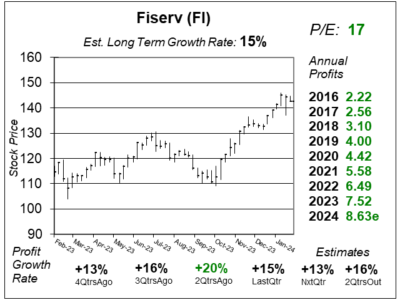

Fiserv (FI) Delivers Another Solid Quarter as Clover and Zellle Drive Results

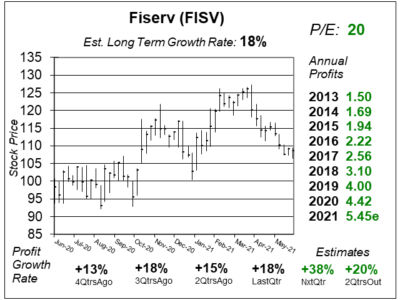

Fiserv (FI) delivered a solid quarter with 15% profit growht as POS system Clover and money transfer app Zelle lead the way.

Fiserv (FI) delivered a solid quarter with 15% profit growht as POS system Clover and money transfer app Zelle lead the way.

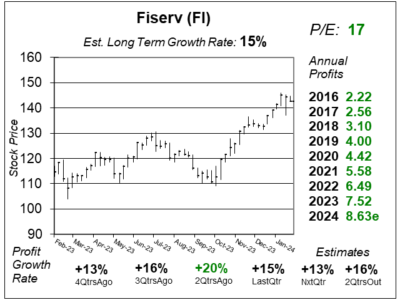

Fiserv (V) is a true value as profits are growing at a high-teens rate yet the stock has a P/E of just 15. I envision a solid move higher.

Fiserv’s (FISV) has had double-digit profit growth every year since 1986. Now it sees future growth opportunity in Latin America.

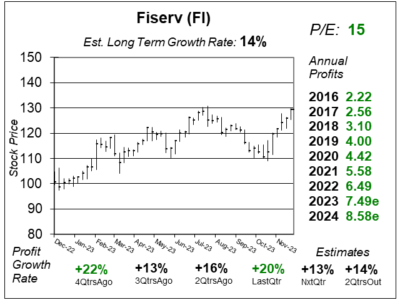

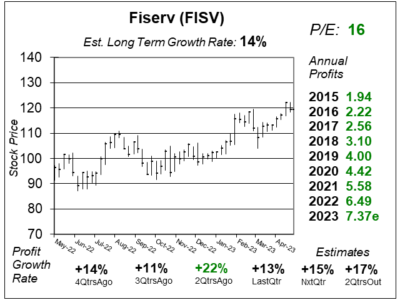

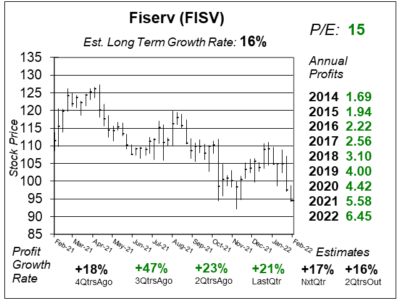

It’s hard to find deals in this stock market nowadays. But Fiserv (FISV) is still a bargain with an Est. LTG of 14% and a P/E of only 16.

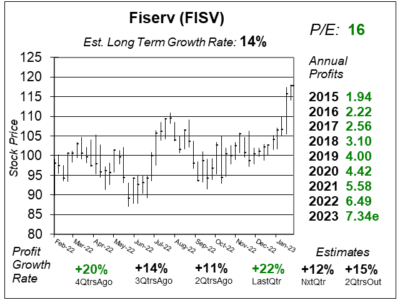

FinTech stock Fiserv (FISV) broke out after posting impressive results, as operating margin improved to 39.2% from 35.6% a year-ago.

