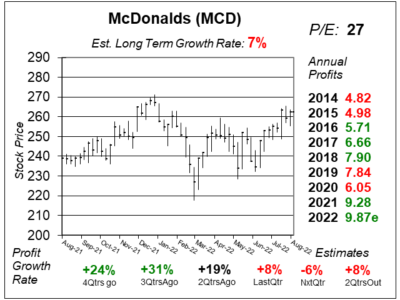

McDonald’s (MCD) continues to deliver impressive results, with new catalysts like McCrispy Chicken Sandwich and Spicy McNuggets.

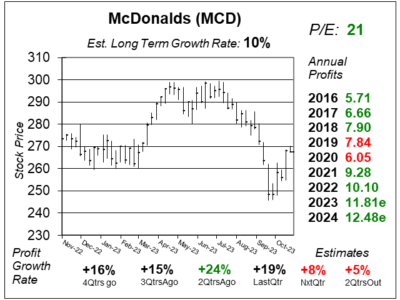

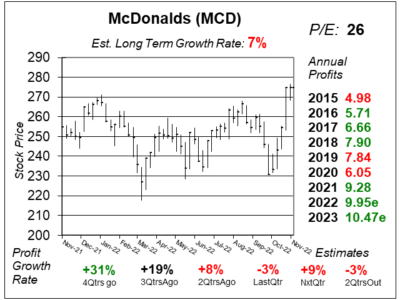

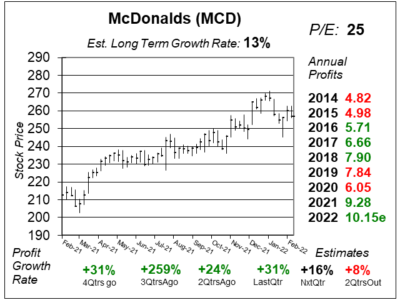

McDonald’s (MCD) is delivering strong results as same store sales jumped 13% last qtr due to strong sales of McCrispy sandwiches.

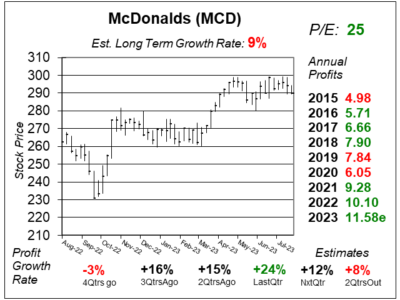

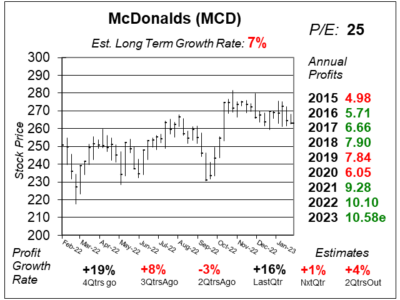

People are loving McDonald’s (MCD) as same store sales jumped a solid 13% last qtr, pushing profit growth up a surprising 16%.

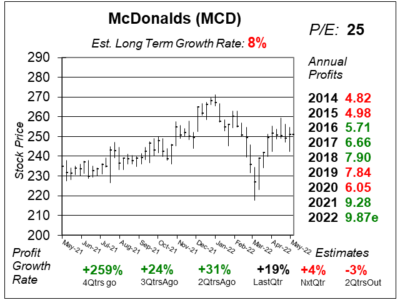

McDonald’s (MCD) is growing sales nicely, but profits are down due to the high USD and inflation in wages, commodities, & energy.

McDonald’s (MCD) delivered solid results last qtr as International markets — including Germany, France and Japan — shined.

McDonald’s (MCD) is seeing strong growth Internationally, but higher food costs and labor inflation are hampering profits.

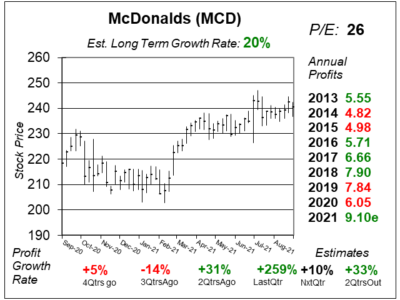

McDonald’s (MCD) contineus to deliver solid results Pent-up demand for vacations, good growth might continue through Summer.

McDonald’s (MCD) Accelerating the Arches initiative has sparked sales due to its focus on digital sales, delivery, and drive-thru.

McDonald’s (MCD) management has a “digital experience growth engine” with the MyMcDonald’s Rewards loyalty program.

McDonald’s (MCD) is focused on its 3Ds — digital, delivery, and drive-thru — as the company aims for record profits this year.

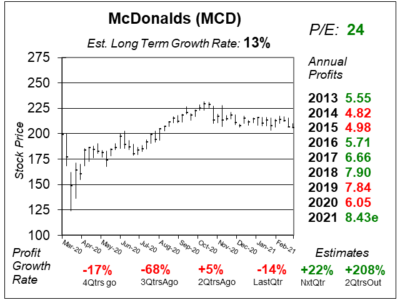

McDonald’s (MCD) should see great numbers starting next qtr as the travel and enertainment come back to life.

Although business is improving, McDonald’s (MCD) is still feeling the affects of COVID-19 lockdowns. 2021 should be better.

McDonald’s (MCD) is still experiencing slower sales due to COVID-19, and the stock might not go anywhere for a year.

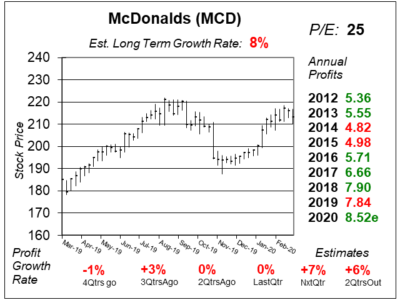

McDonald’s (MCD) has a long way to go before business returns to normal. But the stock price doesn’t seem to mind.

