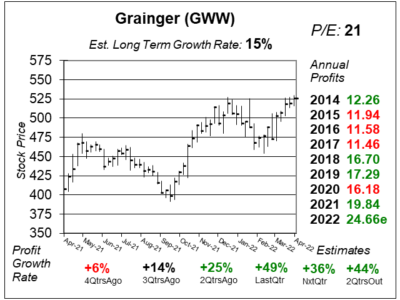

Grainger (GWW) Should See Growth Normalize With Tamer Inflation

Grainger (GWW) had been growing profits briskly with the help of higher product price inflation. Now, growth should normalize.

Grainger (GWW) had been growing profits briskly with the help of higher product price inflation. Now, growth should normalize.

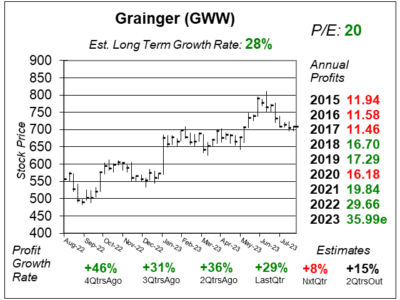

Grainger’s (GWW) industrial supply business delivered 14% revenue growth on 7% sales growth last quarter as sales were steady.

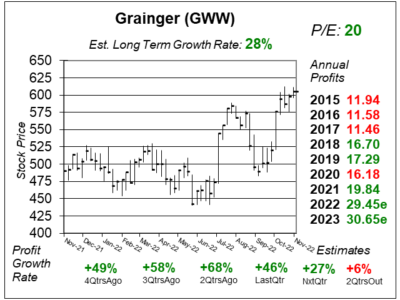

Grainger’s (GWW) profits continue to shine (+29% last qtr) as profit margins expand (+14%). Still, the stock seems underappreciated.

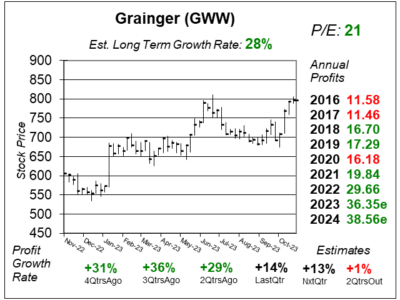

Grainger (GWW) is seeing continued profit gowht and increased profit margins as its supply chain returned to pre-pandemic levels.

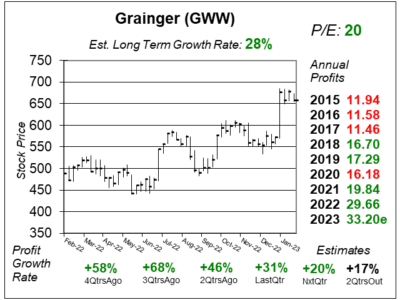

Grainger (GWW) has been executing magnificently as the company grew profits 31% last quarter on just 13% sales growth.

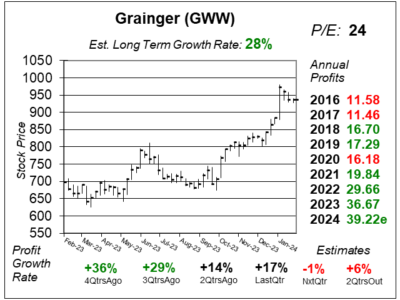

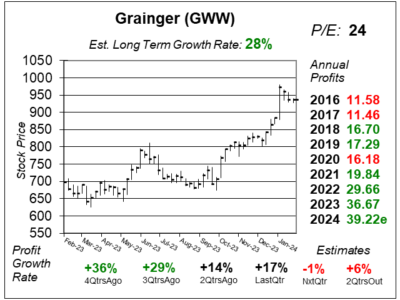

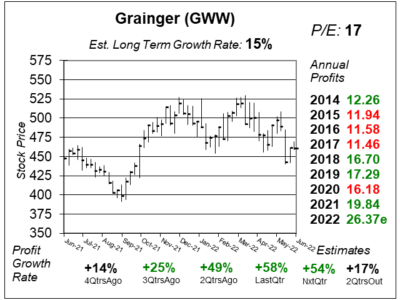

Grainger (GWW) is growing revenue briskly (+17% last qtr) while profit margins are improving. That’s a recipe for good profits.

Maintenance product retailer WW Grainger (GWW) delivered an excellent qtr as profit margins were 37.6%, up from 35.0% a year ago.

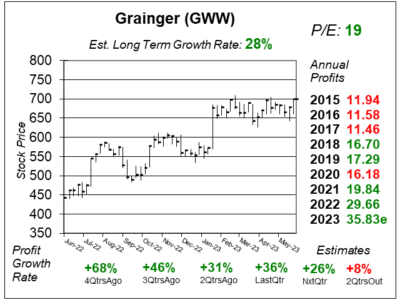

Grainger (GWW) was supposed to be feeling the heat of a recession. Instead the industrial supply store is thriving. Let’s take a look.

W.W. Grainger’s (GWW) customer demand continued to be very strong last qtr, as company profits as profit margins increased.

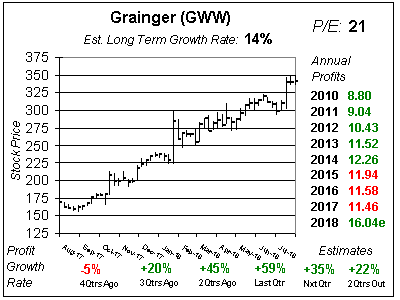

Supply store Grainger (GWW) is dealing with a weak manufacturing sector. But the P/E of 15 is low for this stock historically.

Industrial supply company Grainger (GWW) is around its 52-week lows, but with a P/E of only 15 this Blue Chip is a value.

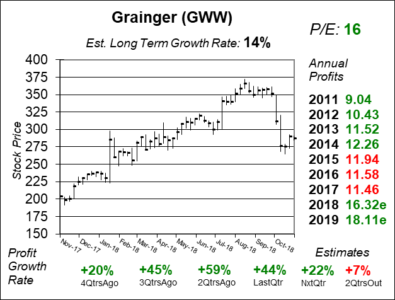

Grainger (GWW) stock fell from $350 to $275 last Fall with the stock market. Now around $300, the stock has good upside around these levels.

Grainger (GWW), stock tanked after posting pretty good results. And now that the P/E is now 16, this Blue Chip is a bargain.

Industrial supply retailer Grainger (GWW) reported its third consecutive strong qtr, proving growth in the economy is back baby!

Trump’s economic plan has put a charge into sales and profit growth at industrial supply chain Grainger (GWW) as large and midsized customers are buying more goods.

Industrial supply company Grainger (GWW) is up BIG after a blowout qtr that saw profits rise 20%. A weak dollar as well as strong construction and infrastructure spending is good for GWW.

Shares of industrial supply company Grainger (GWW) have shot up more than 25% from their lows, and I’ms scratching my head as to why.

Maintenance supply company Grainger (GWW) is having a tough year as it deals with a strong dollar and low oil which are hurting GWW’s customers.

Grainger (GWW) is working in a poor operating environment, with flat sales growth and negative profit growth.

Here’s my first look at building products distributor Grainger (GWW).

Grainger (GWW) is expected to report qtrly profits (EPS) and revenues:

Profits Estimates: $9.53 vs. $9.61 = -1%

Revenue Est: +4%