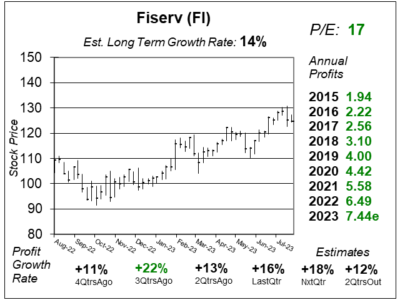

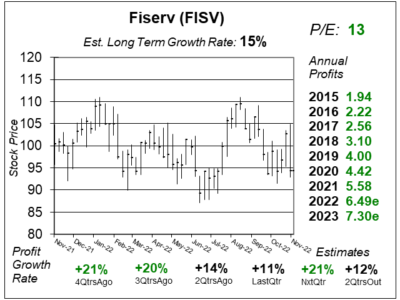

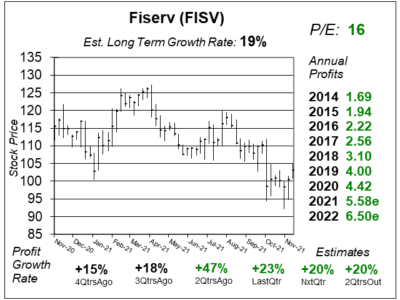

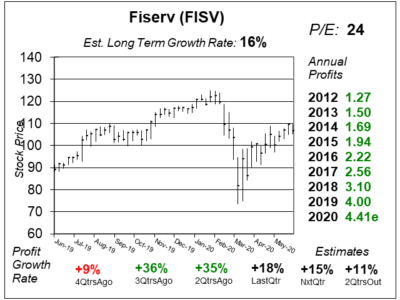

This Bear Market has investors lowering expectations, with many people now looking for 10%-plus growers, like Fiserv (FISV).

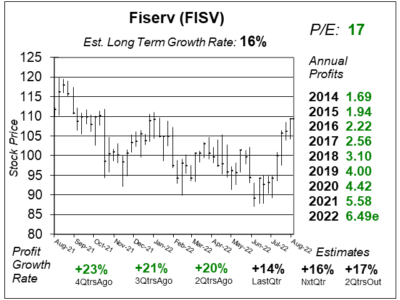

FIserv (FISV) the company is a dependable mid-to-high teens grower profit-wise. Stock-wise, FISV has a very reasonable P/E of 17.

Investors feel Fiserv’s (FISV) profit margins will erode over time as competition including Stripe and Ayden offer lower pricing.

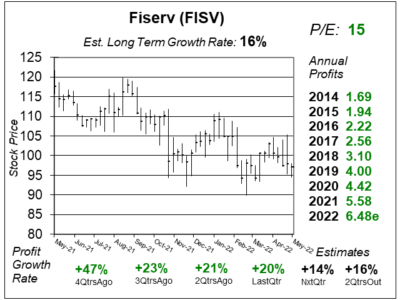

Fiserv (FISV) seems like a real value in the stock market, as its growing profits ~16% while the stock has a P/E of only 15.

Fiserv (FISV) has been cranking out the profits (+23% last qtr) yet the stock is in a downtrend, with a P/E of only 16. Why?

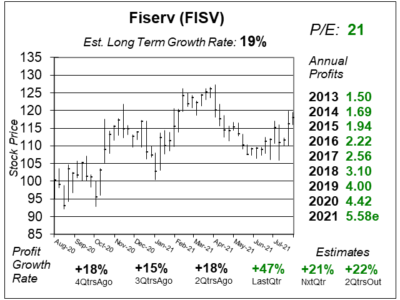

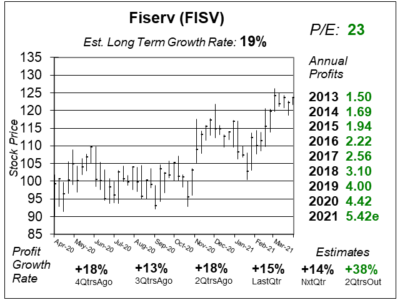

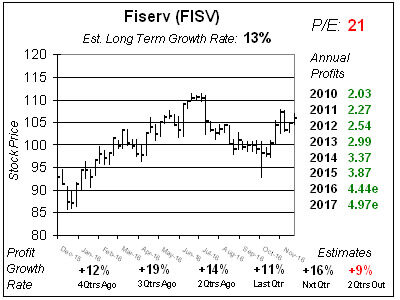

With a P/E of only 21, and 21% profit growth expected, Fiserv (FISV) seems to have great upside for a conservative stock.

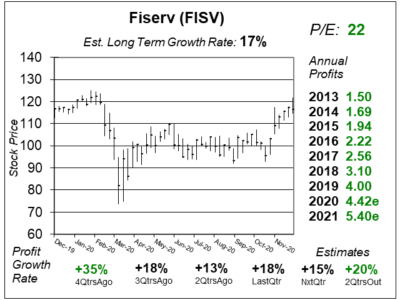

Fiserv (FISV) is delivering some solid profit growth (as usual), but the stock is down a bunch since last quarter.