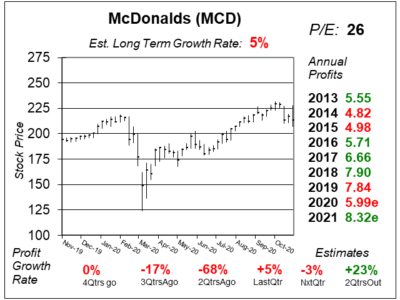

Delivery helped boost McDonald’s (MCD) same store sales by 6% last year. That’s great! But what about the stock?

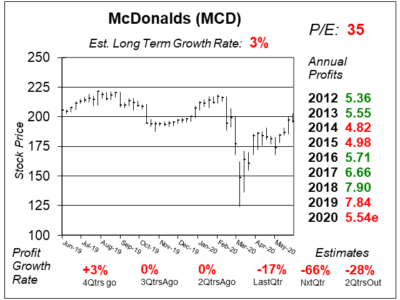

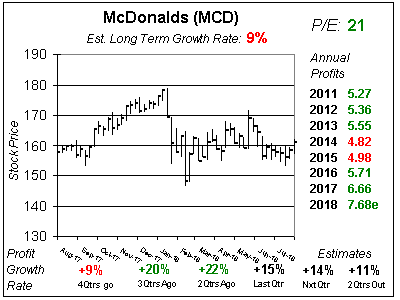

McDonald’s (MCD) let go of its CEO, but what’s more concerning is profit growth of -1%, 3% and 0% the last 4 qtrs.

Shares of McDonald’s (MCD) continue to climb higher even though profit growth has slowed. What gives?

McDonald’s (MCD) stock is up around 25% during the past year, and with profit growth slowing I think MCD stock is high.

McDonald’s (MCD) is expected to have 0% profit growth next qtr, so the burger chains has to beat the street to keep profit growth going.

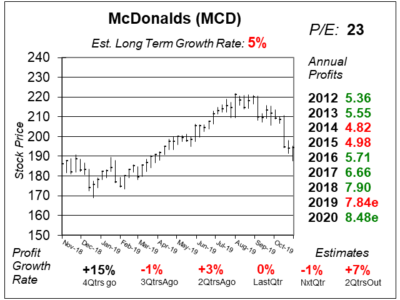

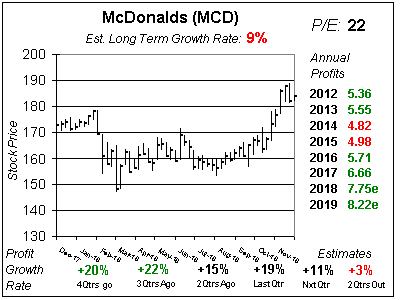

McDonald’s (MCD) is clicking on all cylinders right now. But with the stock shooting from the $160s to the $180s, can it go any higher?

McDonald’s (MCD) profit growth was 15% in 2016, 17% and 2017, with 15% growth last qtr the burger chain is still delivering solid growth. Let’s take a closer look at Mickey-D’s.

Innovation helped drive profit growth of 22% at McDonald’s (MCD) last qtr, as Experience the Future is growing by 1000 stores per qtr.

McDonald’s (MCD) is making things happen in the restaurant world, with a fresh look, ordering kiosks and UberEats delivery. And now the stock is on a dip. Time to buy?

McDonald’s (MCD) Experience the Future campaign give its restaurants new modern look, digital self-service kiosks, and McCafe desert counters, but more importantly boost profit growth.

McDonald’s (MCD) quick embrace of electronic ordering kiosks and UberEATS has made it somewhat of a technology stock. And tech stocks deserve higher multiples.

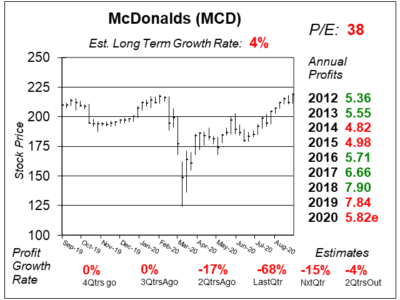

McDonald’s (MCD) continues on the path of success the stock shot to an All-Time high after profits jumped 20%. But the P/E of 24 makes MCD expensive.

In a tough operating environment for restaurants, McDonald’s (MCD) delivered exceptional profit growth of 15% in 2016. Let’s see what 2017 has in store.

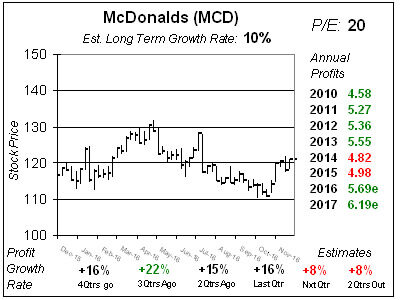

Shares of McDonald’s (MCD) are stuck in the middle of $110 and $130, but the MCD is lookin-good as it kicks out double-digit profit growth.

McDonald’s (MCD) is thriving as it executes its turnaround plan with the All Day Breakfast Menu, McPick 2, and focused menu.

Customers — as well as investors — are lovin McDonald’s (MCD) due to the success of its All Day Breakfast and McPick 2.

The all-day breakfast and McPick 2 have turned around McDonald’s (MCD) so let’s look at the stock.

McDonald’s (MCD) real problem is something the reporters are too afraid to talk about.

Even though McDonald’s (MCD) stock has slumped, MCD still isn’t a deal.

Think investing in Blue Chip dividend payers is the way to go? First take a look at McDonalds (MCD) and then decide.

Mark my words, McDonald’s (MCD) will be this price a year from now. It’s dead money.