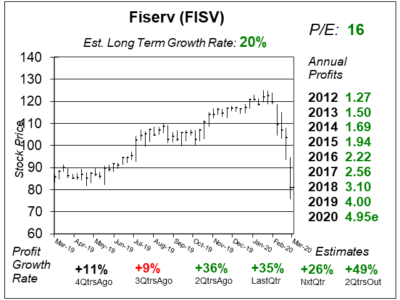

Fiserv (FISV), the worlds largest payment processor, has delivered 35 years of +10% profit growth. This year looks even better.

Fiserv (FISV) looks like a screaming value as the Blue Chip double-digit grower has a P/E of only 22. We see 40% upside.

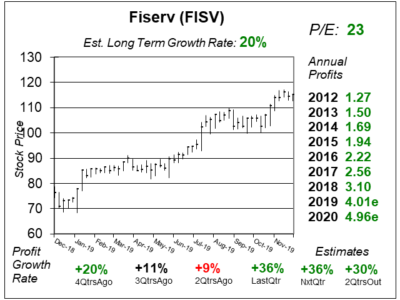

Bank software company Fiserv (FISV) has HUGE upside after its merger with credit card transaction company First Data.

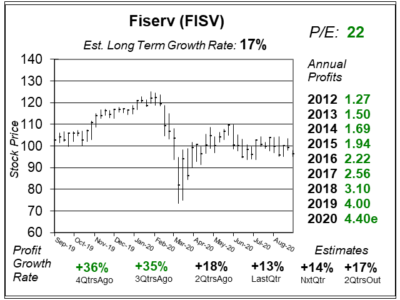

Retail closures are hurting Fiserv’s (FISV) pristine performance. Still, profits are expected to climb 16% on average the next year.

Fiserv (FISV) management affirmed 2020 profit growth guidance of 23% to 27%. And management buys back stock.

The Fiserv (FISV) merger with First Data is already paying off for investors. Now it seems profits will be better than we thought.

Fiserv’s (FISV) stock ha been hot as management said the First Data merger would burst profits by 40% over the long term.

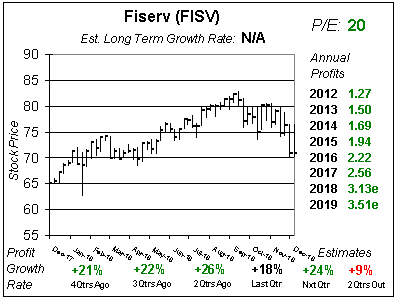

Fiserv (FISV) hit a record high last week, but the stock’s P/E of 27 is higher than the 23 P/E FISV had in 2017 & 2018.

Fiserv (FISV) is going to merge with First Data (FDC) to become a new powerhouse in credit/debit payment processing.

Fiserv (FISV) provides financial services technology to banks. Sharek thinks the Financial & Software sectors will lead the market higher.

Fiserv (FISV) has gone from $10 to $80 during the past ten years, but the P/E has gone from 12 to 25 during that time, zapping upside.

Fiserv (FISV) is focused on innovation and integration in digital and payment solutions for its financial clients, and healthcare ones too.

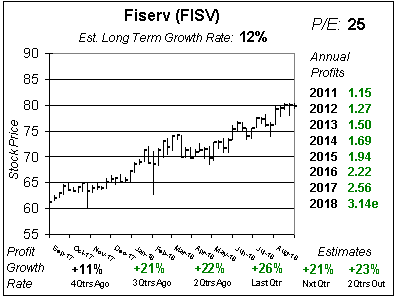

Bank software provider Fiserv (FISV) expects “substantial adjusted earnings per share growth” in its 2018 financial outlook due to tax cuts.

Fiserv (FISV) has missed profit estimates the past two qtrs as sales growth slowed from 5% to 2% to 1%. Now FISV is expected to see sales growth pick up to 6%. Let’s wait and see.

Phone-to-phone (P2P) payments were up 20% last qtr at Fiserv (FISV), which operates financial software banks utilize to operate their businesses.

Fiserv (FISV) provides financial software for banks, and now with mobile transactions becoming more mainstream FISV’s business should remain strong.

Higher interest rates means more money for banks, and that means more bank spending on IT, which is where Fiserv (FISV) comes in.

Banks (and bank stocks) are doing great! Which means more money to spend on software and technology, which Fiserv (FISV) provides.

Fiserv (FISV) runs the technology banks use to run ATMs and mobile banking. Last qtr I said the stock was a bit too high, but now its down 10% from its highs.

Fiserv (FISV) has grown profits at least 10% a year since 1986, and investors have taken notice by sending the stock to All-TIme highs.

Fiserv (FISV) has grown profits by at least 10% every year since 1986. The stock is also timely right now, as investors appreciate consistency.